- Market Overview

- Strategic Analysis

- Key Features

Market Overview

Duration: Short-term – 2-year price forecast and market outlook

The global oxo-alcohols and plasticizers market, including key products such as 2-Ethylhexanol (2-EH), n-Butanol (n-BuOH), isobutanol (i-BuOH), and DOTP, continues to experience structural weakness driven by persistent oversupply and critically compressed producer margins. Although there are signs of improving demand in the Indian Subcontinent (ISC), overall global consumption remains sluggish across major downstream sectors such as coatings, adhesives, and construction, limiting any sustained upward price momentum.

Market conditions are further strained by volatility in the upstream propylene feedstock market and ongoing competitive pressure from low-cost Mainland China exports, which continue to erode regional profitability and constrain operating rates. Chronic oversupply, particularly in the plasticizers segment, has left the market severely unbalanced.

In this prolonged low-margin environment, success depends on optimizing production costs, maintaining disciplined inventory control, and leveraging regional arbitrage opportunities. These strategies are essential for improving competitiveness, monetizing scale, and navigating the complex dynamics of the global oxo-alcohols and plasticizers value chain.

Comprehensive monthly market price, supply, demand, and trade data and analysis for:

- normal-Butanol (n-Butanol)

- iso-Butanol (i-Butanol)

- 2-Ethylhexanol (2-EH)

- Dioctyl phthalate (DOP)

- Dioctyl terephthalate (DOTP)

- Diisononyl phthalate (DINP)

Strategic Analysis

Duration: Short-term – 2-year price forecast and market outlook

The Global Oxo Alcohols and Plasticizers Service provides clients with a comprehensive yet targeted view of the global markets for C4 oxo alcohols, including n-butanol, isobutanol, and 2-ethylhexanol, as well as key plasticizers such as DOP, DOTP, DINP, DIDP, DPHP, and DINCH. The report delivers detailed cash cost analysis, pricing and margin data, supply-demand balances, and operating schedules for oxo alcohols across all major regions. It also includes global and regional feedstock insights, with expert commentary on propylene market trends and demand drivers.

The service further incorporates trade data for oxo alcohols and selected plasticizers, offering clear visibility into global trade flows and competitive positioning.

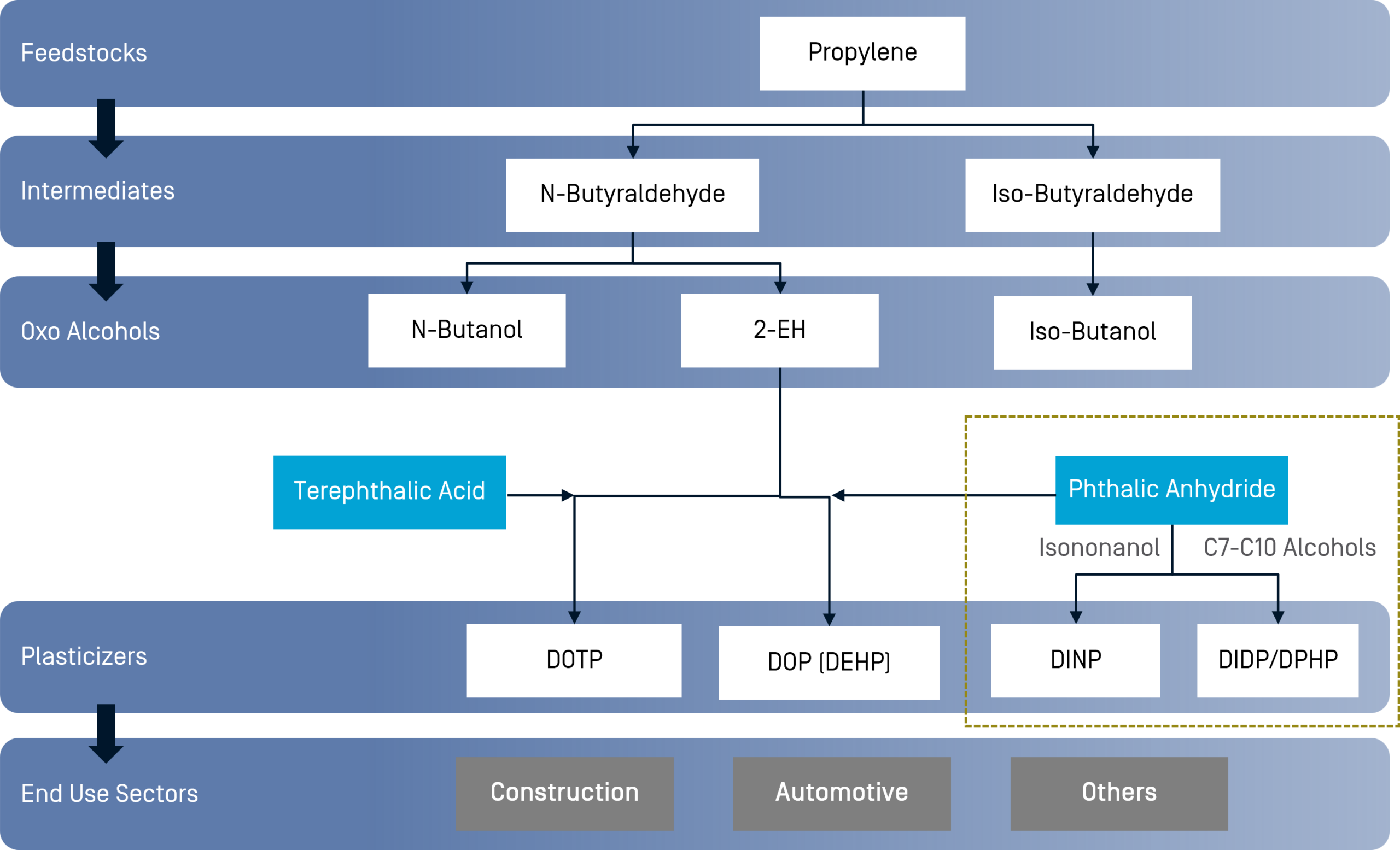

Understanding the Oxo Chemicals market requires a fully integrated perspective of the value chain—from feedstocks such as propylene through intermediates, derivatives, and end-use applications. Chemical Market Analytics offers in-depth expertise and analysis across the entire value chain, equipping clients with the critical insights necessary to navigate a complex and rapidly evolving global marketplace.

Key Features

Duration: Short-term – 2-year price forecast and market outlook

PRICES COVERED

Contract and spot price summary with a brief review of current market conditions.

- 2-ethylhexanol (2-EH)

- n-Butanol

- DINP

- i-Butanol

- DOP

- DOTP

GLOBAL MONTHLY MARKET REPORT

This report provides in-depth insights and comprehensive commentary on key market developments, including operational changes, demand shifts, process economics, and short-term supply–demand conditions. It also analyzes significant events influencing market performance and offers forward-looking forecasts on emerging trends. In addition, the report presents an overview of current developments across Europe, the Americas, and Asia, delivering a well-rounded perspective on global petrochemical market dynamics.

Key country focus: Americas, Asia, China, Europe, Middle East, Africa

ACCESS TO SUBJECT MATTER EXPERTS

Clients receive direct, one-on-one access to industry experts through phone consultations, email support, or scheduled meetings to discuss the key insights featured in the monthly market report. This personalized advisory service enables subscribers to deepen their understanding of market fundamentals, price drivers, and supply–demand dynamics, while clarifying complex data points and analysis. It also provides tailored perspectives on region-specific market trends, empowering clients to make more informed, strategic decisions across the global petrochemical value chain

SUPPLY & DEMAND

This service provides short-term production news updates, detailed production statistics, and plant-by-plant operating schedules, along with analysis of long-term structural supply changes. It also delivers comprehensive end-use sector analysis, including PVC, diesel additives, acetates, acrylate esters, and more, supported by macro-level industry trend assessments across key segments such as automotive and construction. Together, these insights offer a clear view of evolving demand patterns and strategic opportunities within the global petrochemical value chain.

TRADE

This service delivers comprehensive global trade intelligence for the aromatics market, offering the latest trade statistics, detailed global trade flow analysis, and freight rate estimates across major shipping routes. It also provides continuous monitoring of tariffs, sanctions, and regulatory developments impacting the movement of aromatics and related petrochemicals. These insights enable stakeholders to evaluate geopolitical and policy risks, strengthen compliance, and optimize their global supply chain and market positioning strategies across the aromatics value chain.