PBT Supply Remains Strong, With Hope for Demand Growth

The PBT supply has been improving during slow demand growth in the past two years in the United States and global markets. Volatility from the feedstocks has lessened, although capacity additions in Northeast Asia continues. Supply and demand balance is nearing as automotive and other demand segments display improvements this year.

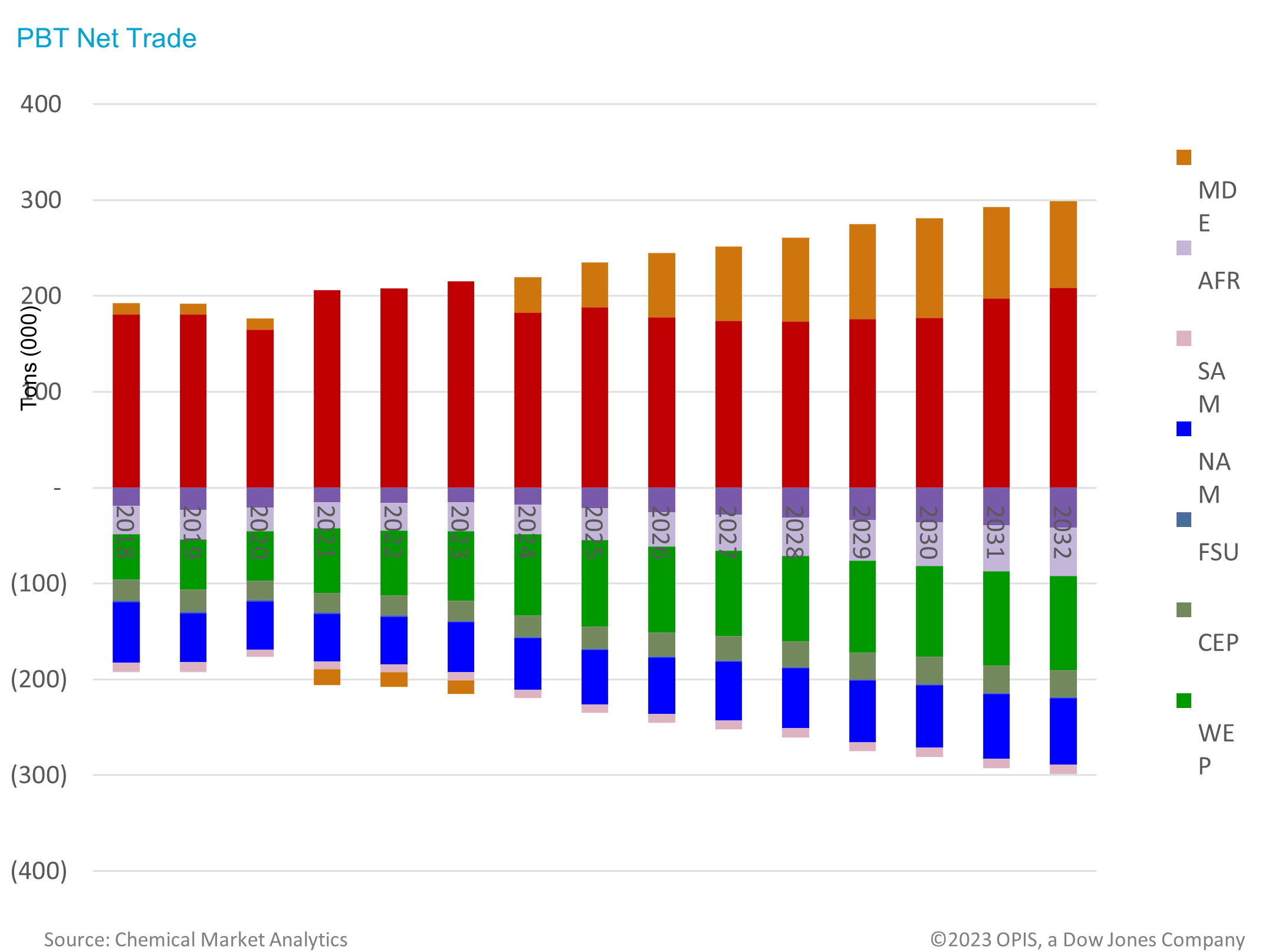

Capacity is growing for the polymer, with global trade patterns becoming increasingly important. North America is a net importer of PBT, with main suppliers having base in Asia. Significant changes are happening in the industry with feedstock (BDO) capacity additions in China and strengthening global trade patterns.

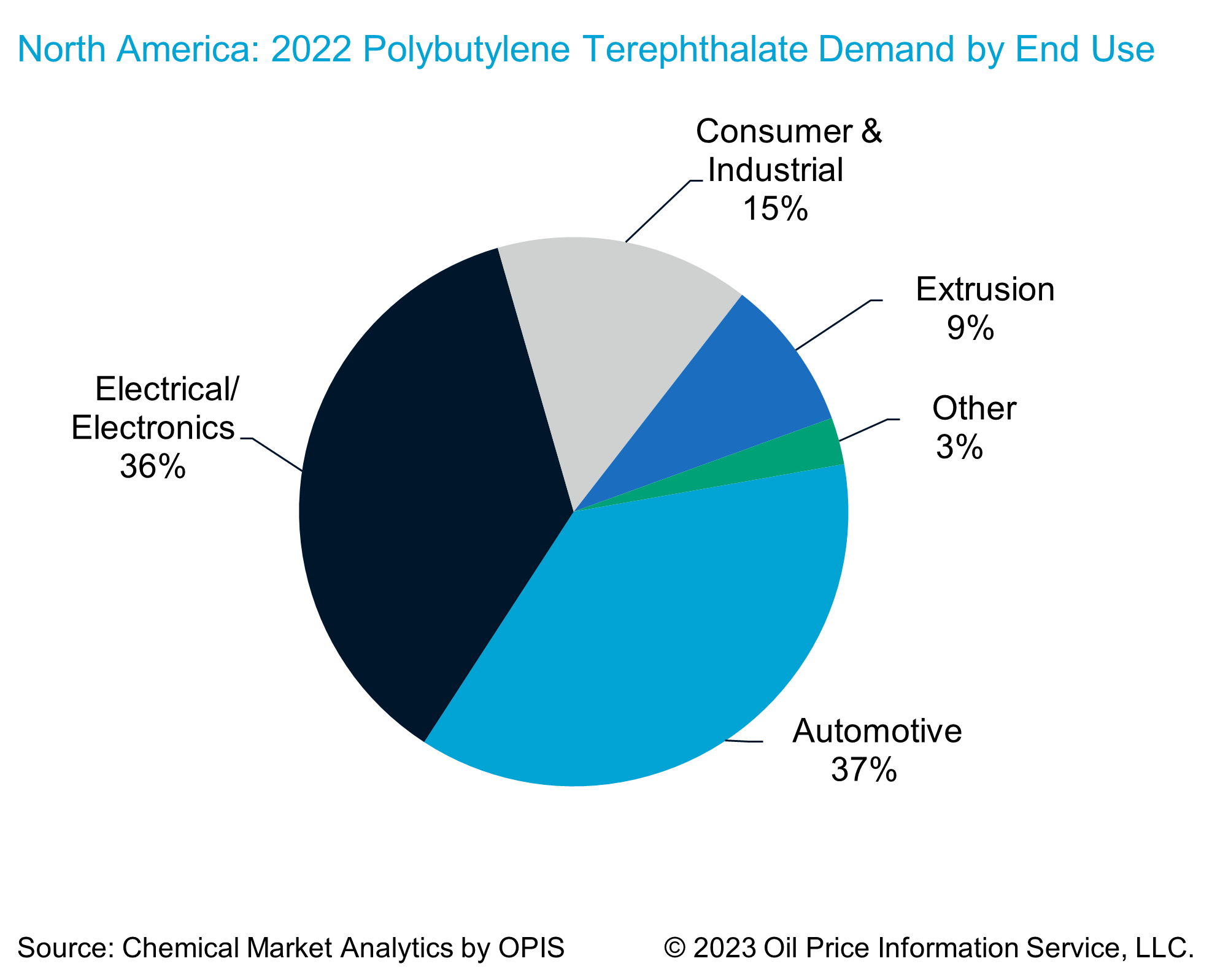

The polybutylene terephthalate market is driven by electrical/electronic and automotive applications globally. Approximately 70% of the demand for PBT comes from these two segments. Due to its superior electrical connectivity, PBT is preferred as the engineering plastics in several niche applications The supply of PBT is largely driven by Asia as the capacity center. Northeast Asia alone represents a whopping 83% of the global capacity followed by Western Europe and North America which represent 11% and 3% respectively.

PBT Market was well supplied in 2023, displaying relief from the tightness in 2022. Global capacity to reach 2.7 MMT by 2025; Global Op Rate estimated at 60% in 2023. Prices of neat polymer, glass fiber, flame retardants and additives have tremendously improved since the tightness experienced in the past two years. Automotive demand continues to grow about 3-4% YOY in the United States, with a positive outlook for each quarter. Northeast Asia is a huge driver of demand for PBT representing nearly 71% of the global demand in 2023.

Prices are determined by costs and market dynamics in North America. Trade is dominated by Northeast Asian countries, with Taiwan dominating imports from Asia. Of the total global imports from Asia, Taiwan supplies 40-50% into the US. US remains a net importer of PBT.

As we look forward to the rest of 2024, supply continues to grow with global capacity additions. Demand growth is mixed in North America, with a favorable outlook for Automotive applications, with the economy slowing from 2023.

PBT compounded resin will continue to diversify in various applications in the forecast period. Low-cost Asian imports into the United States and West European countries will put pressure on domestic pricing, although domestic suppliers with improved lead times and stable supply also protect their market share.

Although there have been supply and demand improvements, the increased supply and demand patterns makes the market dynamic in the foreseeable future.

The chart shows net trade for PBT, with an outlook till 2032, with regional exports and imports. Northeast Asia will remain a large net exporter of PBT in the long term. North America and Europe will be net importers of PBT. North American will remain a net importer of PBT, with import volumes changing with demand growth in the markets.

Author

Preeti Sriram

Director, Crystalline Plastics, North America