- Market Overview

- Strategic Analysis

- Key Features

Market Overview

Duration: Short-term – 2-year price forecast and market outlook

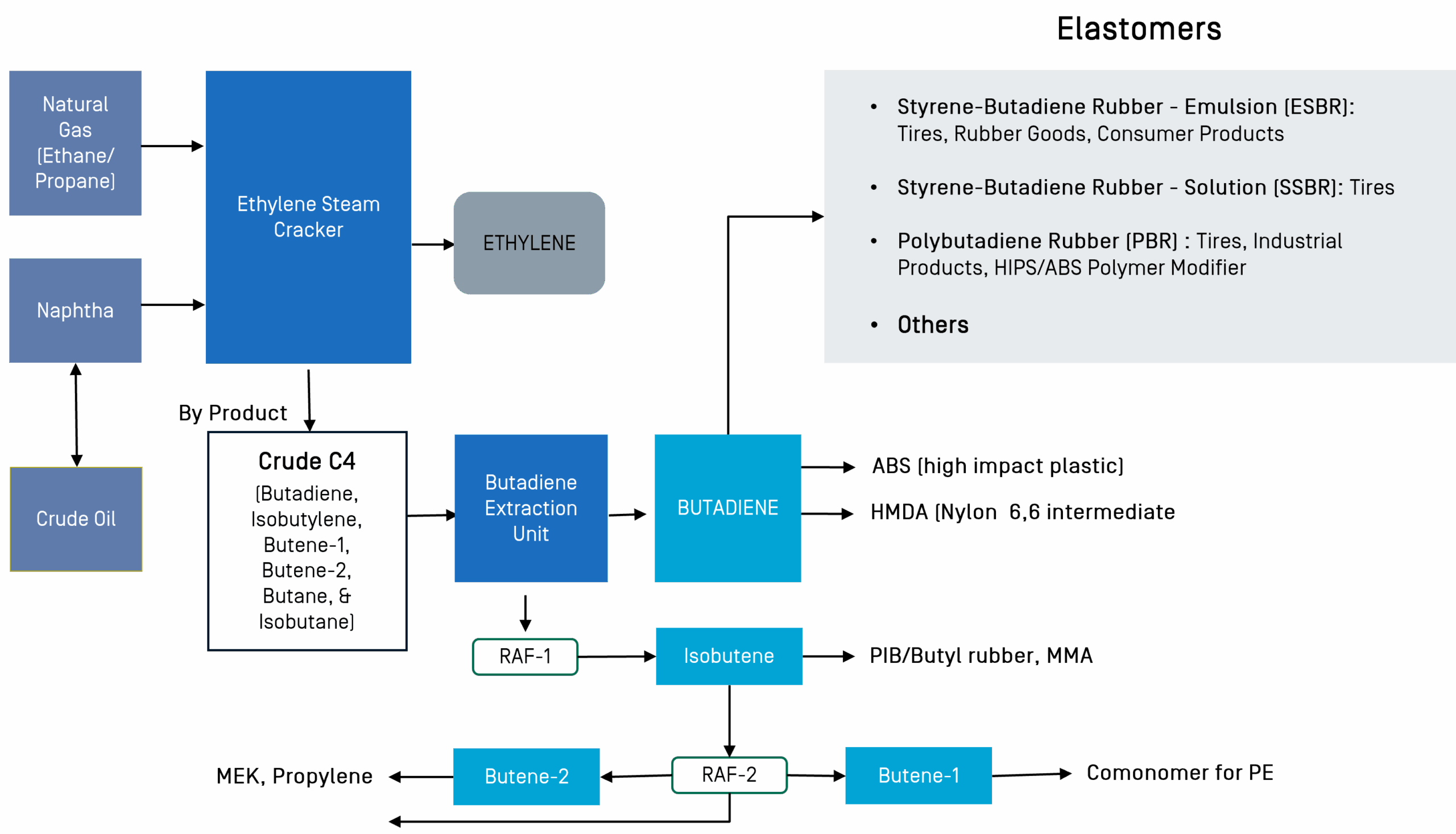

Asia has invested an enormous amount of new butadiene capacities during the last few years and will continue to add more capacities in the region. Mainland China’s butadiene balance is changing from net imports to net exports and is having an impact on other Asian countries as well as other regions that have been exporting to mainland China. Mainland China has been the demand driver of butadiene, but demand growth is slowing down compared to what the market has experienced for the last several years. Asia C4 Olefins & Elastomers Weekly report provides weekly market information, prices, and production economics focused on Asia.

Comprehensive monthly market price, supply, demand, and trade data and analysis for:

- Butadiene

- Crude C4s

- Natural Rubber

- Polybutadiene Rubber

- Raffinates C4

- Styrene Butadiene Rubber (SBR)

Strategic Analysis

Duration: Short-term – 2-year price forecast and market outlook

The C4 Olefins & Elastomers Asia C4 Weekly service is an add-on to the Global C4 Olefins service that provides weekly prices and market updates for the Asia region focused on butadiene, SBR, PBR, butylenes, and natural rubber. The report also provides Butadiene Asia Contract Price, which can be used in term contract pricing.

The Chemical Market Analytics (CMA) Profit Sharing Asia Contract Butadiene Price (CMA ACP) is an unbiased third-party butadiene contract price reference that preserves the economic interest of both producers/sellers and consumers/buyers by ensuring an equitable distribution of butadiene and derivative margins between producers and consumers since the price takes in consideration the average cash cost of the butadiene producer and the average butadiene affordability for the butadiene consumer (referred to as the chain margins). The CMA ACP methodology minimizes possible pricing risks that are inherent in the current contract pricing mechanisms by providing an equitable system of chain margin distribution between butadiene producers and consumers. The CMA ACP is derived from CMA’s production cost models for a butadiene extraction unit (to determine the average butadiene production cash cost) and CMA’s production cost models for butadiene derivatives (to determine the weighted average of derivative butadiene affordability). The CMA ACP is the price at which the total profitability for butadiene and derivative producers is split according to the proportion of their average capital investment for their respective production units.

Key Features

Duration: Short-term – 2-year price forecast and market outlook

PRICES COVERED

Contract and spot price summary with a brief review of current market conditions

Chemicals covered : Butadiene, Polybutadiene Rubber (PBR) & Styrene Butadiene Rubber

ASIA WEEKLY MARKET SNAPSHOT

This document encompasses an analysis of weekly data on C4 Olefins & Elastomers in Asia. It delves into notable changes in pricing, market trading ranges, supply/demand dynamics, and import/export activities. Additionally, a short-term projection of polymer prices is provided, considering imminent market influences such as supply/demand fluctuations, feedstock conditions, market momentum, and other factors affecting prices.

DATA SUPPLEMENT

This report delivers detailed plant operating schedules, comprehensive quarterly supply and demand balances, and in-depth production economics analysis. Designed to support strategic planning in the olefins industry, it offers critical insights into capacity utilization, market supply dynamics, and cost structures across key production facilities.

ACCESS TO SUBJECT MATTER EXPERTS

Clients receive direct, one-on-one access to industry experts through phone consultations, email support, or scheduled meetings to discuss the key insights featured in the monthly market report. This personalized advisory service enables subscribers to deepen their understanding of market fundamentals, price drivers, and supply–demand dynamics, while clarifying complex data points and analysis. It also provides tailored perspectives on region-specific market trends, empowering clients to make more informed, strategic decisions across the global petrochemical value chain

SUPPLY & DEMAND

This service delivers short-term production news, up-to-date production statistics, and detailed plant-by-plant operating schedules, along with coverage of long-term structural changes in global supply. It also features in-depth end-use market analysis across a wide range of downstream sectors, supported by comprehensive reviews of macro-level industry trends. These insights help clients anticipate market shifts and make informed strategic decisions in the evolving global landscape.

TRADE

This service delivers comprehensive global trade intelligence for the aromatics market, offering the latest trade statistics, detailed global trade flow analysis, and freight rate estimates across major shipping routes. It also provides continuous monitoring of tariffs, sanctions, and regulatory developments impacting the movement of aromatics and related petrochemicals. These insights enable stakeholders to evaluate geopolitical and policy risks, strengthen compliance, and optimize their global supply chain and market positioning strategies across the aromatics value chain.

WEBINAR

Client webinars provide in-depth intelligence on critical chemical market developments, offering timely insights into global economic trends, supply–demand dynamics, trade flows, and other key factors shaping the petrochemical and energy value chain. Each session features expert analysis from industry specialists and delivers actionable perspectives on current market movements. These interactive webinars also enable clients to engage directly with our Subject Matter Experts (SMEs) through live Q&A sessions, supporting clearer understanding, stronger strategic planning, and more informed decision-making across the chemical industry.