New Path, New Energy

Introduction of Rystad Energy

Less than a year ago, Chemical Market Analytics (CMA) faced a unique challenge: securing energy insight for our chemical analysis. To forge a new path towards independence, we approached the process as if we were seeking energy integration for our petrochemical complex. After canvasing the landscape of market insight, then evaluating multiple potentials, the right choice for CMA became clear.

We are pleased to announce that Rystad Energy is our new energy insight partner. Founded in 2004, Rystad Energy has a legacy of bottom-up data gathering, research, and analysis of the energy sector. The company has a mix of domain experts and data science professionals, enabling Rystad Energy to provide unique and data-driven insights. We plan to integrate our data sets to provide truly integrated and realistic views of the energy transition, plus we will explore product development opportunities to produce tailored energy products for CMA customers. Over the course of the next three months, CMA will migrate our data sets from our current provider to our new partner. In the meantime, we will give you a glimpse of the insight potential of this powerful partnership. Here’s to a new path, new energy.

Transition & Trilemma

Change is always hard, but forced change is even harder. Industries and businesses often encounter such change, whether it be mergers & acquisitions, policy shifts, macro-level movements, or changes in consumer behaviors. The chemical industry is facing a combination of these as the looming energy transition will create challenges, but also opportunities. To help our clients plan for the energy transition, Rystad Energy provides the various pathways of the energy transition defined by the degree of temperature increase out to 2100. For example, the house view is the 1.9-degree Celsius increase, resulting in oil demand falling from over 100 MMB/d today to 65 MMB/d by 2050; there are other pathways that bracket the house view by plus-or-minus 0.3-degree scenarios as well as the “net-zero” and OPEC cases.

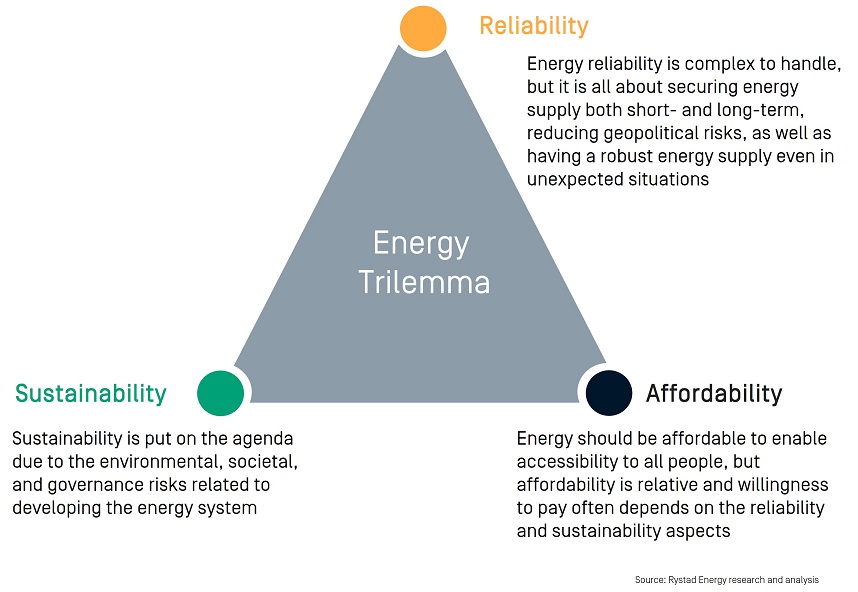

However, one cannot ignore geopolitical turmoil. The most significant revelation from the Russia-Ukraine conflict is that the world remains heavily dependent on traditional forms of energy and green energy sources are still insufficient to replace this dependency. The current state of affairs is such that countries will have to wrestle with the energy trilemma of reliability, affordability, and sustainability. Not only will policymakers have to contend with securing necessary supplies of energy, but they also have to ensure that these supplies are inexpensive, while simultaneously promoting renewable sources. This challenge becomes increasingly daunting amid geopolitical tensions with countries that have a high concentration of resources. The resulting and disparate responses to the near-term energy trilemma will undoubtedly influence the trajectory of the long-term energy transition.

Cost & Consequences

So, what does this all mean for the petrochemical industry? Regardless of the scenario one chooses, the petrochemical industry will take longer to decarbonize because of its outsized reliance on hydrocarbon feed plus its rate of demand growth. By its very nature, the industry cannot remove the “petro” from the petrochemicals it produces every day. Society needs the resulting synthetic materials to continue to enhance the standard of living and facilitate the overall energy transition (lightweighting, food preservation, etc). While the industry can undertake initiatives in the short run to reduce energy intensity, most of those will be at the margin to reduce process emissions. Longer-term, the most realistic option for decarbonization is to continue research & development of low-emission and low-energy intense chemical recycling.

In the meantime, the petrochemical industry will face its own energy trilemma. The availability of feedstock will become an increasing area of concern because lower oil demand will ultimately reduce hydrocarbon development which in turn will adversely impact the supply of natural gas liquids. Furthermore, reduced transport fuel consumption will adversely affect refinery run rates; capacity rationalization will be unavoidable, which will further strain the supply of petrochemical feedstock. The lack of availability will lead to affordability concerns. The price of downstream petrochemicals will need to increase to either carry the cost of upstream development or motivate a refiner to run incremental barrels of crude to provide the necessary feedstock for chemical production. The key question will be whether downstream light manufacturing and consumer product sectors support higher costs versus other materials. Aluminum, steel, glass, and paper are more energy intensive and expensive to produce than plastics and synthetic fibers. Petrochemical prices will likely rise to those alternative cost levels to motivate additional supplies of feedstock.

In the meantime, the petrochemical industry will face its own energy trilemma. The availability of feedstock will become an increasing area of concern because lower oil demand will ultimately reduce hydrocarbon development which in turn will adversely impact the supply of natural gas liquids. Furthermore, reduced transport fuel consumption will adversely affect refinery run rates; capacity rationalization will be unavoidable, which will further strain the supply of petrochemical feedstock. The lack of availability will lead to affordability concerns. The price of downstream petrochemicals will need to increase to either carry the cost of upstream development or motivate a refiner to run incremental barrels of crude to provide the necessary feedstock for chemical production. The key question will be whether downstream light manufacturing and consumer product sectors support higher costs versus other materials. Aluminum, steel, glass, and paper are more energy intensive and expensive to produce than plastics and synthetic fibers. Petrochemical prices will likely rise to those alternative cost levels to motivate additional supplies of feedstock.

Lastly, the sustainability of feedstock will become an area of growing concern. If prices for fresh hydrocarbon feedstock rise to extraordinary levels, then bio-based chemicals and chemical recycling should become more viable and scalable. In the current market, bio-based production of chemicals seems like it would remain a niche segment as the outlook for chemical demand growth would present an outsized impact on an already strained agricultural supply chain. Thus, chemical recycling would bear the brunt of the responsibility to help the industry decarbonize. Will there be sufficient recyclable feedstock material to offset the affordability and availability concerns on traditional hydrocarbon-based feeds? This is the question at the heart of the petrochemical industry’s trilemma.

As it stands today, if the 1.9-degree scenario comes to fruition, petrochemicals will account for 30% of oil demand in 2050. Without further advances in recycling to lower fresh feed consumption, the industry may find itself with very little choice but to pay even higher prices for hydrocarbon feedstock, a sobering prospect in the current environment.

Carlo Barrasa

Vice President, Energy

Chemical Market Analytics by OPIS, a Dow Jones Company

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving in profound ways and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on the specific trends shaping the market.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!

Chemical Market Analytics and Rystad Energy Data and Research Partnership

Delivering you with best-in-class intelligence for energy and chemical markets

Under the new partnership, Chemical Market Analytics and Rystad Energy will share data, forecasts, and expertise to advance research and analysis, providing our customers with an integrated view of the chemical and oil markets and actionable intelligence to navigate the path to net zero.