European Light Olefins – The Bottom of the Trough?

The collapse in market confidence that started in June last year has seen no sign of reversing and though the economic demise that was envisioned has not fully materialised, consumption activity in Europe has shifted into reverse. However, in all shifts in market confidence, the role of the supply chain in driving the dynamics of petrochemical markets cannot be overstated. Understanding to what extent supply chain adjustments are impacting the market at any point in time, versus underlying changes in behaviour, is critically important in gauging trends. The time span between production of petrochemicals and the ultimate consumption needs to be measured in weeks or months, and can even be over a year. Given the length of the supply chain and the number of stages at which inventory can be built and held, changes in stock levels can have a far-reaching consequence on the demand experienced by producers, in the short-term considerably more than the changes in underlying consumption.

Another key component in determining the fortune for European producers is that of trade flows. The rapid growth in capacity availability in low-cost ethylene producing regions and even more extreme growth in demand driven investments in China have resulted in excess supply in olefins markets, to an extent not seen since the early 1980s. This build of capacity has increased the pressure European markets feel from imports, The level of net equivalent trade for both ethylene and propylene shifted away from such heavy imports in the second half of 2022 before rebounding in Q1, 2023. The position for propylene is somewhat less dramatic, reflecting some slightly less extreme price differentials between the regions, though the upward trend in imports remains clear. The large swings in trade have made gauging the dynamics within the supply chain that much more difficult, the exceptionally low demand levels seen may not be entirely down to weak demand.

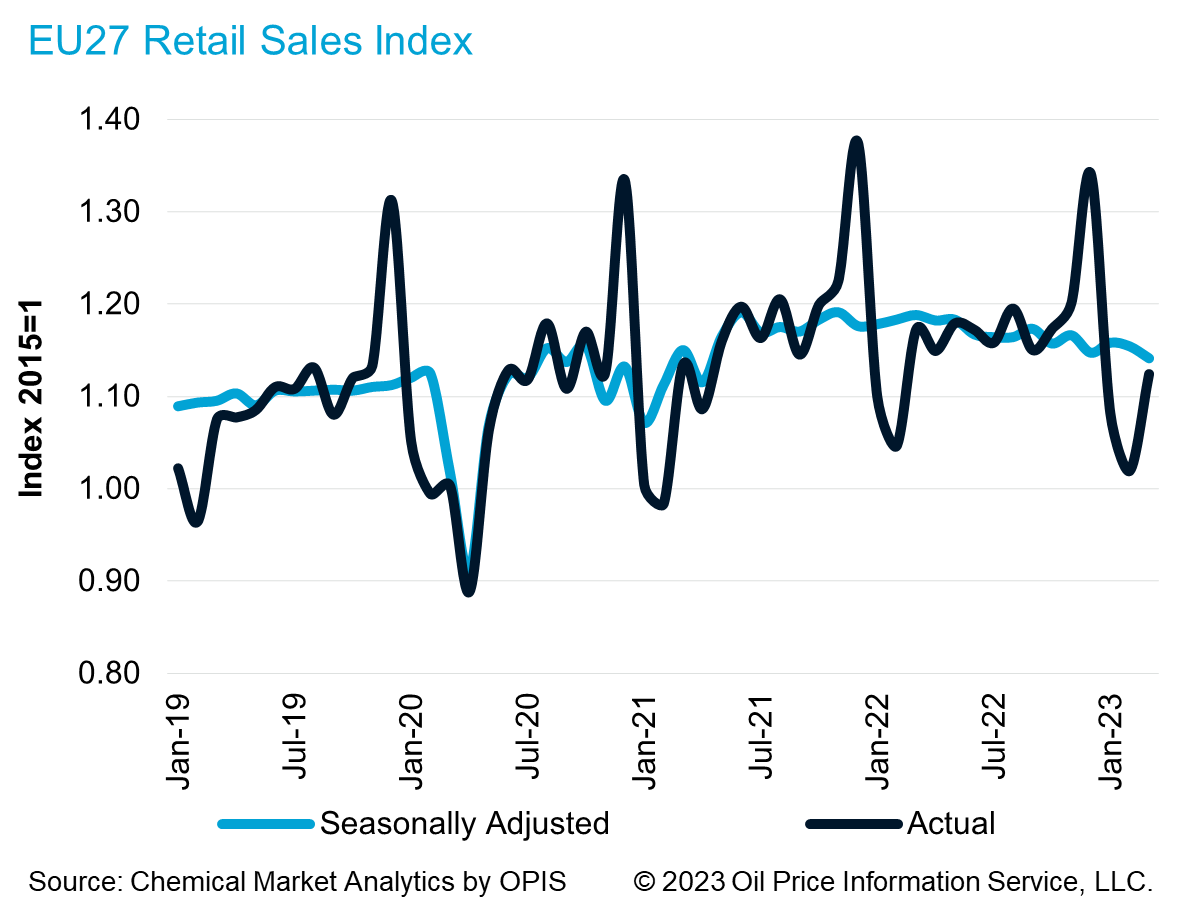

To gain an understanding of the level of real demand, consumer activity can be a useful tool. The changes in consumer activity have traditionally followed a very strong seasonal pattern, with seasonally adjusted figures extremely predictable, any variance turns into an immediate cause for investigation. However, the last 3 years have drastically changed consumer behaviour, with so many impacts on activity due to the Covid-19 lockdowns, shifting policies, travel restrictions, the supply chain constraints restricting goods availability and, finally, the shift into an inflationary environment. This has resulted in the usual large monthly swings in actual consumer demand being overlaid by increasing unpredictability in behaviour. However, what is clear through the volatility is that consumer demand has been in steady decline for the last 12 months, with steady quarter-on-quarter contraction in seasonally adjusted figures.

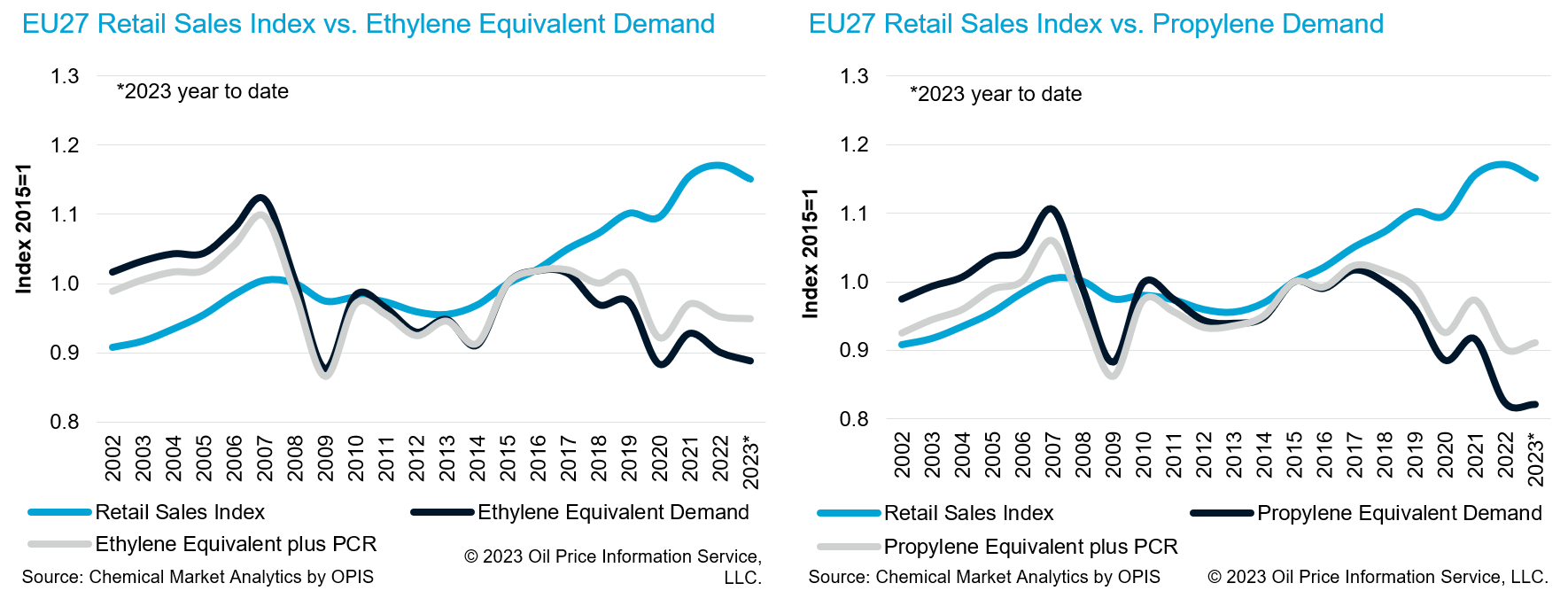

However, despite these declines, retail activity remains above that seen in 2019, before the roller-coaster of the pandemic hit. However, this is not reflected in olefins markets which have seen a notable contraction in demand since before the pandemic. Part of this shift will have been due to increased levels of recycled polymer making its way into the supply chain though other factors need to be considered to bridge the large gap seen. The base point of 2019 was a year of transition from a tight market to a longer market and so the impacts of supply chain changes will have been limited, not build of inventory would have been seen whilst destocking efforts had not really got underway. However, the last 12 months have seen extremely strong destocking signals and the supply chain has been working to remove as much inventory from the system as possible.

Comparing long-term retail activity to ethylene and propylene demand shows a gradual shift away from petrochemical demand, less and less polymer is being used per unit of consumption. The headwinds of environmental concern and technical developments in packaging to achieve more with less have driven this trend. However, from 2020 to present there appears to be a sharper decline in demand than would have been expected given retail activity. This reflects the challenges seen in many downstream sectors; for example, automotive production had been depressed due to supply chain constraints. For ethylene those figures have been in a single digit percent frame, suggesting a smaller inventory correction than seen for propylene. However, for both ethylene and propylene, the weakness in demand suggests that the supply chain has been constrained given tightness in supply and high price levels have been an obstacle for convertors and their customers from keeping stock levels high.

The start of 2023 has seen import levels rebounding though the lack of demand for local supplies points to a more stable inventory position, stock levels are accessed to have declined heavily from August 2022 until February 2023, though in March a more stable position has been seen.

Having dissected the numbers that make up the current demand placed on ethylene and propylene markets, the outlook is not especially positive. For ethylene, the question as to how much of the demand contraction of the last 3 years is structural and how much is based on shifts in consumer behaviour and packaging evolution remains. However, even should a notable level of destocking have been seen, a recovering in underlying demand at current retail levels would only suggest a modest increase, far from enough to support a stronger market position. It would really need to be a notable shift in trade that would allow European markets to recover.

For propylene, there appears to be a more sentiment induced weakness in demand. Even a large structural shift in the market would still leave room for a rebound in demand. A shift away from de-stocking and a return to more normal economic activity would support this move. European producers will have to compete with derivative imports, this will ensure sustained pricing pressure on the market. However, as destocking activity comes to an end and durable goods demand sees a partial recovery, derivative demand will reverse and it maybe that a shift in market balance will be possible.

Authors

Matthew Thoelke

Executive Director

Irina Malashevskaya

Associate Director

Matthew Smith

Principal Analyst, EMEA Light Olefins

Learn how we can help you prepare and navigate market disruptions