European PET Recycling Markets, Huge Pressure in 2023 but Better Times Ahead?

The European recycled PET markets are facing strong headwinds this year due to high costs and weaker demand. Consumers are reducing their spending and processors are questioning the need for high percentages of expensive recycled material. The recycling business model is being scrutinized for profit expectations. The key question is whether this is a temporary effect or whether market conditions are deteriorating over the long term.

PET recycling in Europe is expected to grow significantly in the next five to ten years, particularly in response to increased pressure from regulators and consumers. Governments and major brands are continuously discussing and refining targets to reduce waste and improve the circularity of the plastics value chain. While players in the chemicals industry aspire to expand access to recycling, adopt new technologies, and grow sustainability efforts, many existing European recyclers that have pursued these goals for years have made little progress. In 2017, the European Union set a target for recycling 50 percent of plastic packaging by 2025 and 55 percent by 2030. Industrial players and beverage brand owners have also pledged to improve bottle collection and recycled PET usage, some committing to bold quantitative targets during this same period.

Recycling 2023 – Is the profit slump temporary?

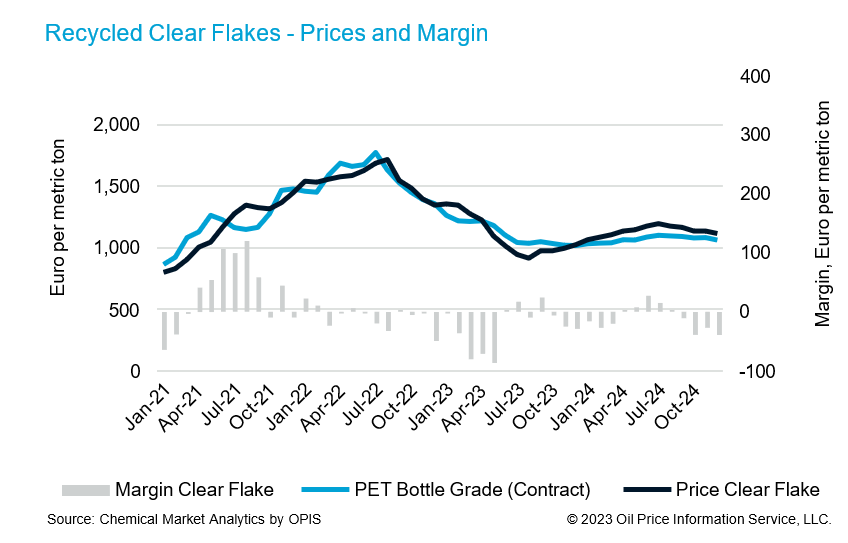

The market conditions for PET recycling do not look bad at first glance. Increasing demand and high utilization rates in recent years have resulted in a reasonable profit level. The increasing energy costs for recyclers in the past year were compensated for, in part, by significantly high market prices. However, the market environment has deteriorated significantly this year. Energy costs remain high, while aggregate demand is weak as consumer spending has fallen due to high inflation. New recycling capacities were added and rPET imports materialized out of nowhere. Also, the recycling industry started the year with high inventory, with most of the bales and flakes stored away in anticipation of higher prices during the peak summer months. These toxic market drivers collided with sharply falling virgin PET prices and the necessary inventory liquidation pressure accelerated the price decline in rPET. This means that many recyclers will lose money this year. It is not a new lesson; recycling is a difficult business model once virgin polymer prices are low. Recycling costs are characterized by a high proportion of fixed and energy costs, but at the same time rPET flakes must remain competitive with virgin PET. Better financial results can be achieved in the markets for recycled pellets as a premium price has been established. At the moment, recyclers are deeply worried about the market conditions which recently led to a recycling plant closure in Germany. But we expect some demand recovery in 2024 on easing inflation rates, that should result in better business performance for both virgin and recycled PET.

The introduction of a tax on virgin polymers in packaging applications is expected to inflate prices of virgin plastics in these market segments in many countries over the next few years, some very significantly. This will provide some opportunity for the necessary increase in recycled resin demand and prices as higher recycling percentages in all bottles and trays become mandatory.

Regulatory Framework

The European Commission has now tightened the rules covering recycling. In November 2022, it proposed a new regulation establishing that single-use beverage bottles must be made from 30% recycled plastic by 2030 and the recycled content should be further raised to 65% by 2040. These rules, which are part of the new Packaging and Packaging Waste Regulation, are still up for discussion at the European Parliament and among member state governments.

Since the plastics strategy was adopted by the European Commission, several things have changed within the PET bottle value chain. In addition to higher recycling targets and changed calculation criteria introduced with the revised Packaging and Packaging Waste Directive (EU) 2018/852, comes the recently adopted Directive (EU) 2019/904, known as the “Single Use Plastics Directive”.

This guideline specifies:

- A mandatory 25% rPET content (calculated as average per EU Member State) in PET beverage bottles by 2025, to be increased to 30% by 2030.

- Specific separate collection targets for PET beverage bottles: 77% by 2025, and 90% by 2029, to be achieved by deposit return or separate collection schemes.

- New design requirements: single-use beverage bottles can be marketed only if caps and closures are designed to remain attached to the bottle.

Challenge for the PET recycling industry

The challenge for the PET value chain is to support the achievement of present and future plastic packaging recycling targets in the EU Member States, while considering the shift in rPET demand from textile to bottle- to-bottle and other packaging applications. In the past, the relatively undemanding textile markets were grateful buyers of cheap recycled PET. More and more material will have to be reallocated to the packaging segments over the next few years. In addition, there are significantly higher quality requirements in processing recycled PET, with respect to performance, discoloration, and other visual defects. While innovation in PET bottle design and performance is essential, it is also crucial that the quality of recycled material over time is not allowed to deteriorate. Therefore, the use of additives, barrier materials, adhesives, sleeves and other components must be limited.

Positive developments were also propelled by simultaneous improvements in collecting, sorting, and recycling, which have led to the growing uptake of recycled PET in a wider range of end applications. rPET content in beverage bottles and thermoformed trays will continue to grow and will address increasing demand into the recycling value chain.

Naturally, these significant changes are also worrying the producers of virgin PET. The demand for European virgin PET is not only depressed by the increasing use of recycled material; imported PET is also taking up a large part of the market. Some domestic PET suppliers have invested in technologies to incorporate flakes or rPET granules into the polymerization process. These technologies are based on a variation of glycolysis and are classified as “chemical recycling” by the European Food Safety Authority (EFSA). In the standard glycolysis concept, PET is reacted at high temperature with an excess of glycol. The final product is PET’s intermediate monomer Bis(hydroxyethyl)terephthalate (BHET) and low molecular weight oligomers. BHET is purified by melt filtration under pressure or with special distillation processes and is relatively easy to re-polymerize into PET, reaching recycled contents up to 30%. Such grades have been commercially available in Europe for years and we estimate the current capacity in recycled feedstock from European PET producers at 220,000 mt per year. On the downside, that technology is very sensitive to non-PET plastics contamination and needs very high quality clear/light blue flakes, so it competes with mechanical recycling.

Collection

The PET bottle collection rate continues to grow in Europe. We estimate that the collection rate reached 69% in 2022, representing 2.5 million tons of PET. But the collection rate must increase further. A key element to increasing collection rates are deposit return schemes or similar systems that are convenient for consumers.

A Deposit Refund Systems (DRS) also increases the purity of the material collected and therefore the quality of what is recovered. Purity is key to achieving the plastic circularity target set out in the 2019 directive on reducing the environmental impact of certain plastic products.

Deposit and return schemes are active in 13 European countries: Sweden, Iceland, Finland, Norway, Denmark, Germany, the Netherlands, Estonia, and Croatia all have a system established for more than a decade. Lithuania joined in 2016.

DRS came back on the agenda following the 2019 Single-Use Plastics Directive, which sets a target of 77% separate collection of plastic bottles by 2025 and 90 per cent by 2029. Slovakia, Latvia, and Malta implemented a DRS in 2022, and Portugal, Romania, Ireland, Hungary, and Austria will do so by 2025.

The three biggest southern countries – France, Italy, and Spain – are notably absent. Italy provided a DRS for single-use beverage containers in 2021 but still lacks the implementing decree to make the law effective. Italian producers claim that they achieve high recycling rates by combining traditional collection through containers with a selective collection system, according to Conai the national packaging consortium.

A similar argument is made in Spain by Ecoembes, the organisation which groups together those who do business selling containers and are responsible for their collection once they are used. All major brand owners are among their members. A law passed in 2022 makes a DRS in Spain mandatory if 70 per cent separate collection of single-use plastic bottles is not achieved by 2023.

France is lagging far behind on its targets for recycling plastic packaging and PET bottles and will have to step up efforts considerably to achieve them. France, which has presented an “ambitious” bill that aims to end plastic pollution by 2040, is in fact among Europe’s worst performers. But challenging objectives are in place, including reaching 100% recycled plastic by 2025 and a proportion of 5% re-used plastic by 2023, increasing to 10% in 2027. Its objectives also include reducing the number of single-use plastic bottles in the market by 50% by 2030. The French government is supporting investments in chemical PET recycling to achieve its ambitions.

Chemical Recycling – Processes Can Produce as-new Building Blocks for a Circular Economy

France will have three PET chemical recycling facilities in place by 2025. Announcements have been made by Eastman, Loop Industries and Carbios. Loop Industries will partner with Suez SA and SK Geo Centric, subsidiary of South Korean group SK to start a 70,000 mt capacity in Saint-Avold. It will use Loop’s depolymerisation technology, Infinite Loop, to break down the PET and polyester waste into its base monomers.

Eastman announced plans to invest up to $1bn in a methanolysis depolymerisation recycling unit in Port- Jérôme-sur-Seine, Normandy, France. The facility would use Eastman’s polyester renewal technology via a unit to chemically recycle up to 160,000 mt per year of PET waste that is currently incinerated. These feedstocks include all types of PET packaging, carpets, and apparel. The plant is slated to be operational by 2025.

Carbios and Indorama Ventures (IVL) have announced a joint venture to build an enzymatic-based PET chemical recycling plant at IVL’s PET production site in Longlaville, Meurthe-et-Moselle. The plant is expected to be operational in 2025 and will have a post-consumer PET waste input capacity of 50,000 mt per year. The plant will use Carbios’ C-ZYME enzymatic recycling technology. Enzymatic recycling is also known as enzymatic hydrolysis and is a form of chemical recycling.

Key Questions Behind New Chemical Recycling Capacities Will Be Feedstock Availability

Chemical recycling requires waste to be sorted to high purity as certain contaminants can prove harmful to the process. Also, the incremental capacities will require high volumes of post-consumer waste, addressing increases in collection and investment in sorting in France. However, with these three recycling projects announced, it may not be enough in the near term. No surprise, mechanical recyclers in Europe expressed concerns about what type of material will be used as feedstock for the units, as they might compete for PET bales. However, Loop and Eastman intend to be complementary to the mechanical recycling process by consuming coloured and contaminated PET, as well as polyester fibers. Also, the Carbios/IVL technology can process waste polyester textiles as well as packaging. The focus of chemical recycling should be on those hard- to-recycle waste streams that currently have little value and are lost through either incineration or landfill. PET chemical recycling plants are scaling up and time will tell whether the momentum in chemical recycling will slow evolution of mechanical recycling.

Mechanical recycling and chemical recycling have critical roles, they can and should complement each other.

Mechanical Recycling

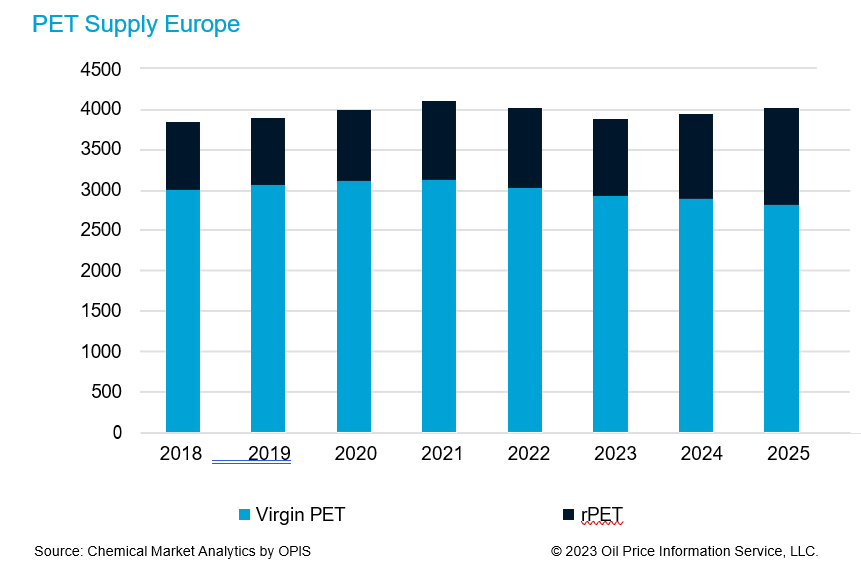

PET bottle recycling bears a large part of the burden to achieve the European plastic recycling targets. Last year probably 2.1 million tons were processed by the European recyclers, roughly 950,000 tons virgin PET was replaced by recycled flakes and pellets in the beverages and trays segments.

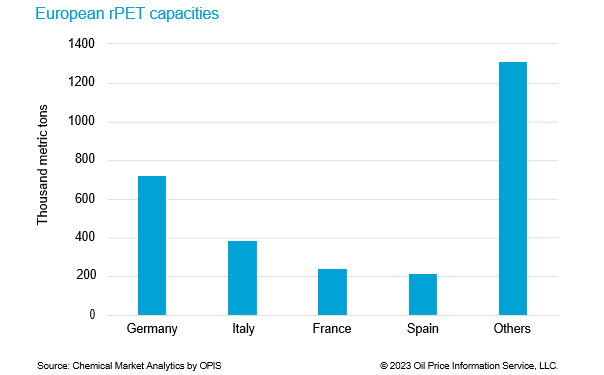

Recycling capacity in Europe will need to expand by at least one third by 2030 to enable EU Member States to meet the EU 90% collection rate and the mandatory recycled content targets. Germany, Italy, Spain, and the Netherlands account for 55% of the total installed capacity, estimated at 2.7 million metric tons with major growth registered in the countries with larger populations.

The circularity and sustainability agenda of global operating brand owners and legislation will continue to be the key drivers toward a fully circular economy for beverages and trays made by PET. But recyclers would have to shoulder enormous costs in order to build the capacities that are still necessary to achieve the industry targets for 2025 and 2030. Therefore, a return to profitable operating results is imperative – this is also known to all market participants. Structural problems such as high European energy costs and very low-priced imports are swords of Damocles. Not only is the recycling industry challenged here, but the EU legislators may also have to address these problems.

Author

Martin Wiesweg

Executive Director

We can help you prepare for and navigate methanol market disruptions – learn how by watching the video below or by contacting us today.

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving in profound ways and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on the specific trends shaping the market.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!