US Propylene and Polypropylene Export Competitiveness

Despite recent propylene price decreases US Propylene and Polypropylene export competitiveness remains limited

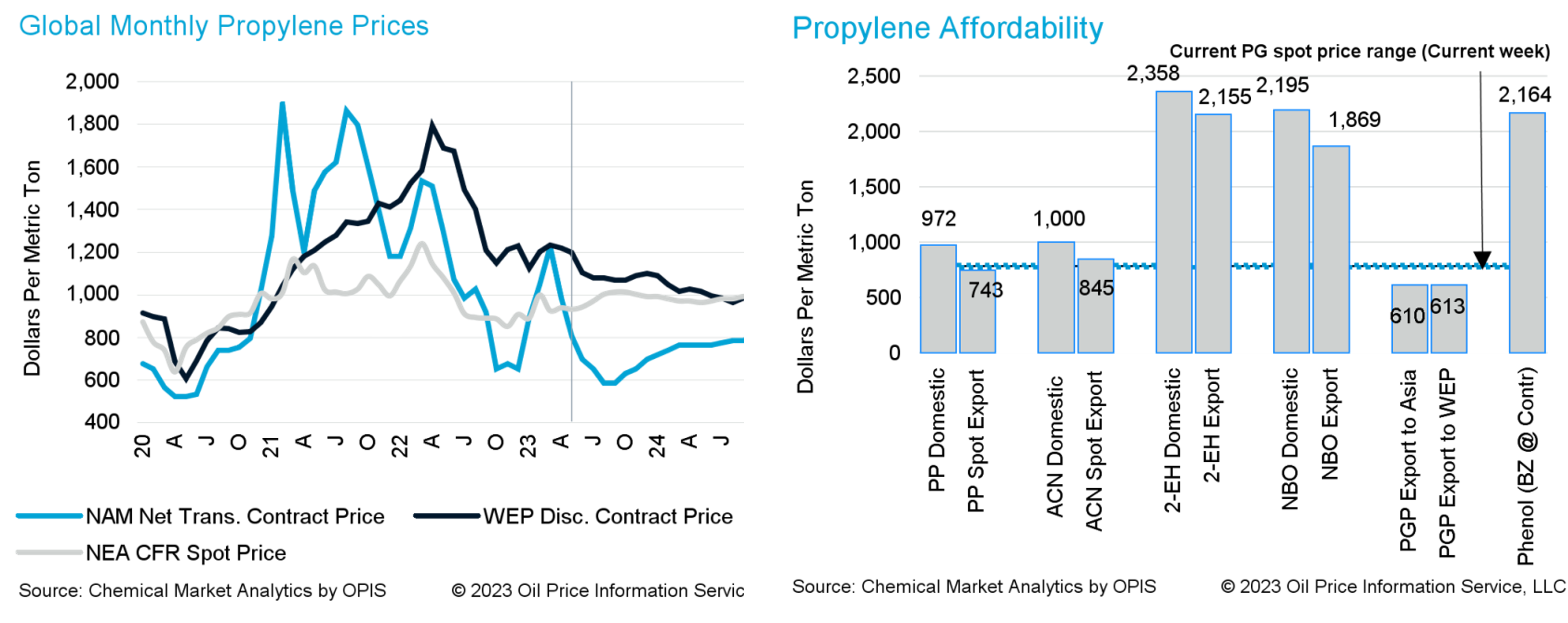

In the US, domestic demand for propylene derivatives remains bearish. Even with the recent propylene price decreases, polypropylene (PP) cannot afford to export much, and it needs more competitive pricing to be able to clear the market through exports.

The global oversupply of propylene and its derivatives might also impact the demand for US propylene. Much like PP, other derivative exports are not gaining significant traction and lower propylene prices would be needed to boost demand and incentivize them. No major derivative turnarounds are forecast, but neither is more demand, so the result will only be reduced effective operating rates. Monomer consumption should increase as the new Vistamaxx plant from ExxonMobil starts up later this year and Formosa’s new PP plant starts up in the first quarter of 2024.

In terms of our Propylene price forecast, Propylene is still priced to incentivize some inventory rebuild, as the current price level is not enough to either incentivize additional exports or cause any supply reduction.

Suppliers are not desperate to sell, and additional demand caused by the Shell steam cracker fire is slowing down the pace at which prices are falling. June and July prices were increased from last week’s forecast, but are still on a downward trajectory. Prices should decrease further to incentivize more demand, which will be destined for the derivative export markets. On the other hand, as increased competition in the global markets caused by oversupply impairs additional exports, propylene prices would need to drop even further to incentivize the needed demand.

Derivative demand will increase once ExxonMobil’s Vistamaxx unit starts up later this year, but supply will increase even more with Enterprise’s PDH 2 start-up, which is forecast for July. Affordability for derivative exports will increasingly influence propylene prices. Nevertheless, affordability will be challenged as the United States establishes itself as an exporter of propylene derivatives.

Authors

Steve Lewandowski

Global Olefins & Derivatives Lead

Matthew Thoelke

Olefins, EMEA

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving in profound ways and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on the specific trends shaping the market.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!

Learn How We Can Help You Prepare and Navigate Market Disruptions