Will the classic phenolics cycle continue?

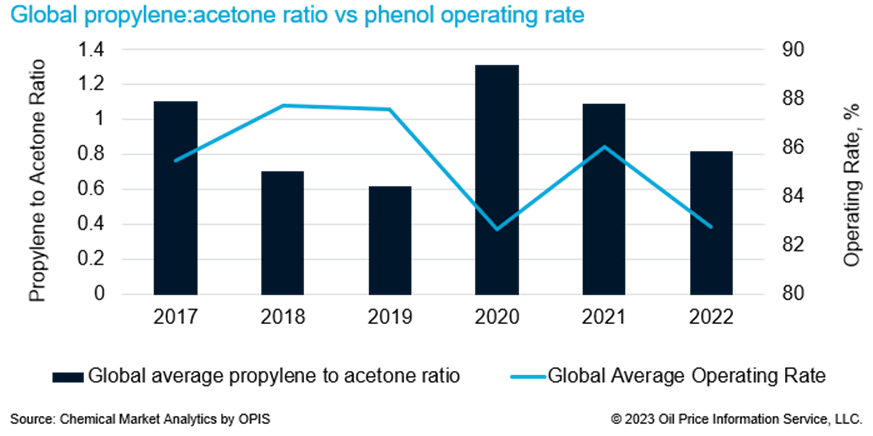

Acetone is a co-product of phenol production, and the availability of acetone depends on phenol demand. Acetone economics are best judged by its ratio to propylene, and this drops in a long market.

Over the last few years, it has become increasingly clear that bisphenol-a (BPA) is now an intrinsic part of the phenolics equation too. This is because BPA units consume both phenol and acetone, and because demand for BPA derivatives is still seen as strong over the long-term.

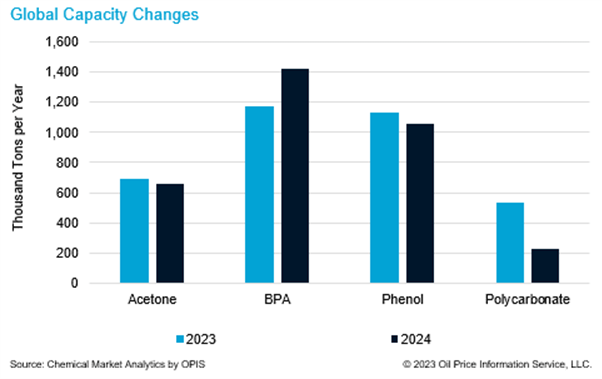

The new capacity will support expected growth through the BPA and polycarbonate (PC) chain, but it will also create issues around excess acetone supply on a global basis. Phenolics producers are used to the cyclical nature of their business; historically, sustained periods of strong phenol demand has coincided with acetone weakness – caused by the volume of acetone produced when phenol demand is being satisfied – whilst in phenol downturns, acetone pricing has strengthened as supply becomes constrained.

However, the longer-term situation could see the market shift away from its traditional dynamics. The strong focus on integrated phenolics/BPA units creates a challenge for the phenolics sector, as the stoichiometry between the units does not favour acetone. This raises fears of a structural shift in acetone pricing, with acetone carrying long-term weakness.

The potential growth in excess acetone doesn’t just stem from integrated phenolics/BPA units, but also from standalone phenolic units. Integrated producers are unlikely to sell to their competition, but standalone phenol/acetone producers will still be able to target non-upstream integrated BPA/PC. There are also many other phenol derivatives offering demand for phenol, such as nylon intermediates, phenolic resins and alkyl phenols. The BPA-integrated producers will focus on BPA demand and profitability above all else.

Acetone is used as a solvent across many downstream sectors, such as the paints and coatings industry, pharmaceuticals and cosmetics, whilst methyl methacrylate (MMA) accounts for over 20% of global acetone demand. Concerns around MMA demand for acetone are growing. In late 2022, Mitsubishi announced that it was closing its production facility in the United Kingdom, removing at least 90,000 metric tons of acetone per year.

In North America concerns for longer term acetone demand revolve around process changes in MMA production. Both Röhm and Mitsubishi have announced their intention to build ethylene-based MMA units in the United States and Röhm has already started construction of its new unit. Building new ethylene-based capacity in the United States will inevitably bring downward pressure on acetone demand in the United States. If Mitsubishi also builds an ethylene-based MMA unit in Geismar, LA, then acetone demand in North America could be off by 200,000 metric tons.

Are you attending AFPM IPC? Join us at our Chemical Market Seminar: Conquering Market Turbulence on Sunday, 26 March 2023 from 1 PM – 3 PM Central Time at the Marriott Rivercenter Hotel. Our thought leaders will provide an in-depth overview of the challenges and future opportunities for the Olefins and Polyolefins, Aromatics, Inorganics, and Syngas sectors.

Register now and secure your place: Conquering Market Turbulence

David Potter

Executive Director European Aromatics and Fibers

Chemical Market Analytics by OPIS, a Dow Jones Company

Learn how Chemical Market Analytics, Market Advisory Service enables you to optimize decisions with reliable price, cost and margin data to stay abreast the Chemical Industry.