China’s Methanol-to-Olefins (MTO): Integrated Economic Analysis

China’s methanol-to-olefins (MTO) development represents a significant strategic move within the petrochemical industry. It is being driven by the country’s growing demand for olefins such as ethylene and propylene, which are key building blocks for a wide range of products, including plastics, fibers, and chemicals. MTO processes convert methanol, which can be derived from various sources—including coal, natural gas, or biomass—into olefins.

Chemical Market Analytics by OPIS defines MTO as sourcing all or most feedstock methanol from the merchant market. MTO plants in China exhibit varying economic dynamics depending on their locations and product derivatives. MTO plays a pivotal role in both the merchant methanol and olefin markets within China. MTO plants, especially those not integrated with methanol production, constitute a significant source of demand for methanol.

Gain comprehensive analysis into light olefins in Asia:

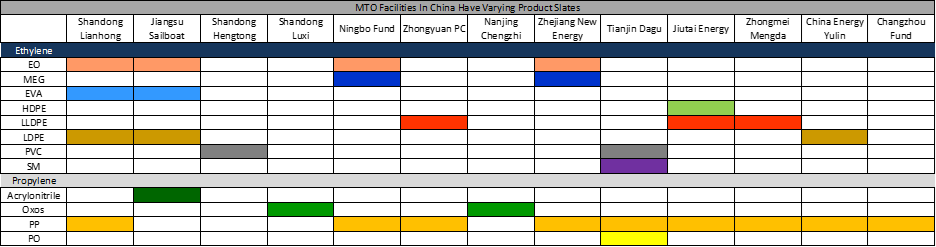

Short-term outlooks

MTO olefin derivatives encompass a wide array of products. While polyolefins represent the largest segment of olefin derivatives in China, accounting for over 60% of olefins consumption, the distribution of such products across the nine MTO facilities is varied. Among these, only three MTO plants have the capacity for polyethylene production while five possess capabilities for polypropylene manufacturing, with Nanjing Chengzhi and Shandong Luxi exclusively marketing all their ethylene monomers while Shandong Henghong commercializes all of its propylene monomers. This strategic approach to marketing underscores the unique operational dynamics within each MTO facility and reflects their individual market strategies.

Certain East China MTO plants have the flexibility to trade olefin monomers based on market conditions. Unfavorable economics for MTO facilities could worsen their impact on the ethylene market. Integrated players actively participate in the spot ethylene market. If downstream units remain unprofitable, MTO owners may scale back or cease operations, choosing to buy spot olefins instead—particularly when methanol-to-olefin price gaps narrow.

in China © 2024 OPIS, LLC

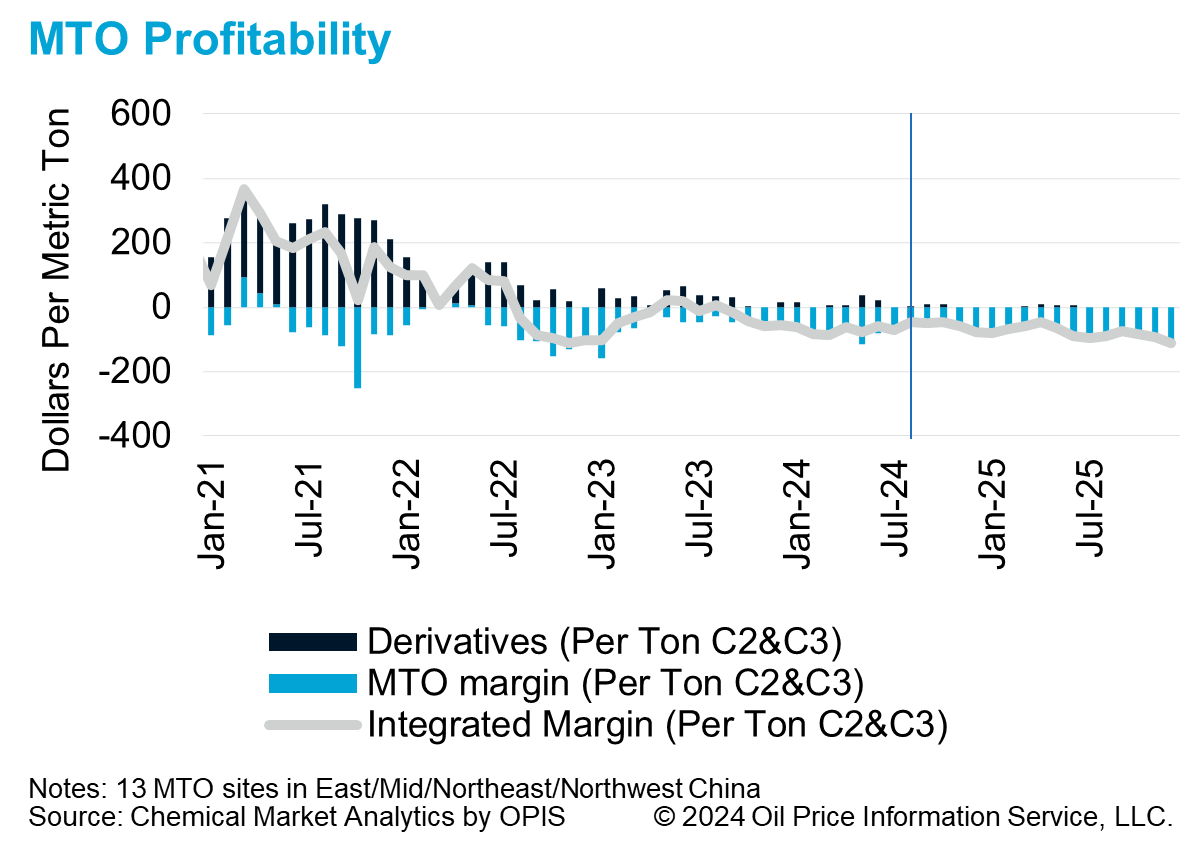

Since the middle of 2022, high energy prices have weighed on MTO production economics. On one hand, rising methanol prices have increased MTO production cost. On the other hand, it is hard for MTO players to raise product prices due to the increasing olefin and derivatives supply, particularly from steam crackers.

The production economics for MTO plants remained weak, and most MTO plants are estimated to have had negative light olefin margins in June this year.

The weighted-average derivatives margin based on spot ethylene and propylene prices is currently much higher than the light olefin margins, and MTO plants may choose to reduce olefin production and purchase light olefins to produce derivatives.

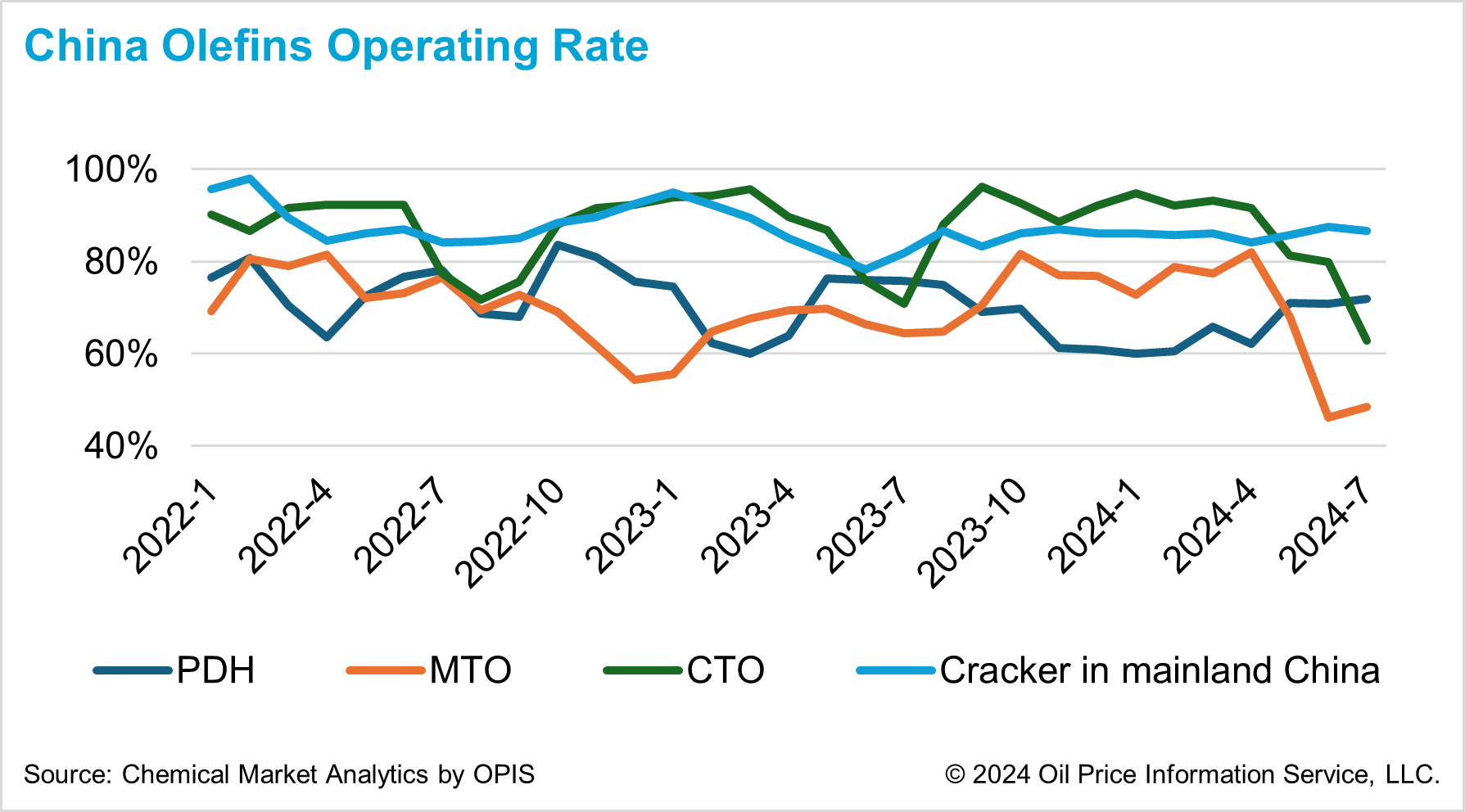

Driven by soft margins, production at MTO units continued to run at reduced rates, with several units continuing to implement production cuts at various levels. It is anticipated that other MTO producers will maintain production cuts due to unsatisfactory margins in June earlier this year.

Additionally, three MTO plants are integrating with steam crackers or crude-to-chemicals (COTC) processes. The prospect of higher derivative margins might prompt companies to optimize MTO light olefin production. In the coming years, Chinese steam crackers will pose direct competition to MTO facilities in terms of olefin production.

In the past several years, two MTO plants were idled. Hence, we anticipate that MTO operating rates will remain low in the near-future.

China has been aggressively expanding olefins capacity by building plenty of new steam crackers. We expect that if steam crackers can produce olefins more cost-effectively than MTO plants, it could lead to pricing pressure and reduced market share for MTO-derived olefins. In the past several years, two MTO plants were idled. Hence, we anticipate that MTO operating rates will remain low in the near-future.

Join us at the Global Acrylonitrile & C4s Forum, taking place 14-15 November in Singapore. This forum focuses exclusively on the Butadiene and Acrylonitrile Markets. With both markets facing complex futures, attendance at GACF24 is a must for anyone seeking a comprehensive understanding of market forces and likely outcomes.