With a High Oil Price Environment Give More Advantages to MTO Economics?

In the case of MTO, methanol may be domestic production or import. The unit usually has very broad derivatives. Many of them are owned by private companies and are typically located in East China coast.

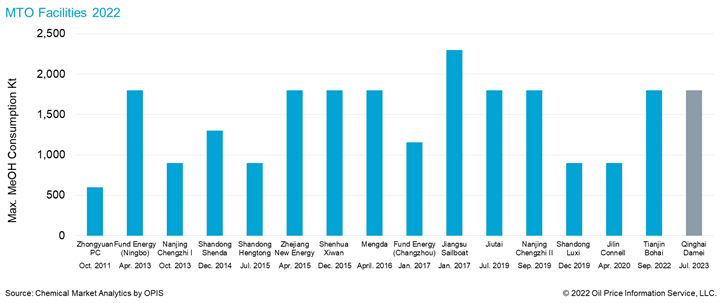

The chart below shows you all the MTO units in China.

In addition, the starting time and their maximum consumption. When looking at the newest MPO unit, “Tianjin Bohai,” just started commercial production has risen. China has 14MTO facilities currently running.

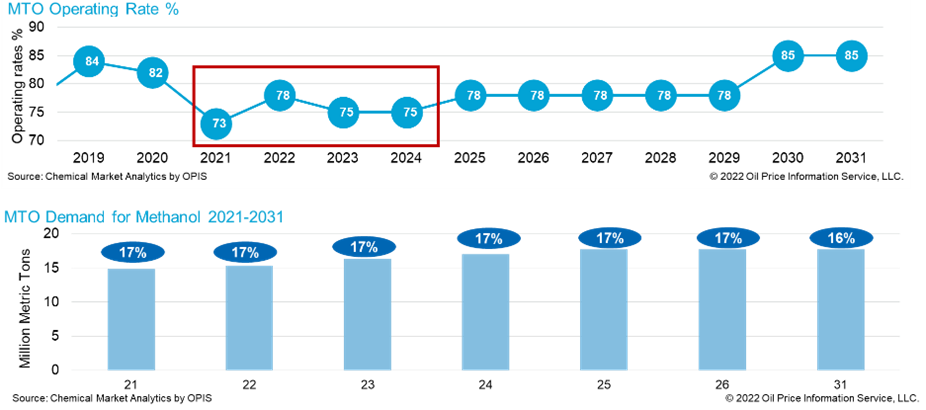

Only one new unit is under construction, scheduled to come on stream by 2023. MTO is the largest methanol derivative in China and is the second largest in the world. It is very significant for methanol industry. That also explains why MTO producers sometimes are very powerful in price negotiations in China. MTO’s operating is estimated at around 78% in 2022, equal to over 15 million metric tons per metric consumption.

In the recent supply and demand balance, published in August, MTO operational rate for 2021 was 73% due to the high methanol price driven by China coal price. Relatively low operating rate in 2023 and 2024 under the assumption of there are lots of new olefin capacity, naphtha cracker, PDH and etc.

With the high oil pricing environment will gives more advantages to MTO economics, showing production cut on the MTO sector as two large MTO producers Zhejiang Xingxing and The Jiangsu Sailboat have started the app new olefins capacity through other process. They will become more flexible in choosing the way to access olefin supply. Our middle term view on the immediate sector is quite very bearish due to surplus. MEG is a major MTO derivative in the east coast. Estimated MEG production cost may also reduce MTOs operating rate in the next two years.

The industry is already at the end of the second wave of MTO development. As a result, MTO demand for methanol basically will fly, will flight out. If you look at the bubbles above the bars showing the percentage of global methanol demand represented by MTO, you can see those numbers begin to go down because methanol to olefins is flagged. Other applications for formaldehyde, acidic acids, and others will increase. MTO percentage will go down and the methanol industry development will be back to the old eighties as more depending on the conventional derivatives.

Xiaomeng Ma

Asia Methanol

Chemical Market Analytics by OPIS, a Dow Jones Company

Expand Your Reach in the Global Methanol and Acetyls Markets, with Chemical Market Analytics Market Advisory Service. The most comprehensive analysis for over 100 commodity chemicals across 34 individual services.