Reviewing Styrene for H1 2023 and Ongoing Rationalizations

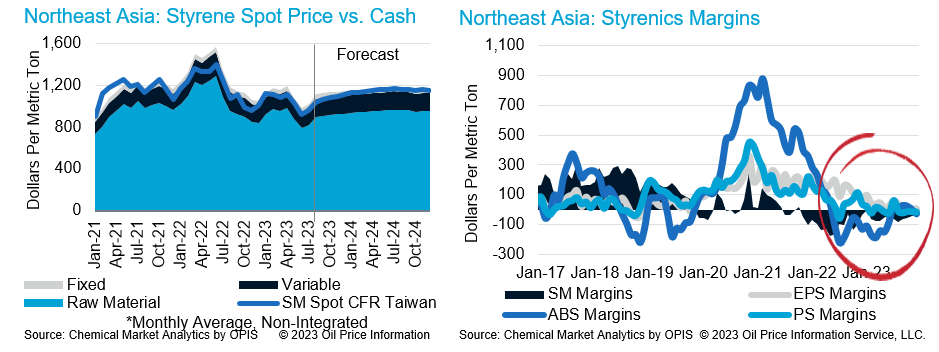

In the first half of this year, Asian styrene prices were less volatile compared with 2021 and 2022 but prices were largely in a downtrend in line with energy and feedstock prices before rebounding in July. Meanwhile, styrene production economics have remained negative since the end of 2021 and, as a result, voluntarily production cuts and shutdowns were seen to minimize losses. Large styrene capacity additions have also been on the way with total capacity of approximately 4.0 million mt expected to start up in 2023 mainly in mainland China, including the plants that had already started up by July.

Meanwhile, feedstock benzene prices were relatively firm supported by a strong gasoline market, which resulted in higher prices of benzene feedstock like reformate and toluene. Reduced steam cracker operations and lower PX operating rates kept the benzene market in balance despite lower downstream operations due to negative margins. Styrene demand has been slow, in line with the bearish macroeconomic outlook and margins for downstream products have been below breakeven levels, resulting in reduced operations. All the above factors put pressure on styrene margins during the first half of 2023.

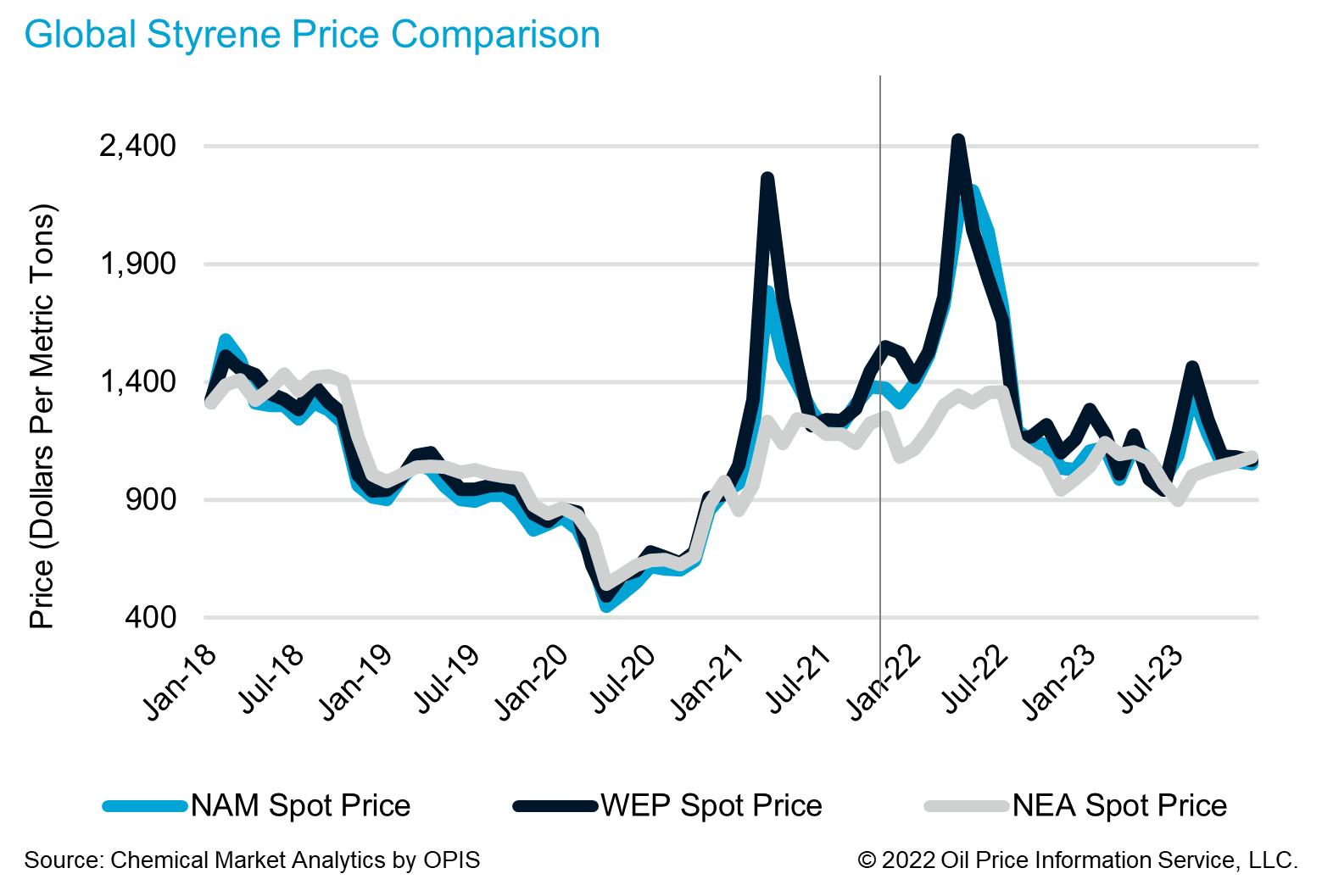

Unfortunately for Asian producers, with styrene prices in other regions including North America and West Europe also remaining relatively stable, the price differential to Asia remained subdued, leading to reduced export opportunities this year, after regional styrene price differentials grew to record levels in 2022, prompting strong export demand. Even as styrene prices in West Europe spiked in July and the price arbitrage opened again, the actual styrene volume that could be exported has been limited by export vessel availability and price risk for the forward market in West Europe.

Total exports from Northeast Asia to other regions including West Europe, Turkey and India are estimated at 25-30 kt between late July and early August. This volume is not enough to fundamentally change the Asian balance or impact economics substantially.

Meanwhile, the current price increase in other regions was a result of voluntary production cuts or shutdowns due to negative economics amid stagnant demand, rather than production upsets. However, if these production cuts lead to a permanent closure, particularly in West Europe, there is a potential opportunity for Asian producers to export, as this is where we see excess capacity. Unplanned outages in those markets will provide a further boost to exporters from Asia.

As a result of reduced opportunities, exports from mainland China have reduced by more than half during the first half of 2023, year on year, with more than 70% of total exports destined to South Korea. Imports into mainland China have also fallen as more capacity has started up in the domestic market, but the decline in imports was less than expected due to stable imports from the Middle East and higher imports from Japan and Singapore. We are forecasting that net imports into mainland China will reduce from approximately 580 kt in 2022 to 340 kt in 2023, with exports expected to be 778 kt and imports 438 kt in 2023. We do not expect mainland China to become a net exporter in the near future unless aggressive rationalizations happen outside mainland China.

Meanwhile, South Korea became a net importer during the first half in 2023 due to massive production cuts and shutdowns amid heavy spring maintenance, despite lower polymer operations. The country imported major volume from mainland China, Japan and from the Middle East. It appears that South Korea will remain a net importer in 2023, which is the first time in the last 30 years, with net imports reaching 180 kt.

Ongoing unfavorable economics of styrene producers and their low operations resulted in short-term trade flow changes as described earlier. The question now is whether this change will be temporary or permanent, and the answer to that depends on rationalization in the styrene industry.

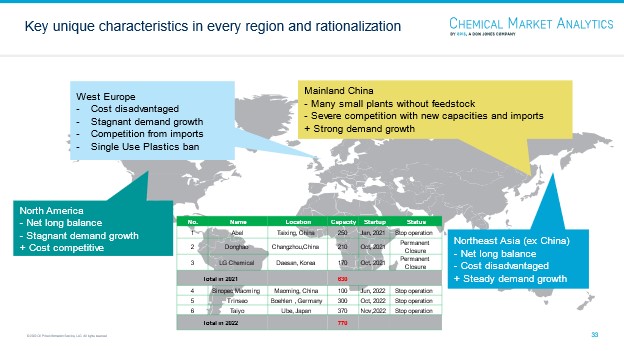

Restructuring in the styrene industry has been expected following massive investments announced earlier. Those investments have now come to fruition, and it is clear that we will hear more news regarding rationalizations during the next couple of years. Regarding the question of which region or producer will be the first to close, there are different characteristics in each region, including structural balances, cost positions, and demand growth, which will influence the rationalization decision.

Considering these factors, our forecast is that restructuring will happen in mainland China first, as there are many small-scale plants that are not integrated with feedstock and will find it difficult to compete with new larger scale plants nearby or competitive imports. Some producers have already shut their plants from the end of 2021, with some announcing that they will shut permanently.

The next potential region for rationalization is West Europe, which has a disadvantaged cost position and slow demand growth. Particularly after the conflict in Ukraine, the situation has worsened, with some units shutting down temporarily and some announcing permanent closures.

Plants in Northeast Asia, excluding mainland China, reacted faster than expected due to the substantial decline in domestic demand driven by the slow economic recovery and difficulty in exporting polymers to mainland China. As a result, one producer in South Korea has already scrapped their smaller line from the end of 2021, and another producer in Japan announced that they will shut permanently from the end of 2022.

Currently, most producers are operating only some of their lines or have been extending shutdowns after planned maintenance. Some are considering shutting for a longer period or to exit from the styrene business. In North America, operations have not been stable due to unplanned shutdowns or production cuts depending on economics, but as they are capable of exporting to South America and West Europe, their position looks less risky at this stage compared with producers in other regions.

The styrene market is difficult to balance without rationalizations and margins will not recover to favorable levels without rationalizations, unless demand grows rapidly in the near term, which appears to be unlikely considering the macroeconomic uncertainties. As a result, voluntarily production cuts or shutdowns will continue and some of them will decide whether they will continue or exit from this market, like the massive restructuring seen between 2008-2010.

Authors

Brian Lee

Executive Director, Asia Aromatics

Learn how we can help you prepare and navigate market disruptions today.