A Second Wave of Mainland Chinese Crackers is Looming

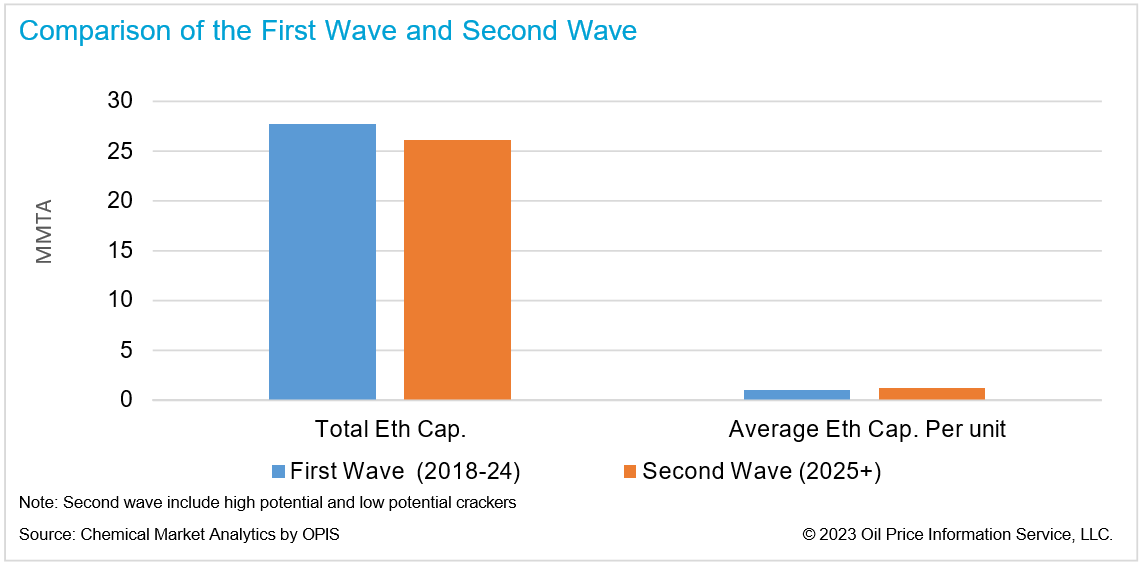

In 2018-24, with the startup of the first wave of new crackers in mainland China, total ethylene capacity will be increased by approximately 28 million metric tons (mt). Although the first wave of steam crackers is still ongoing, a second wave of steam crackers is already on the horizon with many planned steam crackers included in the second wave of investments. Some of them may be delayed or canceled; however, if all the planned steam crackers in the second wave come onstream, total ethylene capacity will be increased by approximately 26 million mt. The total capacity addition from the second wave of investment is currently slightly less than the first wave. However, the average ethylene capacity per unit in the second wave is higher as there are no planned small steam crackers.

The Second Wave of New Crackers in Mainland China

There are 21 planned steam crackers in the second wave of investments, including the two recently announced projects, PetroChina Tarim II and Sinochem Quanzhou II. Although most planned steam crackers are still in preliminary work status, five of them are confirming conditions, including Sinopec Fujian, CSPC III, Yulong Island II, BASF Zhanjiang, and PetroChina Jilin. Construction could start in 2023; if so, these new steam crackers could start up in 2026.

Like the first wave of new steam crackers, most planned steam crackers in the second wave are either naphtha-based or using heavier feedslates. However, we will see several pure light feedslate steam crackers, including PetroChina Changing II and PetroChina Tarim II. In 2021, both the PetroChina Tarim ethane cracker and PetroChina Changqing ethane cracker started up in Northwest China; their ethylene derivatives are polyethylene (PE). Both of these crackers would like to build their second phase with light feedslates.

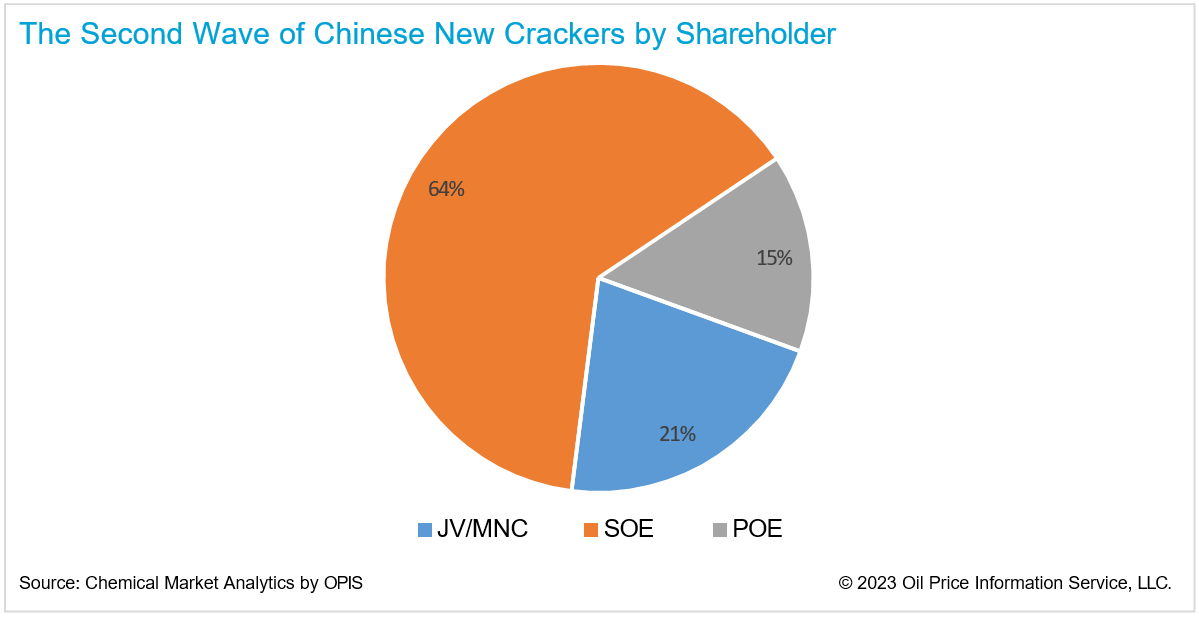

Private-owned enterprises (POEs) were the largest investors in the first wave of investments, accounting for 53% of total ethylene capacity addition in the first wave. However, there will be much less POE involvement in the second wave of investments, accounting for only 15% of total ethylene capacity addition in the second wave. The Yulong Island project is a key investment by POEs. Phase I is under construction. To support the Yulong Island project, Shandong will need to phase out several independent refineries.

According to mainland China’s central government guidance, the phase-out ratio is 1.25 to 1.00. With that, 25 million mt of crude distillation unit (CDU) capacity from independent refiners will be phased out as the central government would like to restrict the growth of refining/CDU capacity. In addition, Yulong Island plans to build a phase II with the same CDU and cracker capacity. Grand Resource is a PDH player. Although it plans to participate in the ethylene industry, its planned steam cracker is moving slowly. Wanhua Chemicals has already put a propane steam cracker into operation. The company has been considering building a standalone mixed-feed steam cracker without an integrated refinery. The project was delayed as the local government was more supportive of the Yulong Island project, which is located in the same city as Wanhua Chemicals. In addition, Wanhua Chemicals plans to import ethane from the United States as one of the feedstocks for the planned steam cracker. If so, Wanhua Chemicals will become the third importer to import ethane from the United States, following SP Chemical and Satellite Chemistry. In 2022, because of the high crude oil price, steam crackers with imported ethane from the United States enjoyed healthy margins due to cost advantages over naphtha crackers in Asia.

State-owned enterprises (SOEs) account for only 33% of the total ethylene capacity addition in the first wave of investment. They will play a more important role in the second wave of investment, accounting for 64% of total ethylene capacity addition in the second wave. PetroChina and Sinopec will lead the second wave of investment, accounting for 53% of total ethylene capacity.

Both are keen to increase the chemical yields from their existing integrated refinery-cracker complexes. They might shut down smaller units to build a large one. For example, PetroChina Jilin will shut down a 150,000 mt cracker to build a 1.2 million mt cracker. Meanwhile, Sinopec Tianjin plans to close a 200,000 mt unit to replace it with a 1.2 million mt cracker, which is under construction with INEOS. In addition to Sinopec and PetroChina, Sinochem is another key SOE investor. There are two planned steam crackers from Sinochem. Sinochem Huachang is in Shandong. Like the Yulong Island project, Sinochem plans to phase out inefficient refining capacity to build a mega refinery-cracker complex in Shandong. Meanwhile, although Sinochem has already put one refinery-integrated cracker project into operation in Quanzhou, it plans to build a second refinery-integrated cracker project in Quanzhou. However, it will have difficulty obtaining a quota for new refining capacity unless it has existing inefficient refining CDU capacity to be phased out. Hence, if Sinochem Quanzhou builds a new 1,500 kta ethylene cracker in addition to its existing 1,000 kta ethylene cracker, its feedstock supply will be challenged.

Multinational companies (MNCs) will remain key investors in the second wave. Although rising tensions between mainland China and the United States and other Western countries delayed some MNC investments, with high crude oil prices and strong support from the government, some MNCs have restarted their investments in mainland China. Aramco, Shell, SABIC, and BASF will be part of the second wave.

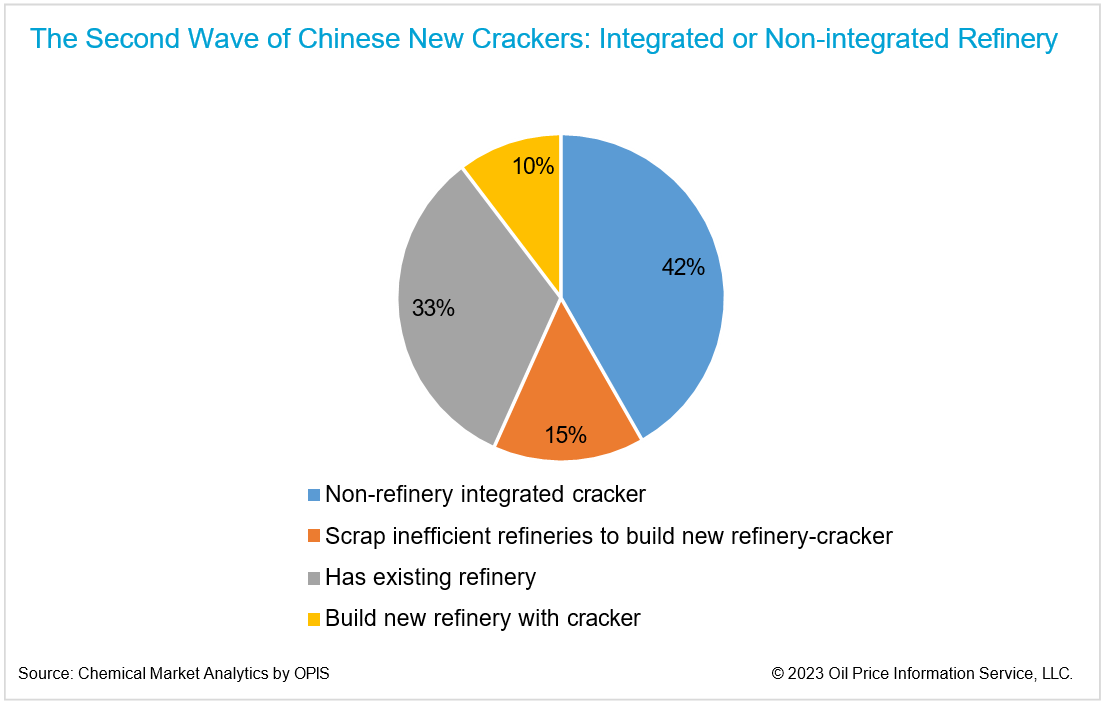

Like the first wave, although there are more refinery-integrated crackers in the second wave of investments, many players are interested in non-refinery-integrated crackers. Only two of them are going to build new refineries with steam crackers: Sinopec Gulei II and Aramco/China North JV. Investors hold the view that chemical demand will grow faster than demand for oil products in the long term amid the energy transition. It is difficult for investors to build new refinery-integrated crackers. Only Sinopec Gulei II and Aramco/China North JV plan to build new refinery-integrated crackers as they obtained refining quotas earlier than other investors. If other investors would like to build a new refinery-integrated cracker, they have to find existing inefficient refining capacity to phase out and secure a quota for a new refinery-integrated cracker.

Summary

Although the first wave of steam crackers is still ongoing, mainland China has been aggressively promoting the second wave of investments. It is still difficult to evaluate how many planned crackers can actually be built in mainland China and when they will be brought onstream. Some of them could be either canceled or delayed.

We could also see more new projects announced. If most of them start construction in the next few years, mainland China’s olefin markets will enter another build cycle and result in overcapacity beyond 2025.

Although POEs and MNCs will be involved in the second wave, the key driver of the second wave is SOEs, which are keen to increase the chemical yields from their existing integrated refinery-cracker complexes amid the energy transition. However, because of many uncertainties, most of these projects have not been included in our base-case outlook. Chemical Market Analytics will continue to track all the planned steam crackers and share timely updates with our clients.

Authors

William Chen

Asia Olefins

Mike Park

Asia Olefins

Zeng Wei Yin

Asia Olefins

Young Guen Lee

Asia Olefins

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving in profound ways and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on the specific trends shaping the market.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!

Learn How We Can Help You Prepare and Navigate Market Disruptions