Will Mainland China Demand Pull The PVC Industry Out Of Its Doldrums?

As the world’s polyvinyl chloride (PVC) industry leader, China significantly influences global PVC market dynamics as global supply and demand rebalance and focus shifts to margins recovery.Mainland China is the world’s largest polyvinyl chloride (PVC) market. Mainland China has been the key driver for global supply and demand expansion since its inclusion into the World Trade Organization (WTO) in 2001. What followed was phenomenal Chinese GDP growth, averaging 9% from 2001 to 2019 annually until the COVID-19 pandemic in 2020.

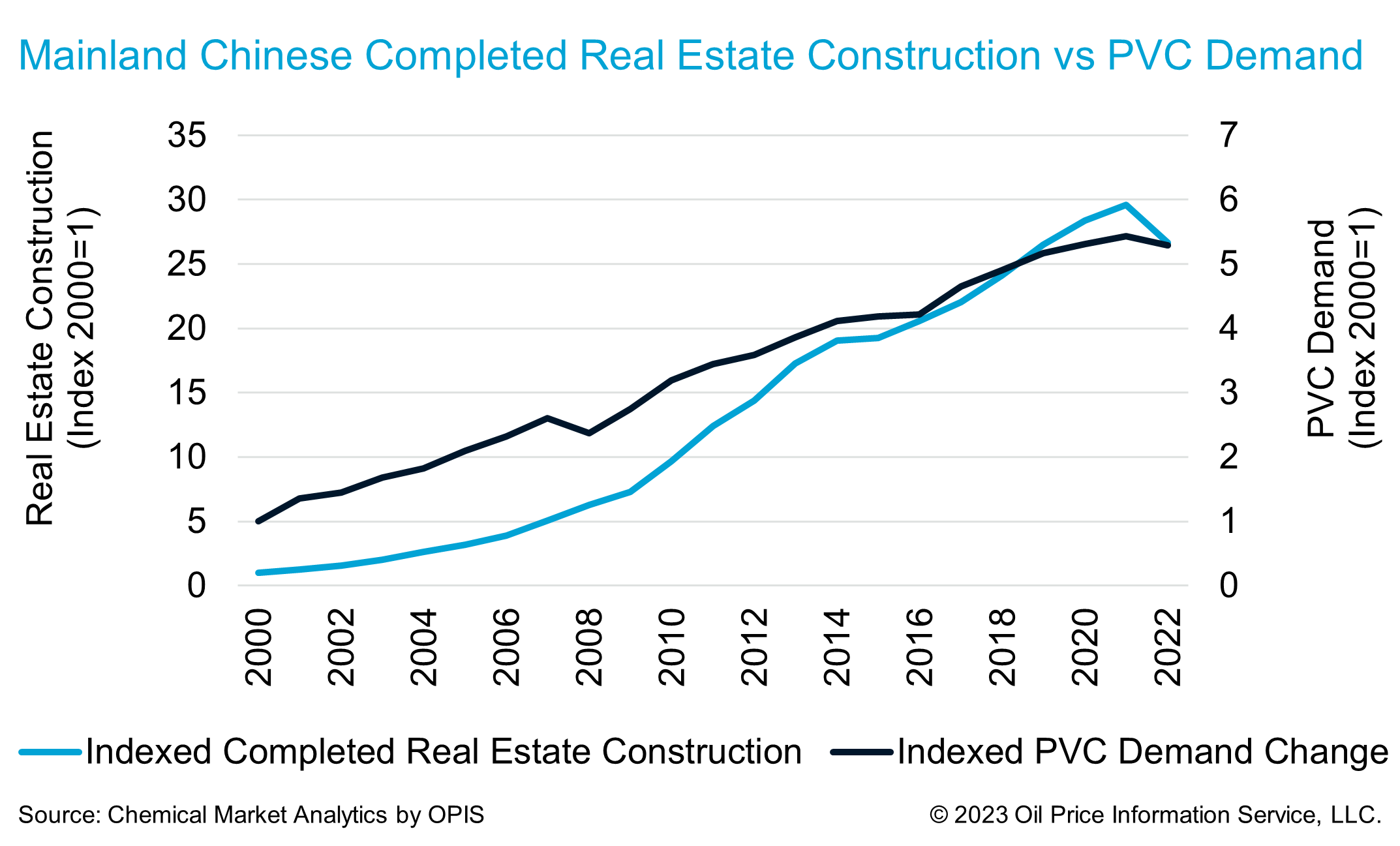

Chinese PVC market demand was significantly impacted by the pandemic from 2020 to 2022. Government energy and environment control policies implemented at the height of the pandemic caused unprecedented supply chain disruption in the mainland Chinese domestic PVC market. On the supply side, “dual control” and power restriction policies significantly increased cash production costs, catalyzing operating rate reductions that tightened PVC supply and elevated prices to a historical peak in 2021. However, the tight supply/demand balance did not last. By the third quarter of 2022, the Chinese PVC market shifted to an oversupply situation due to construction sector demand destruction resulting from weak consumer sentiment and high interest rates. Financial troubles among mainland Chinese real estate developers initiated a property sector meltdown and a subsequent sharp decline in construction activity.

Mainland China is now entering a new, post-pandemic era. Multiple supply/demand factors that are still in play will affect mainland Chinese PVC market development over the next 5-10 years. Likewise, China’s PVC market will profoundly affect global PVC industry market dynamics.

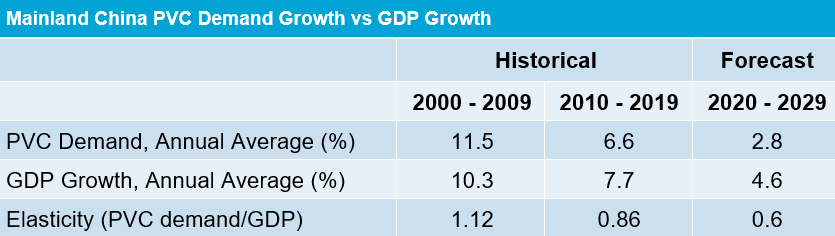

Chemical Market Analytics by OPIS, a Dow Jones company (CMA), correlates forecasted GDP growth to forecasted PVC demand growth. Depending on the stage of a market’s maturity, PVC demand growth elasticity concerning GDP growth could be less than, equal to, or greater than 1.0. Elasticities exceeding 1.0 mean that PVC demand is growing faster than GDP; the opposite is true if elasticity is less than 1.0. The attached table illustrates average mainland China PVC demand elasticities for 2000 to 2030, according to Chemical Market Analytics’ new 2024 PVC supply/demand balance.

There are many ways to analyze data and trends. In this analysis, we employ average changes in PVC demand versus GDP growth in ten-year blocks to compare and highlight mainland Chinese PVC market development phases. From 2000 to 2009, PVC demand grew faster than GDP growth, a typical characteristic of a fast-developing economy when the base demand volume is still relatively small. Per capita PVC demand was less than 5 kg in this period. From 2010 to 2019, PVC demand volume reached a critical mass, signified by per capita consumption breaching the 10 kg level. As we advance, we project a maturing phase. In the maturation phase, demand growth will depend on economic development, population growth, and socioeconomic market factors. We forecast mainland annual average Chinese PVC demand elasticity over the upcoming decade to decline to 0.6. Key considerations and assumptions include:

- Declining population: We expect the population to shrink by 10 million within the next 10 years;

- Soft real estate and construction sector: We anticipate that a credit crunch, high interest rates, and weak consumer confidence due to developer defaults will slow the real estate sector recovery.

Although mainland PVC demand has reached a slower, mature development phase we do not anticipate a market contraction.

Given a projected slower PVC growth scenario in mainland China and excess supply anticipated for approximately three years, how will the new, post-pandemic Chinese PVC industry reshape the global supply/demand balance? Over the next five years,

- Regarding trade, we expect excess Chinese capacity to act as a lever to balance regional and global trade. We project average annual mainland Chinese net PVC exports of approximately 1.5 million metric tons over the next five years.

- Regarding economics, we expect fully-integrated carbide- and ethylene-based PVC producers to be competitive with other Northeast Asian producers.

- Regarding capacity, we anticipate slow supply expansion as the PVC industry focuses on margin recovery. We expect little or no new carbide-based PVC capacity expansion after 2025.

In summary, mainland Chinese PVC market demand has entered a new phase. Nevertheless, mainland China will continue to significantly influence global PVC market dynamics as global supply and demand rebalance and focus shifts to margins recovery.

Other important PVC market issues, including the development of mercury-free catalysts, coal and power supply dynamics, and mainland China’s “drive for net zero” will impact the PVC future.

Authors

Eddie Kok

Executive Director, Vinyl

Learn how we can help you prepare and navigate market disruptions today.