Changes Across Top Propylene Producers and the Impacts to the European Market.

In the summer, the Chemical Market Analytics, Olefins team presented a brief overview of European ethylene integration. Recently, the team looked at the development of the European propylene market and assumed that nearly all plants run at 100 percent utilization against the nominal database capacity. When including refinery grade capacity, the view of regional balances and real exposure to the propylene market is broader, as it reflects industry players’ exposure to the propylene market more accurately.

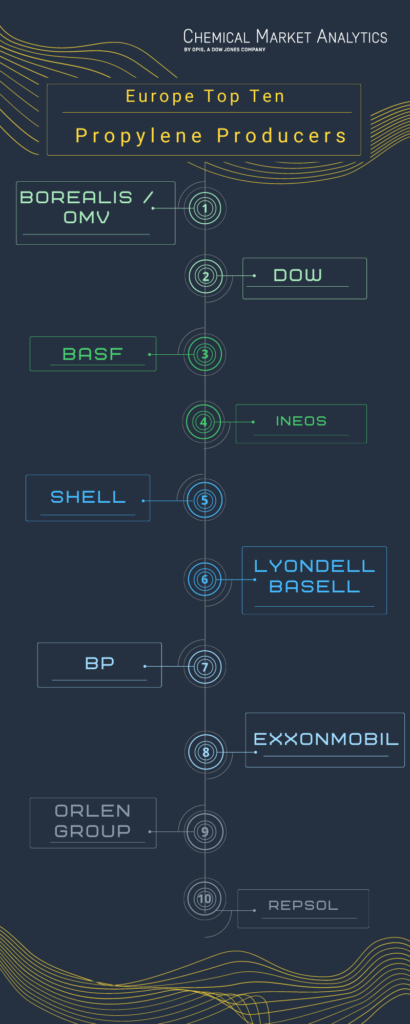

The top ten propylene producers have seen some changes over the past couple of years, with the addition of Borealis/OMV and Repsol to the exclusion of Sabic and ENI. There have also been capacity changes with the closure of Versalis in Italy.

The major producers remain the large steam cracker and FCC operators, but four of the top 10 producers in Europe are chemical companies with no or minimal supply from refinery operations. The oil companies such as BP, ENI/Versalis, Shell, Total, and BP continue to be the major propylene sellers and the largest. Dow is the exception, with their sale of polypropylene and cumene assets to Braskem and Olin, respectively, and the more recent idling of acrylic acid capacity. The Borealis and OMV businesses merged and no longer appear as sellers. The leading group of sellers’ accounts for roughly 2.3 million metric tons of net sales.

OMV increased its stake in Borealis from 36 percent to 75 percent in 2020, making the joint entity the second-largest propylene producer in Europe. There are 31 consuming companies in the propylene market, with 55 percent consumed in polypropylene production. The top 10 consumers account for over 77 percent of the market, a slightly more concentrated grouping than is the case for producers. The top 9 consumers of propylene are also top producers, though some have insufficient internal supply and remain large net buyers of propylene. LyondellBasell remains the largest buyer of propylene, though the closure of their Seal Sands acrylonitrile unit in the U.K. in 2020 reduced that purchase requirement. Braskem is the largest pure merchant buyer of propylene, with OQ, Bazan, Evonik, and Seqens also participating in the contractual settlement process. The spread of propylene supply and demand in Europe is like that seen for ethylene, but there is a much smaller level of pipeline integration in Europe for propylene than is the case for ethylene.

The United Kingdom, Sweden, and Norway have a surplus of propylene, while Portugal, Spain, and Italy are slightly short. The U.K., Sweden, and Norway have a deficit due to the increased use of ethane, while Hungary is slightly long. The European propylene industry has moved to a structural shortage, with Belgium now the largest deficit country and France becoming structurally short on chemical and polymer grade. The extreme energy costs seen in 2022 and weak markets have resulted in a long rather than short market.

As the market evolves, an upside in supply is expected as buyers work on alternative solutions to the structural tightening in market balance. Refineries are coming under increasing pressure, and further closures are a distinct risk, though the rebound seen in 2022 has pushed off that potential closure scenario. The upcoming start-up of the Borealis investment has reduced the risk of feedstock-driven derivative closures in the short term, but it is not expected to meet future supply constraints.

Matthew Thoelke

Research and Analysis Executive Director

Chemical Market Analytics by OPIS, a Dow Jones Company

Stay ahead of the competition by accessing reliable and unbiased data to help you make critical business decision. Connect with us to learn more on our Propylene coverage and get your sample report.