Caprolactam – Caught Between a Rock and a Hard Place

The turmoil caused by the COVID-19 pandemic has turned the world upside down. Demand in the nylon industry has fallen then risen and, like a roller coaster, seems to have ended up back where it started. However, the ride continues to be bumpy as the macroeconomic headwinds from geopolitical conflicts and record-high inflation continue to drag on demand recovery. On top of subdued demand, the nylon industry has been suffering from too much supply given the continuous overexpansion in mainland China. Caprolactam (CPL) – the nylon 6 feedstock – has fallen victim to increased competition. With mainland China moving towards self-sufficiency, traditional exporters are finding themselves being left out in the cold.

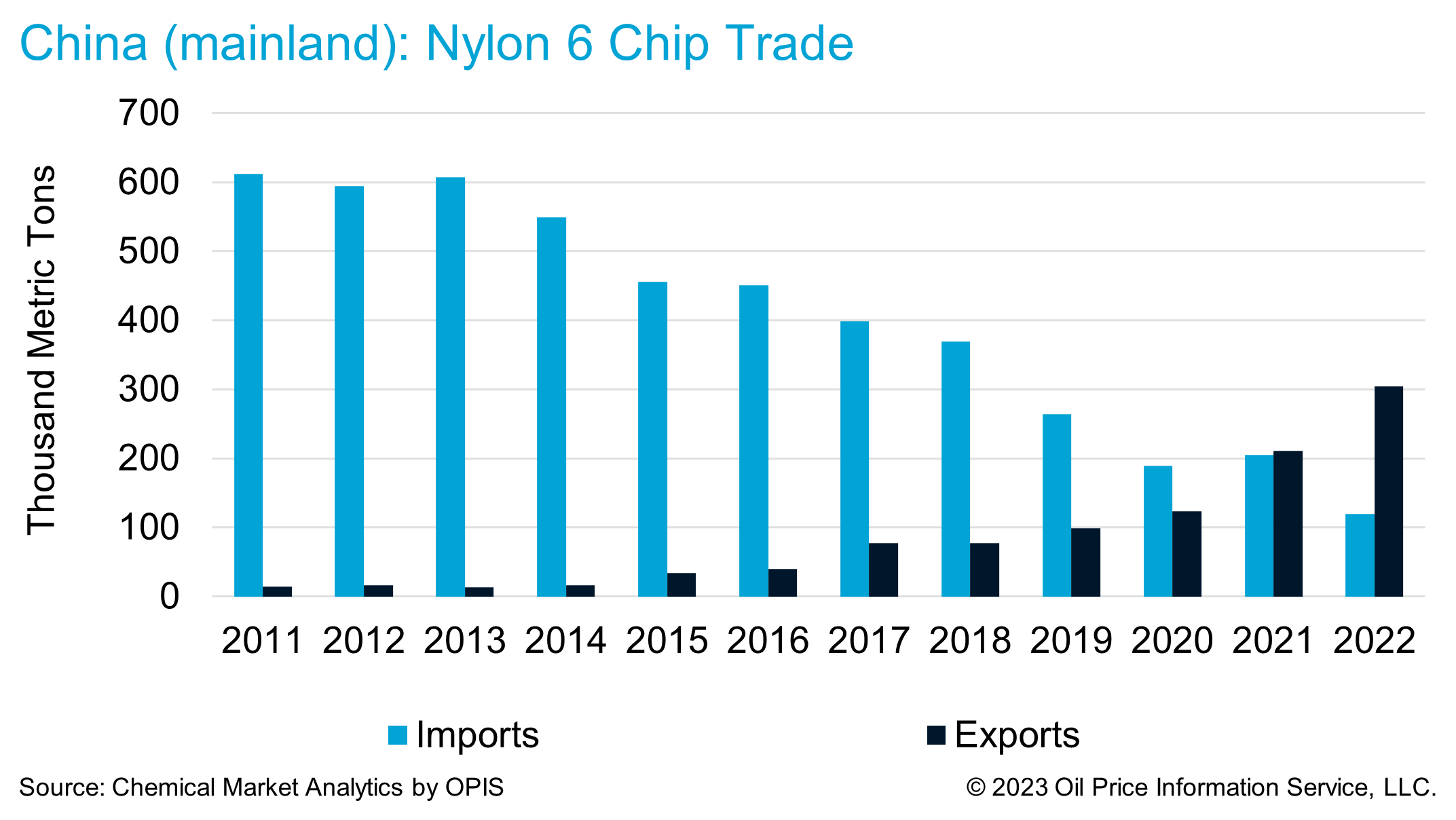

Further confounding these factors was an over-expansion of nylon 6 chip production capacity. Mainland China has been producing its own nylon 6 chips with gradually improving quality over the past years. The avalanche of new nylon 6 chip supply in mainland China has seen its own imports dropping significantly while exports have risen, which has turned mainland China from a net importer to a net exporter since 2021.

Since nylon 6 chip producers outside mainland China are not only suffering from shrinking exports to China but also losing market share to low-priced mainland Chinese exports. Nylon 6 chip producers outside of mainland China have been forced to cut back production or idle lines due to a reshuffle of export market share. This has in turn resulted in lower caprolactam demand and brought down CPL operating rates in other parts of the world outside mainland China.

Except in India where a strong demand rebound in ammonium sulfate fertilizer (a side product of CPL) during the COVID-19 pandemic has encouraged Fertilizers and Chemicals Travancore Ltd (FACT) to restart its CPL plant in 2021 after being idled for more than 8 years, we have seen more cases of CPL plant shutdowns outside of mainland China in recent years. Univex in Mexico closed its capacity permanently in late 2021. In Japan, Sumitomo announced the closure of its CPL business in October 2022. Ube is planning to reduce its CPL capacity in Ube city in the second half of 2024. In addition, CAPRO in South Korea closed its large line in late 2022 while CPDC in Taiwan will likely keep its two Toufen lines idle for the time being. Most recently, BASF announced plans to close several of its plants in Ludwigshafen Germany, including a CPL plant, having had excess capacity for a number of years which was previously used for exports.

It seems likely that mainland Chinese CPL producers will increase export sales to ease the growing surplus pressure. Nevertheless, with mainland Chinese CPL producers moving towards vertical integration to downstream nylon 6 polymerization, most mainland Chinese companies are producing CPL for their own captive use and selling nylon 6 chip in the export markets rather than exporting CPL directly to their competitors. In other words, they don’t want to use their own “spear” (CPL) against their own “shield” (nylon 6 chip). Besides, in order to move CPL outside of mainland China, producers will either need special isothermal tanks to keep CPL in liquid form or convert molten CPL to flakes. Currently, no producer in mainland China has the ability to move molten CPL overseas while less than 10% of China’s CPL production capacity can produce CPL flakes for exports. In addition, export netbacks are lower than domestic sales considering all the handing costs – including conversion costs (from molten to flakes), packaging, port charges, and transportation fees.

The latest forecast at Chemical Market Analytics suggests that global nylon 6 demand will gradually recover from the slight contraction seen in 2022. Our base scenario is that there will be no strong rebound in nylon 6 demand in mainland China even now that Covid-related restrictions have been lifted entirely. A modest demand recovery will be most likely over the next two years. Meanwhile, demand contraction in Asia (outside mainland China) is expected to moderate in 2023 before positive growth resumes in 2024. North America (NAM) has slowed significantly since the fourth quarter of 2022 and high interest rates, inflationary pressures, and economic uncertainty will continue to have a chokehold on the nylon 6 business in 2023. A meaningful recovery is not expected to kick off until 2024. The European demand outlook for nylon 6 is also far from positive. High energy costs and a fall in domestic demand have plagued the industry. However, it is unlikely that demand will go any lower, and it seems likely we may be close to the bottom. As the Eurozone’s economy improves, consumer demand is expected to slowly recover, although the still unstable European energy situation remains a hindrance to further European growth.

From a margin perspective, more and more nylon 6 chip buyers in Asia are using mainland Chinese export prices as a guidepost for negotiation. For nylon 6 chip producers in other Asian countries to compete with mainland Chinese producers, they will need their feedstock costs –Asian CPL CFR prices – to align with mainland Chinese RMB prices. Currently, there are two main Chinese indexes, which are Sinopec contract postings and East China spot prices. As such, despite the fact that other CPL producers don’t really compete directly with mainland Chinese CPL producers, CPL producers who are selling cargoes in Asia have been losing pricing power and suffering from huge margin pressure. This situation is not going to change any time soon. Meanwhile, CPL producers in Europe will continue to suffer from low demand and high costs in the short term. On the other hand, margins in the US will also weaken but stay above breakeven as CPL is more structurally balanced in the NAM region which is spared from low-priced imports from mainland China due to the shield of 25% import duties.

Overall, the CPL industry will continue to face challenges as demand growth is not going to catch up with the rapid capacity expansion any time soon based on Chemical Market Analytics’ projections. Even though CPL producers in mainland China are not currently actively engaged in the export markets, the intensifying competition in the downstream nylon 6 chip sector has already caused unprecedented changes to the nylon 6 chip landscape for producers in the rest of the world. This suggests CPL operating rates outside of mainland China will remain curtailed and no improvement in margins is expected in the foreseeable future.

Author

Meiko Woo

Executive Director

Learn how we can help you prepare and navigate market disruptions

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving in profound ways and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on the specific trends shaping the market.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!