- Market Overview

- Strategic Analysis

- Key Features

Market Overview

Duration: Short-term – 3-month price forecast and market outlook

Polypropylene and polyethylene markets continue to face significant pressure as China enters an unprecedented wave of capacity expansions—driven by self-sufficiency strategies, product-mix upgrading, and accelerated pre-2030 project timelines aligned with Dual Carbon objectives—while domestic demand growth slows. Softer macroeconomic conditions, weaker industrial production, and declining fixed-asset investment have reduced consumption in durable goods and infrastructure-related sectors, though packaging demand has remained relatively resilient. Rising uncertainty amid U.S.–China trade tensions may further dampen market sentiment and heighten price volatility. With substantial new polyolefin capacity scheduled to start up through 2028, supply is expected to outpace demand, widening the imbalance, lowering operating rates, and potentially triggering localized rationalization as production growth lags capacity additions. Despite these pressures, China will remain the leading driver of global polyolefin demand growth and a critical export destination for cost-competitive international producers.

Comprehensive monthly market price, supply, demand, and trade data and analysis for:

- Polyethylene (PE)

- Polypropylene (PP)

Strategic Analysis

Duration: Short-term – 3-month price forecast and market outlook

Supply-demand fundamentals and cost dynamics remain the most critical factors shaping the operations and strategies of stakeholders across the polyolefins value chain. A disciplined and accurate approach to tracking China’s domestic capacity and actual production—factoring in both scheduled maintenance and unplanned outages—is essential for understanding supply conditions. At the same time, end-use demand plays a pivotal role in gauging the market’s ability to absorb the rapid expansion in China’s polyolefin supply, both in recent years and in the years ahead.

This understanding is especially crucial as market participants navigate the current trough in the cycle, amid heightened volatility in feedstock and energy prices and an evolving global landscape. Suppliers’ cost competitiveness, influenced by these shifts, remains a key consideration.

With robust, practical modeling tools and strong market connectivity, Chemical Market Analytics (CMA) delivers unique insights and actionable analysis to help market players confront today’s increasingly complex and challenging environment—not just to survive, but to thrive. Additionally, CMA offers deep expertise across the entire plastics value chain—from upstream oil and gas through to downstream end-users of polymer raw materials—positioning it as the trusted provider of data, intelligence, and strategic insight for the industry.

Key Features

Duration: Short-term – 3-month price forecast and market outlook

PRICES COVERED

Contract and spot price summary with a brief review of current market conditions.

Chemicals covered : Polyethylene & Polypropylene

WEEKLY MARKET SNAPSHOT

This document provides a comprehensive analysis of weekly plastics and polymers market data for mainland China, alongside key insights from the Middle East and India. It evaluates critical developments in pricing trends, trading ranges, supply–demand fundamentals, and import/export activity across major polymer value chains.

The report also includes a short-term price outlook, incorporating upcoming market drivers such as shifts in supply and demand, feedstock cost trends, buyer and seller sentiment, and other relevant pricing influences. To enhance global context, it further offers a brief overview of market conditions in North America and Western Europe, supporting a well-rounded perspective on international polymer market dynamics.

MONTHLY MARKET REPORT

This report provides a comprehensive overview of the global macroeconomic environment and highlights key risk indicators across major economies. It offers an in-depth assessment of China’s current polyolefins market, tracking spot price movements across key product segments and evaluating the influence of major economic policies on regional trade flows.

The analysis includes detailed insights into upstream feedstock trends, tradeable price movements, and market feedback from industry participants. The report also presents a thorough review of China’s import and export data, along with an evaluation of domestic supply–demand fundamentals. In addition, it summarizes recent shifts in operating rates among local producers, identifies the primary factors shaping future market direction, and provides an informed outlook on emerging drivers of polyolefin supply and demand growth.

DATA SUPPLEMENT

This report provides a detailed analysis of the key economic challenges and operational factors impacting the global chemical and petrochemical industry. It also includes comprehensive trade data and market intelligence for major resin-producing and resin-consuming countries, supporting a clearer understanding of international polymer trade flows, supply–demand dynamics, and competitive positioning across the global value chain.

MARKET FOCUS REPORT

This report offers in-depth research on critical and emerging challenges facing the plastics industry. Previous analyses have covered a range of key topics, including recycling markets, trade disputes, the impact of extreme weather events, and other relevant industry developments.

ACCESS TO SUBJECT MATTER EXPERTS

Clients receive direct, one-on-one access to industry experts through phone consultations, email support, or scheduled meetings to discuss the key insights featured in the monthly market report. This personalized advisory service enables subscribers to deepen their understanding of market fundamentals, price drivers, and supply–demand dynamics, while clarifying complex data points and analysis. It also provides tailored perspectives on region-specific market trends, empowering clients to make more informed, strategic decisions across the global petrochemical value chain

WEBINAR

Client webinars provide in-depth intelligence on critical chemical market developments, offering timely insights into global economic trends, supply–demand dynamics, trade flows, and other key factors shaping the petrochemical and energy value chain. Each session features expert analysis from industry specialists and delivers actionable perspectives on current market movements. These interactive webinars also enable clients to engage directly with our Subject Matter Experts (SMEs) through live Q&A sessions, supporting clearer understanding, stronger strategic planning, and more informed decision-making across the chemical industry.

Related Products

- Market Advisory Service – Asia Polyethylene

- Market Advisory Service – Asia Polypropylene

- Market Advisory Service – Asia, Middle East & India Plastics & Polymers

- Market Advisory Service – Europe Plastics & Polymers

- Market Advisory Service – North America Polyethylene

- Market Advisory Service – North America Polypropylene

Related Chemicals

- Benzene

- Dimethyl Terephthalate (DMT)

- Ethylbenzene (EB)

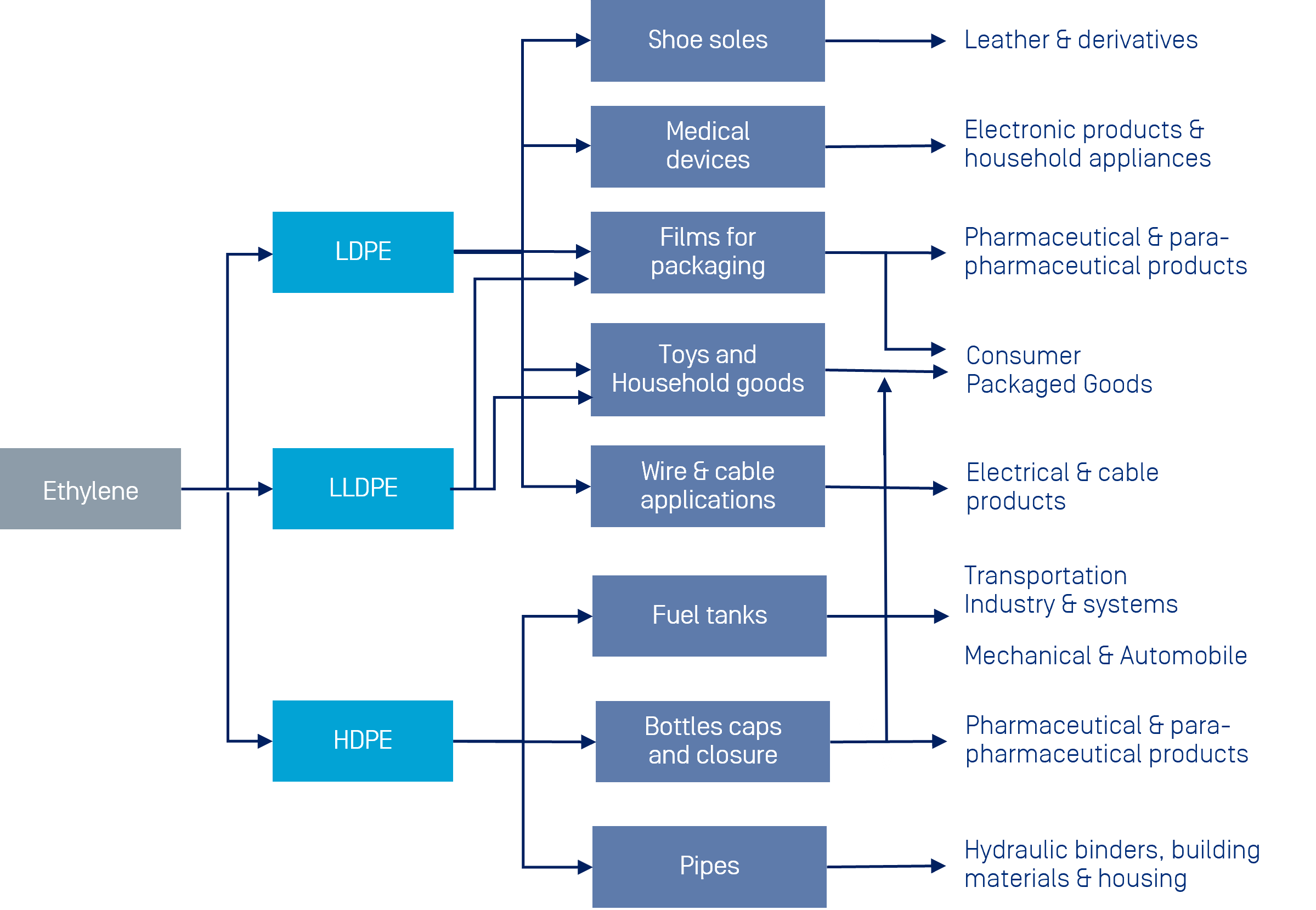

- Ethylene

- Expandable Polystyrene (EPS)

- Polyethylene (PE)

- Polyethylene Resins, High-Density (HDPE)

- Polyethylene Resins, Linear Low-Density (LLDPE)

- Polyethylene Resins, Low-Density (LDPE)

- Polyethylene Terephthalate (PET) – Bottle Resin

- Polyethylene Terephthalate (PET), Recycled

- Polypropylene (PP)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Propylene, Polymer/Chemical Grade

- Propylene, Refinery Grade (RGP)

- Salt (Sodium Chloride)

- Styrene

- Terephthalic Acid (PTA)