The Latest Ethylene Market Developments in Indonesia

There has been great progress over the past decade in the Southeast Asian petrochemical industry. Several world-scale ethylene and derivatives complexes were built to take advantage of the growing regional demand of those, as well as the geographic proximity to the huge mainland Chinese market. Thus, regional ethylene capacity rose by 23% in the past five years.

Meanwhile, ethylene capacity addition in Indonesia has been quite limited despite the robust ethylene net equivalent demand growth in the past 10 years. The lack of capacity addition in Indonesia has resulted in the country being the largest importer of ethylene monomers and downstream products. Indonesia is the world’s fourth most populous country with a population of more than 280 million. Meanwhile, its plastics consumption per capita remains low, so the country has strong potential to see higher ethylene demand growth in the future. Looking ahead, a few cracker projects are either under construction or under review, which will impact the regional trade flows in the future.

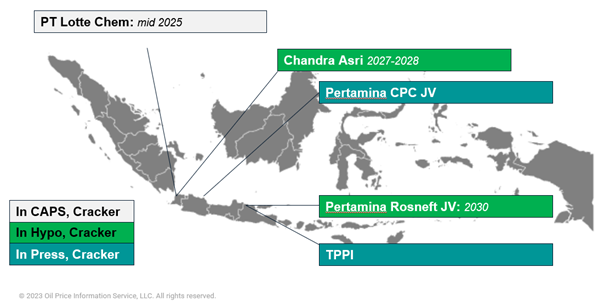

New Cracker Projects in Indonesia

With the healthy demand growth and low self-sufficiency, there have been several new projects reviewed by various parties. The above map shows the status of the new cracker projects in Indonesia. PT Lotte Chem’s new cracker project is currently under construction, and it is expected to start in mid-2025. None of the other projects shown on the map have obtained financial investment decision (FID) yet, although Chemical Market Analytics expects that approximately two additional cracker projects could be started by 2030.

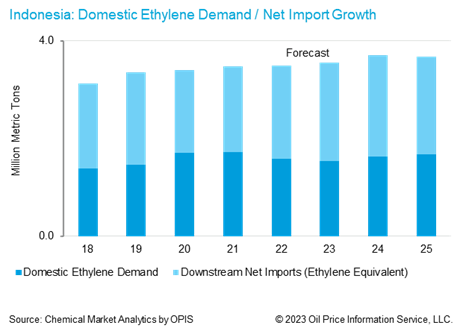

Ethylene Net Equivalent Demand Growth in Indonesia

In Indonesia, the ethylene monomer demand from downstream sectors has historically not grown rapidly due to the limited downstream capacity additions. Meanwhile, the ethylene equivalent demand—including the imports of downstream products into Indonesia—has been growing rapidly. Going forward, domestic ethylene demand is expected to grow at a compound annual growth rate (CAGR) in the high single digits until 2030 with the associated new polyethylene (PE) capacities from the new crackers, including the hypothetical capacities mentioned earlier. Net imports will decline from 2026 as both monomer and downstream imports decline as well.

Indonesia Ethylene Supply and Demand, Trade Changes

Indonesia’s ethylene monomer imports have remained at approximately 800 kt per year since 2020. These ethylene imports will start to gradually decline from 2025 as the new capacity from PT Lotte Indonesia starts up in mid-2025. As the cracker’s ethylene monomer will be fed to its existing PE units, no significant ethylene demand is expected to be added after the startup of the cracker in 2025, but the ethylene imports will decrease gradually thereafter. Indonesia is likely to turn into a net ethylene exporter only after some additional hypothetical capacities start up.

Conclusion

Indonesia’s self-sufficiency for ethylene, including net imports of downstream products, remained lower than 30% as of 2022. This low self-sufficiency rate and high potential from the country’s large population support the new ethylene and downstream capacity additions in the region. With the one confirmed cracker from PT Lotte Indonesia and two hypothetical capacities starting up by 2030, the country is expected to become a net exporter of ethylene monomer in the next decade.

Southeast Asia is expected to achieve a net export position for ethylene from 2027 as import demand from Indonesia declines. Mainland China has been an outlet for shipping excess monomers from Southeast Asia. However, the new wave of capacity additions in mainland China from 2026 will limit the import volume in mainland China, which remains a bearish factor for the ethylene operating rate in Southeast Asia.

Further details can be found in World Analysis-Ethylene and World Analysis-Propylene.

Authors

William Chen

Executive Director

Mike Park

Director

Young Geun Lee

Senior Research Analyst

Zengwei Yin

Principal Research Analyst

Learn how we can help you prepare and navigate market disruptions

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving in profound ways and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on the specific trends shaping the market.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!