Special Focus: Crude C4 Market Overview

Introduction

More than 95% of global butadiene is produced using the ethylene coproduct, crude C4, as a feedstock. On a global basis, crude C4 supply has been more than sufficient to meet butadiene demand. This is somewhat misleading since some of it has been in the wrong place and logistically inaccessible. However, generally the market has been able to source sufficient crude C4 to meet butadiene demand. More recently, the market concerns have been in the other direction. Markets that have been short of crude C4, such as North America, now find themselves is a situation of extreme length.

In this article, we will take a deep dive into the crude C4 balance and present our view of the near term outlook for crude C4 supply as well as raise some key longer term issues.

C4 Olefins Streams Basics

Crude C4 is a coproduct of ethylene production. The exact quality and quantity produced are highly variable. They depend on cracker feedstock selection and quality, operating severity, furnace technology, among other things. As a result, crude C4 is typically sold on a component basis in the US. Outside the US, it is typically sold as a multiple of the local naphtha price, but the value of the multiple is affected by the stream quality so the result is similar. In our work, we make simplifying assumptions of the stream quality and quantity.

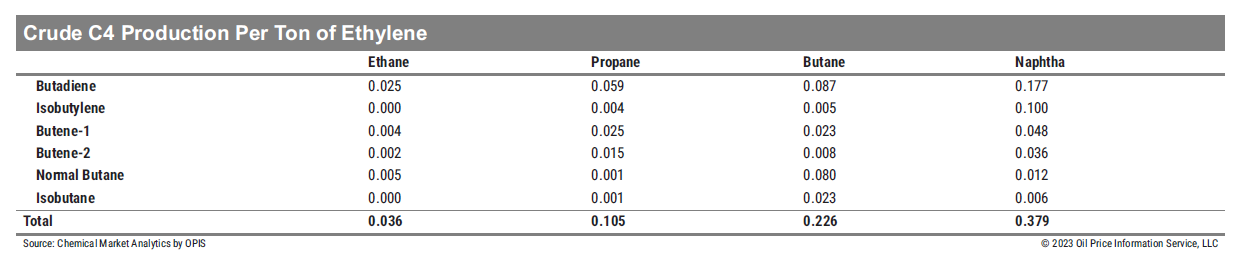

As previously described, there is a significant quality and quantity difference in the crude C4 produced from various cracker feedstocks. Much of our work is focused on the contained butadiene. We commonly reference the butadiene to ethylene production ratio (B/E) as an indicator of cracker feedstock. The B/E varies from 0.025 for ethane cracking all the way to 0.177 for naphtha cracking, a difference of roughly a factor of 7. The total raffinate production also increases dramatically for heavier feedstocks with a ratio to ethylene ranging from 0.011 for ethane cracking up to 0.202 for naphtha cracking a difference of over a factor of 18.

There is a significant quality difference in the crude C4 streams as well. Ethane based crude C4 is nearly 70% butadiene while naphtha based crude C4 is over 50% raffinate. Crude C4 from butane cracking has 35% or so normal butane as all of the uncracked butane ends up in the crude C4. There is no recycle butane steam back to the cracking furnaces as there are for ethane and propane. So butadiene extraction units are designed to handle the crude C4 that is likely to come to them from their local crackers. This also means that the real capacity of the extraction units, which is different from the nameplate capacity, is affected by quality shifts in the crude C4 stream. We have seen this most notably in the US. US crackers have significantly increased their ability to crack butane in recent years.

However, the extraction units were not built to handle all of the contained butane. So there have been times, and likely will be again, when butadiene production was nearly limited by the contained butane at a level well below the butadiene nameplate capacity.

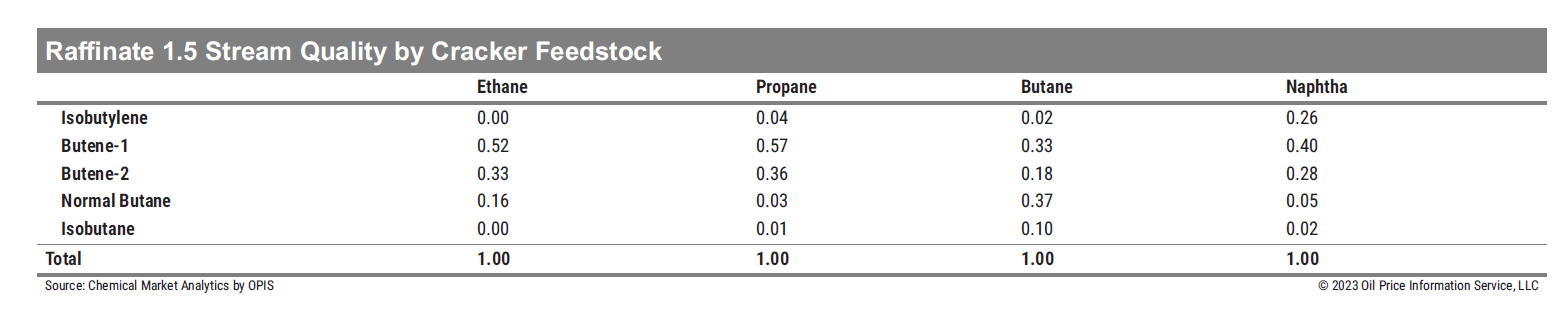

After the butadiene is extracted from the crude C4 stream, it is known as raffinate-1, or C4 raffinate-1. Again the quality of this stream varies significantly. Ethane cracking generates essentially no isobutylene or isobutane. This is key because in many parts of the world, the isobutylene is the key value added component of raffinate-1. In the chemicals markets, key isobutylene derivatives include high purity isobutylene, which is further used to produce butyl rubber or highly reactive grades of polyisobutylene, and conventional polyisobutylene. However, the dominant consumer of isobutylene is fuel ethers, mostly MTBE but also ETBE. Even in the US, where MTBE is not blended into the gasoline pool, the MTBE netback is generally higher than the alkylate value of the isobutylene, otherwise why would we continue to export MTBE from the US.

After the isobutylene is removed from the raffiné-1 stream it is known as raffinate-2. It contains all of the normal butylenes and iso and normal butanes from the original crude C4 stream. The key value added component of this stream is the butene-1 which can be purified and sold primarily as a polyethylene comonomer. Again, though, most of the volume ends up in the motor fuel market often as alkylate. The value of raffinate-2 as alkylate feedstock is highly dependent on the normal butane content. The more normal butane in the stream the lower its value to the alkylate producer.

With all of these options for processing crude C4 it is no wonder that there is a wide variety of configurations for C4 olefins processing units. Some simply extract the butadiene and sell the raffinate-1 into the motor fuels markets. Others, extract the butadiene and isobutylene and sell the raffinate-2 into the fuels or LPG markets. Finally others process the stream to its fullest chemical potential and have a stream, known as raffinate-3 at the end of the process that contains butene-2 and all of the butanes which is generally a relatively low valued feedstock for gasoline blendstocks.

Even with all of these options, there is still crude C4 that does not find a home in this value chain. It is generally hydrogenated, either all the way to butanes or selectively to simply convert the butadiene to normal butylenes. The volume that is fully hydrogenated is typically recycled as cracker feedstock but could also be sold into the LPG market. The product of the selective hydrogenation process is a normal butylene rich raffinate-1. To differentiate it from more conventional raffinate-1, in our analysis we refer to it as raffinate-1.5. It is becoming a more interesting stream, especially in the US. We will describe those market dynamics later in this report.

Crude C4 Supply and Demand

Trends in crude C4 production from ethylene crackers are a function of cracker operating rates and feedstock selection. For players in the C4 Olefins Value Chain it is important to understand that the value of crude C4s to ethylene producers is not large enough for changes in the C4 olefins markets to impact decisions about either cracker operating rates or feedstock selection. Even in late 2016 and early 2017, when butadiene prices were extremely high and the market was short, the impact of prices on cracker feedstock choices was minimal. Therefore, while the butadiene market is highly dependent on the ethylene market, the two markets often behave as if they are completely decoupled. From an ethylene producer’s perspective, they essentially always are.

Crude C4 production is a function of both cracker feedslates and operating rates. As noted, ethylene producers view their crude C4 stream as economically insignificant. As a result, they operate using the following priorities: first make sure the volume has a home to avoid negatively affecting the cracker, second maximize the stream’s value. Decisions related to cracker operating rates and feedslates will be made without serious consideration of their impact on butadiene supply, therefore it is important for C4 market participants to understand those dynamics to prepare for their future effects.

We have already described the impact of cracker feedslates on the C4 olefins streams. Now we will consider the cracker feedslate trends. Globally, ethylene cracker feedslates are predominately influenced by the relative prices of natural gas and crude oil, along with ethylene, propylene, and at times, benzene prices. In recent years, the dominance of ethane cracking economics compared to heavier feedstocks, especially naphtha and gas oil, has resulted in ethylene cracker capacity additions dedicated to light feedstocks. This trend started in the Middle East, but more recently has focused on shale gas based ethane supply in North America. Ethane supply is not unlimited, and much of it is already committed to existing ethylene crackers.

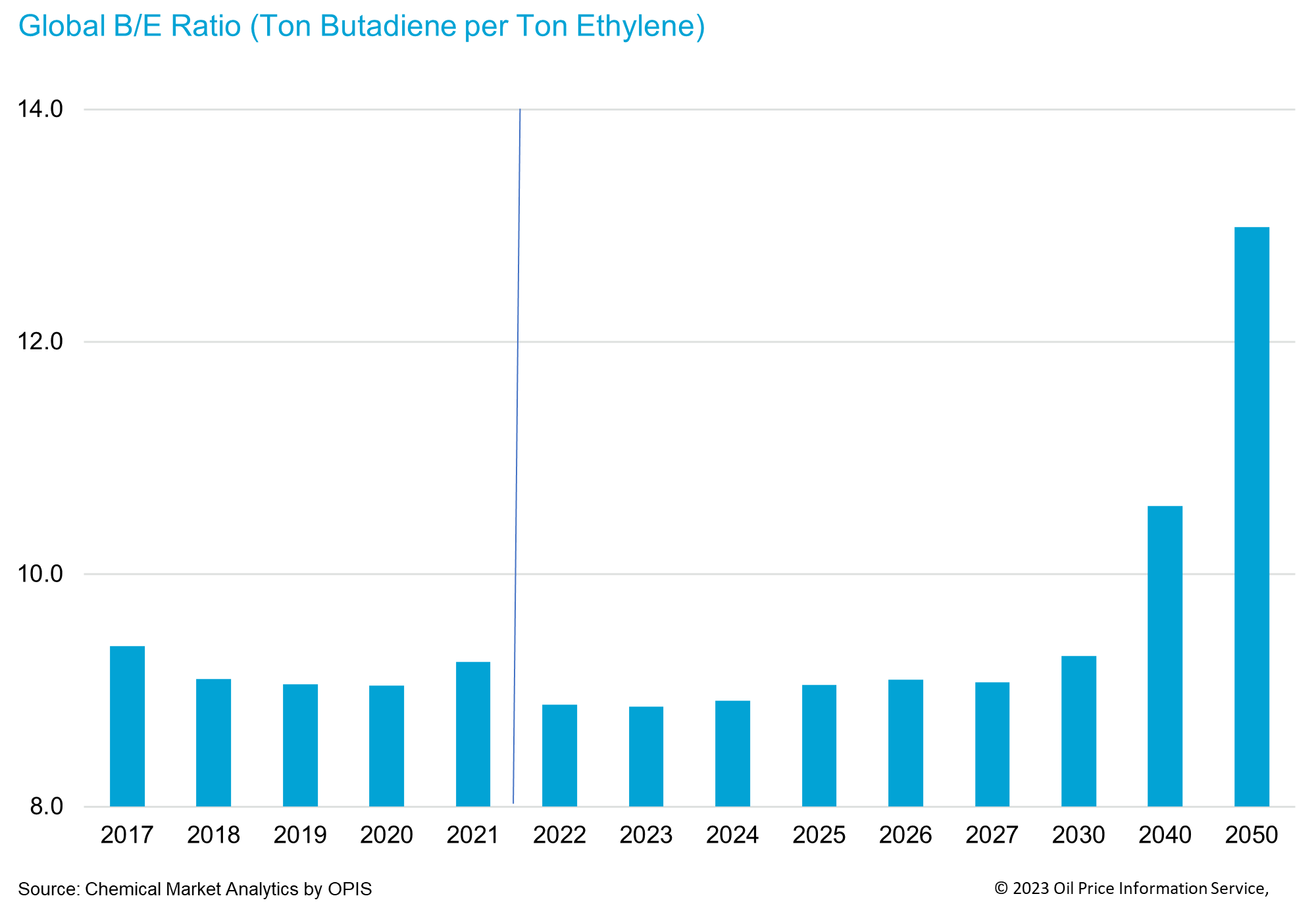

We forecast that globally, the lightest average ethylene cracker feedslates will be in 2022 and 2023. For the remainder of the 2020’s the B/E ratio will gradually increase. This trend will be so gradual that even by 2030 the B/E will still be slightly lower than the 2017 value. However, there simply is not enough ethane available to supply the world’s ethylene demand, so heavier feedslate cracking will increase, primarily in Asia. Mainland China is not the only market adding heavy feedstock–based capacity, but it is adding by far the most.

This trend will increase in the 2030’s as the combination of naphtha cracking and the large investments in crude-oil-to-chemicals (COTC) facilities that are expected to produce olefins in mainland China and the Middle East come onstream. We model the COTC facilities as very heavy naphtha crackers so their impact on global crude C4 production and the B/E ratio will be significant. By 2040 we forecast the B/E ratio to increase from 8.9% in 2022 to 10.7%. The increase will accelerate in the 2040’s with the 2050 B/E forecast at 13.3%.

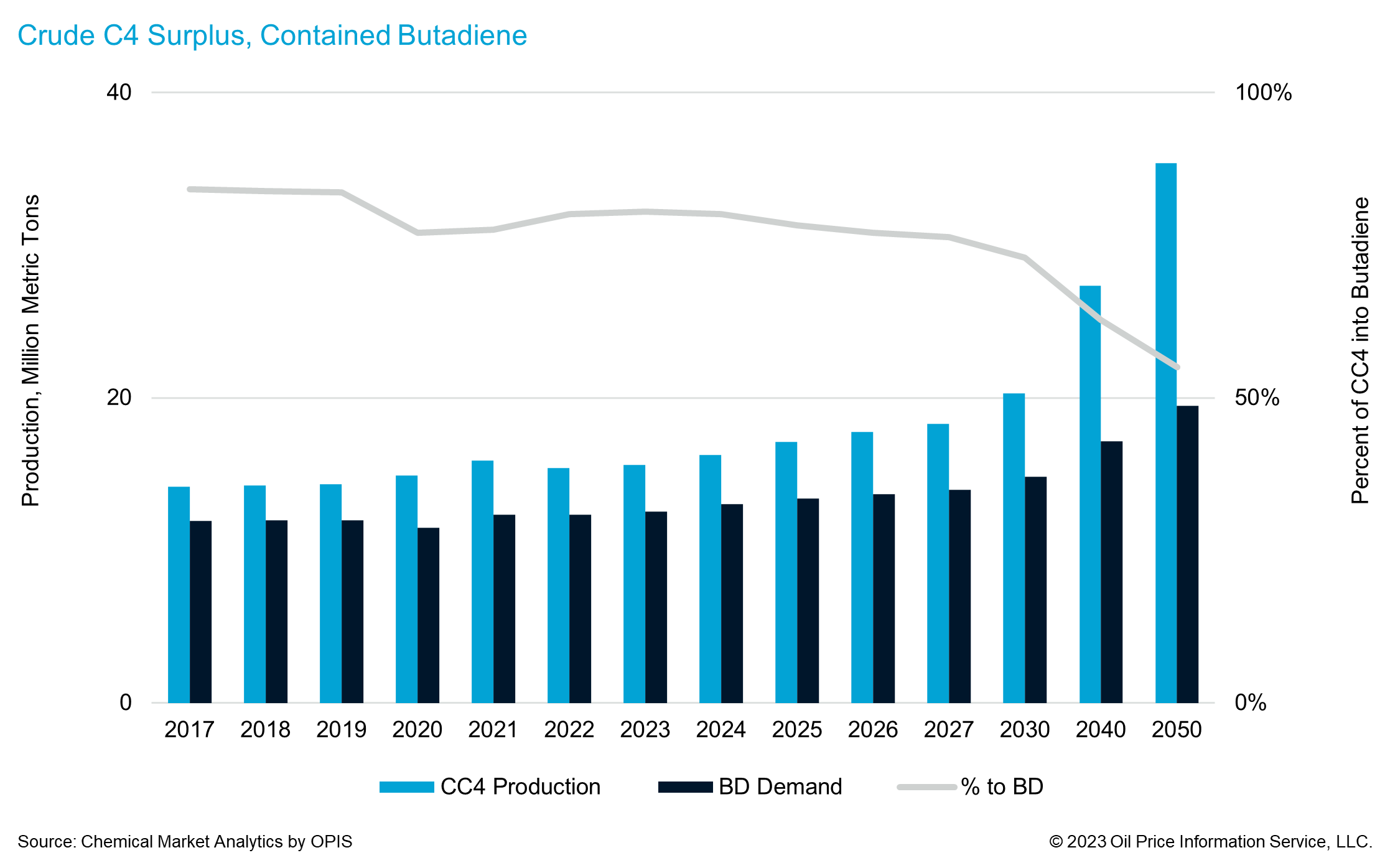

The other factor that drives crude C4 is ethylene production rates. Ethylene demand grows at a faster rate than butadiene demand. Ethylene demand typically grows around 4% per year. On the other hand, butadiene demand is forecast to grow at less than 2% per year. The ethylene market is also more than 10 times larger than butadiene market so even a small difference in growth rates translates into a significant difference in absolute volume. As a result, we expect the crude C4 balance to lengthen in the future. The details behind the ethylene outlook are available to clients of our World Analysis – Ethylene.

Historically, around 80 percent of the butadiene contained in the world’s crude C4 has been processed through a, extraction unit to purify it and make it available to synthetic rubber producers and other butadiene consumers. The remaining volume is generally located in an area with limited butadiene demand and expensive logistics costs to butadiene consuming area. However, as noted, crude C4 production will grow much faster than butadiene demand, especially after 2030. By 2050 the percent of the butadiene contained in the global crude C4 required by the butadiene industry will fall to close to 55 percent of supply.

Other Crude C4 Options

There are several options to conventional extraction available to the crude C4 value chain, each with strengths and weaknesses. There is chemical demand for other crude C4 components that make sense to selectively hydrogenate butadiene in the crude C4 to produce high valued butylene derivatives. However, these markets are too small to consume the looming surplus. At a high level, the volume will have to find its way into the LPG pool and consumed as cracker feedstock or into the broader market, or it will have to find its way into the gasoline blendstock market. Ethylene producers planning projects that start up in the late 2020’s, and certainly any time after that, will need to carefully consider their crude C4 options. Building a butadiene extraction unit with the intent to sell into the merchant market at that time will definitely be much more risky than it has been historically.

We used to refer to these alternative uses for crude C4 as destruction partially because they involve actually destroying the contained butadiene and potentially other C4 olefins, but mostly because we believed it to be destroying value. That was probably not rigorously true since any volume that could efficiently find its way into a higher value application did just that. However, more recently the question has arisen if selectively hydrogenating crude C4 does in fact destroy value. The answer is less certain than we might have thought.

The process of selectively hydrogenating crude C4 to raffinate-1.5 is relatively simple and low cost. It is a catalytic process that likely involves a capital investment in the neighborhood of $75 million for a world scale unit. In addition to the crude C4, hydrogen is the only other feedstock. Additionally, the unit is relatively easy to run so would not likely require significant manpower additions in an existing plant to operate. We estimate the operating cost to be around $110 per MT of contained butadiene fed to the unit. We understand the conversion to be nearly 100% with 97% going to a combination of normal butylenes and 3% to normal butane. The normal butylenes are roughly 60% butene-1 and 40% butene-2.

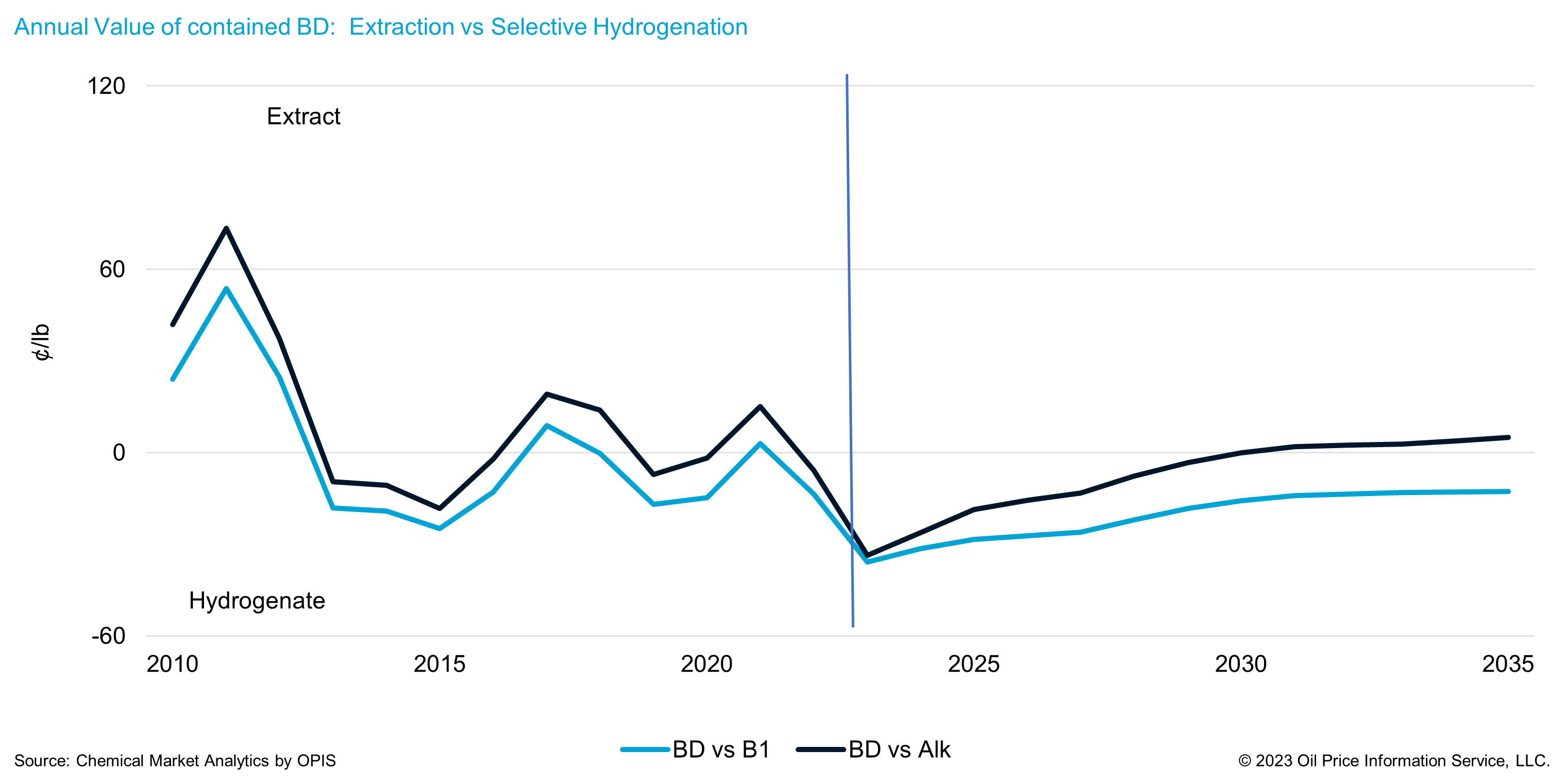

We have compared the economics of selective hydrogenation with extraction in the US market for producers that put all of the raffinate-1.5 into the alkylate market and for producers that separate out the butene-1 and sell it into the comonomer market. We looked at the period between 2010 and 2024 using actual prices in history and our forecast through the end of next year.

In our analysis we have made several simplifying assumptions. The first is all of the raffinate finds a home in the alkylate market with a butylene price at alky value, normal butane discounted from the market price and isobutane at market. Our calculated alkylate value for butylenes is a function of the unleaded premium gasoline (ULP), isobutane, and natural gas prices. We believe the key risk to this assumption is the availability of alkylation units. We understand that they often run at maximum rates and might not have been able to take additional feedstock. Second, for the butene-1 option, we make a similar assumption, that there is a market for the butene-1 at our gasoline based formula price. Finally, we ignore the capital investment impact. So this analysis can be considered based on a US facility that already has the ability to either extract or selectively hydrogenate crude C4. Admittedly that is a small set. However, the results do point to a potentially interesting trend in the medium and certainly longer term crude C4 market.

Before beginning this analysis, we expected the results to show butadiene extraction to the be best use of the crude C4 essentially all of the time. Butadiene is an important chemical commodity that is used to produce many higher value products including synthetic rubber, ABS, and nylon. The finished goods in its value chain are indispensable in our modern world, especially in the mobility sector. Alkylate is a premium gasoline blendstock with a high octane number, low vapor pressure, no olefin or aromatic content and no sulfur. However, it is a fuel, one blendstock among many that are available to gasoline blenders, not a higher valued chemical. So of course the chemical application will generate the highest netback, except often it didn’t.

Our butylene alky value formula yielded a higher price than would have been expected. Over the entire 15 year period, the average butylene alky value was just over 1.2 times ULR. In the six year period 2019 – 2024 the multiple is essentially 1.3. Over the same 15 year period, our gasoline based B1 price formula averaged 8 cents per pound higher than the butadiene contract marker, and 20 cents higher over the last six year. So the net result of the analysis was between 2010 and 2024 the netback from selective hydrogenation and selling raff-1.5 into the alkylate market was higher than extraction nearly 55% of the time. The butene-1 upgrade meant selective hydrogenation was favored over extraction nearly 70% of the time.

If we extend the forecast well into the future using our annual price forecasts for the relevant commodities, it is clear that this is not a passing phase, but a feature of the market. Our outlook calls for butadiene margins to be pressured for a number of years by the overcapacity that exists in the global market. Oil and gasoline prices are forecast to remain higher than the low prices seen between 2014 and 2019. So, based on our current price forecast, it will be into the early 2030’s before extraction is preferred over alkylation. Again with the B1 option it seems unlikely to ever happen.

In the very near term this is a very interesting theoretical exercise but not actionable. US butadiene producers run to consume as much of the domestic crude C4 production as possible. All of the volume is under contract and the ethylene producers are relying on them to find a home for the crude C4 that does not affect ethylene cracker run rates. At the current time this means maximizing selective hydrogenation, meeting domestic butadiene demand, and exporting the remaining volume at whatever price it takes to clear the market. Recently that has been a massive discount to the contract marker. This trend will continue for some months as ethylene production is set to increase while there is less optimism among butadiene consumers.

However, in the medium term when the US butadiene balance is tighter there will be times when US butadiene consumers are in need of incremental volume. If there is surplus crude C4 available, at least one butadiene producer will have to choose between selling spot butadiene or selective hydrogenation. Another way to think of this is, at least for a portion of the US market, selective hydrogenation economics will eventually set a spot price floor that is higher than the contract price.

Longer term this dynamic becomes particularly interesting. There has been discussion in the market after the loss of the Pt. Neches of debottlenecking US butadiene production capacity. New ethylene capacity has been announced which will push existing butadiene extraction operating rates to the point where cocracking might become more common. Selective hydrogenation capacity is much less expensive to build and generates competitive or superior returns. So any butadiene capacity creep that requires significant investment should be considered in that light. Of course another complicating factor in this analysis will be a view of the longer term outlook for the gasoline markets and by extension alkylate demand.

Summary

Since the 1960’s and the rise of naphtha cracking, global butadiene supply has been dominated by crude C4 extraction. The relationship between ethylene and butadiene producers has not always been one of working together for the common good. The economics of ethylene production are far more compelling than butadiene production. So crude C4 supply has been a function of ethylene feedslate economics and operating rates. Butadiene producers, and consumers, have reacted base on dynamics that are not always consistent with those of their own markets.

Historically about 80% of the butadiene contained in global crude C4 production has been processed through extraction units to produce refined butadiene. The balance has mostly been produced in areas that are logistically unavailable to the butadiene market. However, this trend will change due to two main factors. First, ethylene demand will grow faster than butadiene demand. Second, the average ethylene cracker feedslate will trend heavier. So an increasing percentage of global crude C4 will have to find a home outside the butadiene market. By 2050 we forecast only 55% of the world’s contained butadiene production will be needed by butadiene consumers.

There have always been options for crude C4 other than butadiene production. Cocracking crude C4 is always a last resort. However, the stream can be hydrogenated either completely into a mixed butane stream or selectively into a raff-1.5 stream. In the US, the current surplus of crude C4 has the market asking about the economics associated with selective hydrogenation. Our analysis indicates that selective hydrogenation is often a competitive alternative consumption of crude C4.

In the near term, as long as the US butadiene market balance is long, crude C4 is being consumed however it can be, extraction for domestic sales, selective hydrogenation, and extraction for extremely low price export sales. However, once the market returns to a more typical, tighter balance the option of selective hydrogenation will serve as a spot price floor for part of the market at a minimum. Longer term, the option of adding selective hydrogenation capacity instead of extraction capacity will have to be considered.

Authors

Anthony Song

Director

Bill Hyde

Vice President

Remko Koster

Executive Director

William Chen

Executive Director

Learn how we can help you prepare and navigate market disruptions

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving in profound ways and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on the specific trends shaping the market.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!