The European PVC Industry – In the Eye of a Storm, or Just a Storm in a Tea Cup?

Background

The global PVC market has been buffeted by seismic external shocks in recent years. It all started with the COVID-19 pandemic in early 2020, which initially was detrimental to PVC. 2021 was defined by supply shortages due to significant planned and unplanned outages regionally and globally, not least of which was the lasting effects of Winter Storm Uri in the US. Meanwhile, domestic demand surged, in large part due to the so-called ‘cocooning effect’ of the COVID-19 pandemic. The upshot was PVC pricing and calculated margins for producers that reached record levels. In 2022, the European bubble burst in spectacular fashion. In the first half of the year, demand held steady on a high level but from mid-year it collapsed, resulting in an annualised market contraction that easily exceeded the surge in demand seen in 2021. Chemical Market Analytics by OPIS estimates that domestic demand grew 8-9% in 2021, while it contracted as much as 15-16% in 2022, which is all the more remarkable when one considers that all of this contraction was concentrated in the second half of the year.

The 2022 collapse was multi-faceted with the Ukraine conflict being a driving force in many cases. The collapse was the result of rising inflation squeezing disposable income, higher interest rates dragging on investment and economic activity generally and the energy crisis hitting demand, affordability and sentiment. Moreover, with the release from COVID-19 confinement and, as economies re-opened, the population returned to spending less of their, albeit reduced, disposable incomes on products that consume PVC and more in leisure, services, etc. In summary, in the period from early 2020 to mid-2022, the pressure that built in the bubble was significant, the market over-heated and the adverse reaction when it came from mid-2022 was even more intense, magnified by multiple negative factors. Using 2019 as the last ‘normal’ reference point, Chemical Market Analytics by OPIS believes domestic demand lagged approximately 25% in Q1 2023 and operating rates have collapsed.

Market Overview & Outlook

To the extent that the confluence of events over the last three years were so extra-ordinary and so intense, we assume that the resulting market volatility was a once-in-a-generation occurrence and that market conditions will normalise. However, it is difficult to overstate the scale of the downturn and recovery from deep deficit territory is likely to be protracted and gradual. The reason for this is that some of the forces underpinning the downturn in demand are considered structural shifts, in particular the fall out from the Ukraine conflict which we expect to feed into enduring macro-economic and cost pressures. Also, as the European economy pivots away from a fossil fuel-based economy to renewables, this will add to costs and r-PVC is expected to remain a limiting factor for prime PVC demand growth.

West Europe is likely facing a shallower and shorter recession than previously expected before moving to positive below-trend GDP growth. However, PVC demand will not necessarily correlate with this economic outlook because GDP expectations in West Europe are heavily weighted towards the services sector, meaning roughly 70%. Only about 30% of the economy relates to the manufacture of goods, meaning products that may consume PVC.

Why is demand so weak and is there any light at the end of the tunnel? Let’s respond to the second part of this question first. Regardless of the application or geography, buyers are unanimous in reporting no expectations of a fundamental pick up in demand over the next three/four months at least. Moreover, we will soon be entering the seasonally slower summer period. Order visibility is reduced and, at present, we expect demand to deteriorate at a moderating rate before stabilising on a low level until late 2023 at the earliest, at 20-25% below the seasonal norm. Beyond the short-term, growth should return to the market because the region fundamentally needs housing and infrastructure and PVC’s multiple properties mean it will remain the ‘go-to’ polymer for many construction-related applications. However, when this will happen goes to the heart of the reason why demand is so weak. The impact of extremely high interest rates, which may not have peaked yet, is really biting hard as it cools investment, construction and economic activity generally. Consumer purchasing power is constrained and investment in durable goods has been sacrificed. The downturn in the construction sector has been most acute in Germany, but it is also significant across geographies. In Germany, some large construction companies have halted any new house-building projects for the rest of 2023 and building permit rates have declined to levels not seen since 2018. Moreover, a good portion of the discretionary spend on goods that consume PVC into the DIY segment happened 1-2 years ago during COVID-era lockdown projects. As and when interest rates start to moderate, we expect to see a delayed inverse correlation as PVC demand picks up gradually. As such, a measurable pick up in demand is not anticipated before early 2024.

Assuming that there will be no measurable improvement in demand until early next year, domestic suppliers face a difficult balancing act if they are to continue operating. The subsidising effect of caustic soda is much diminished and we believe that Europe will not be able to export its way out of difficulty because the economics will not justify producing for export. Converters need to compete with low-priced imports of S-PVC or finished products, and producers’ order intake is likely to continue to suffer unless domestic pricing offers a viable alternative to imports. Against this background, there is virtually no prospect of industry operating rates increasing in the short-term, from their current levels estimated at 65%, on average. Despite these low rates, producers have been struggling to contain upward pressure on their inventories. If anything, there is more downside risk than upside to operating rates in the near-term, especially for those sites at the upper end of the cost curve.

Based on our twice-yearly balance updates that we last completed at the end of 2022, excess capacity is on course to increase from 2 mmt in 2020 to about 2.5 mmt in 2023. However, this already pessimistic view has worsened since then. Based on our supply/demand balances that we are in the process of updating, excess capacity is expected to increase even further.

Note: Chemical Market Analytics by OPIS expects to publish our World Vinyls Analysis 2024 version in Q3.

For further information on this strategic resource please refer here or contact your regional consultant for assistance.

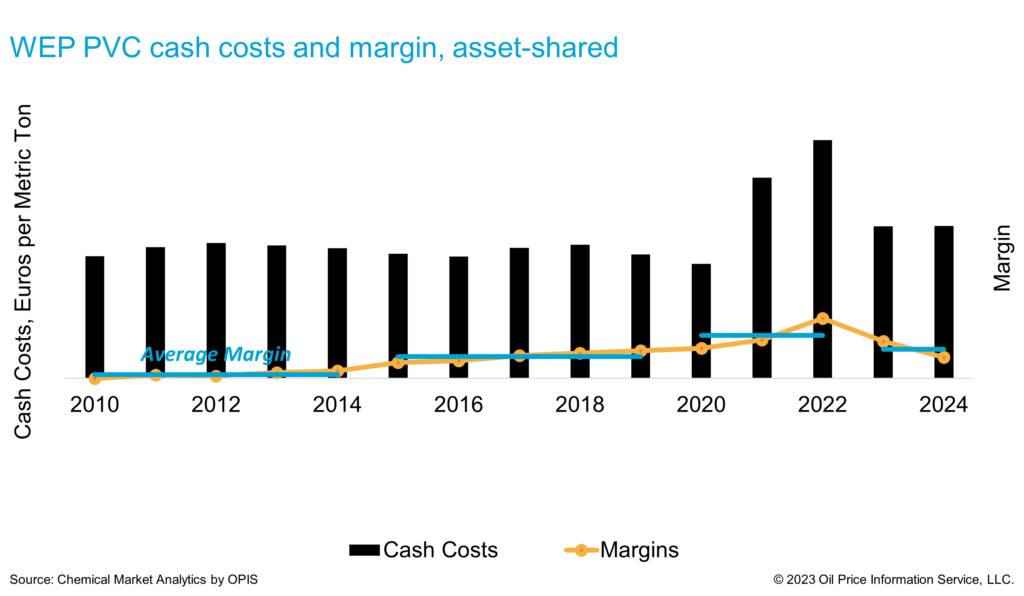

Economics

Although, PVC costs in West Europe are forecasted much lower than the last two years, they are expected to remain elevated by historical standards, which will likely remain a drag on demand growth prospects. PVC margins for integrated producers are expected to correct to pre-COVID levels over the next two years but we do not expect a full collapse to the dark days of 2010-14. One of the main reasons is that, although caustic soda has fallen sharply it should continue to carry more than its historical share of ECU margins, which will help to suppress calculated chlorine costs for integrated producers. Also, ECU costs are expected to stabilise on a lower level, albeit still high by historical standards. In the current climate, it is difficult to see the vinyls business contributing more to ECU economics. As such, a lot is riding on caustic soda continuing to support more than its historical share of ECU margins. If this market weakens more than currently envisaged and coincides with persistent weak vinyl market conditions, then asset-shared margins would be lower than currently forecasted.

Global Competitiveness

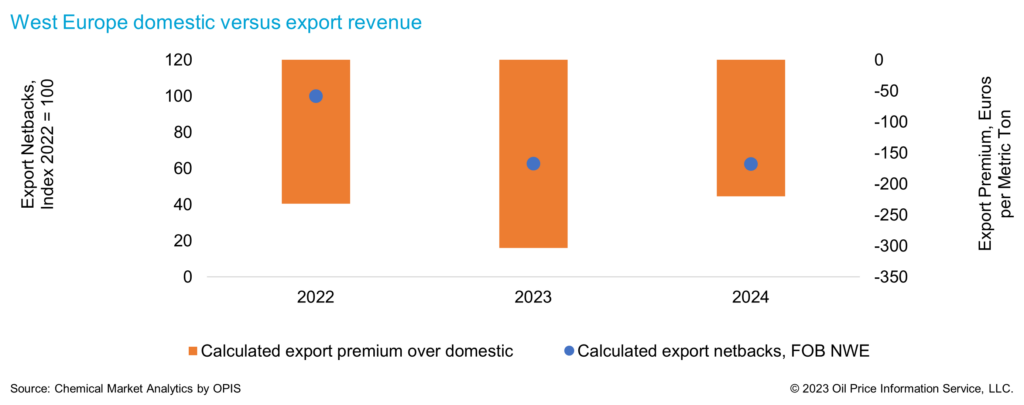

Trade is the mechanism for moving PVC from surplus or cost-advantaged regions to deficit or cost-disadvantaged regions. West Europe has long been a surplus region and, despite being a high cost position, historically it has been able to leverage its geographical advantage and, in some cases, anti-dumping advantage to export to large deficit markets nearby.

Additional export volumes are typically allocated based on marginal economics with a cost allocation that is at the upper end of a producer’s spread. Weak international markets and Europe’s uncompetitive cost position relative to other regions mean European export economics are and will likely remain unattractive. The export-to-domestic premium is set to remain deep in negative territory. As such, the normal export lever that producers often rely on to help balance the domestic market during periods of instability is likely to play a much-diminished role over the next two years at least.

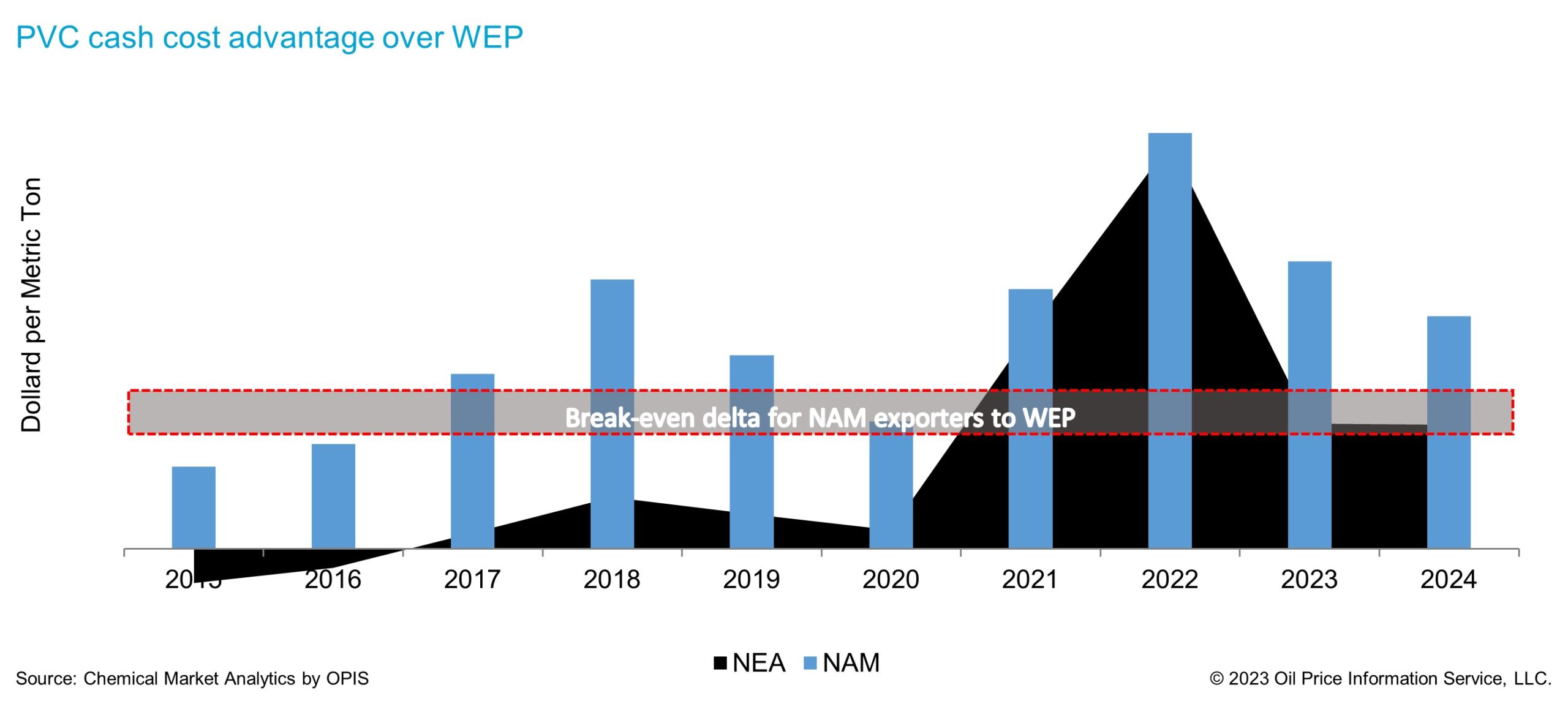

The region is currently, and is expected to remain, the highest cost region in the world for years to come. An arbitrage presents opportunities for suppliers in North America. Meanwhile, Northeast Asia used to have a cost position that was on a par with West Europe, since both regions are naphtha-based ethylene producers. However, following the hike in European power costs, Northeast Asia now has a cost advantage that is sufficient to access Europe competitively.

Other than cost differentials, there are other factors supporting our prognosis that import volumes are likely to remain high, including:

1) previously prohibitive freight rates have corrected back to pre-covid levels, or even below;

2) with fragile-looking demand in the US, producers in that region may turn increasingly to Europe as a priority export destination to help support domestic operating rates and limit margin pressure at home and;

3) lagging demand and new capacity in Asia is likely to fuel increased export activity from that region.

Conclusion

Producers are faced with deficient demand while also confronted with reduced support from the caustic soda side of the business, sustained import pressures and many would normally look to exports as their ‘go to’ lever to help balance the market, but export conditions are also challenging. For lack of other options, operating rates have fallen off a cliff to levels that may be on the threshold of viable in some cases. But there comes a point where it becomes less costly to close for a period or even permanently, as fixed costs and lost economies of scale mount.

Assuming Europe’s costs remain elevated versus the historical norm and given that:

1) PVC is a commodity plastic that is actively traded around the world and;

2) Europe is already a surplus region with a demand growth profile that is expected to remain amongst the lowest of any region, one could make the case for rationalisation, and there is precedent for this following the 2008-09 crash. Moreover, we have already seen examples of rationalisation in other value chains during the current upheavals, most recently by BASF at Ludwigshafen, where they intend to replace domestic TDI supply from their capacity in other regions. Time will tell if the European vinyls industry is heading down a similar path.

Authors

Ana Lopez

Director

Eddie Kok

Executive Director

Henry Warren

Director

Xingyu Zhu

Associate Director

Gordon Kuo

Associate Director

Learn how we can help you prepare and navigate market disruptions