The 2024 Energy and Feedstocks Landscape: A Surprising Calm Before the Storm?

The 2024 Energy and Feedstocks Landscape: A Surprising Calm Before the Storm? Analyzing Current Trends in Crude and Natural Gas Markets

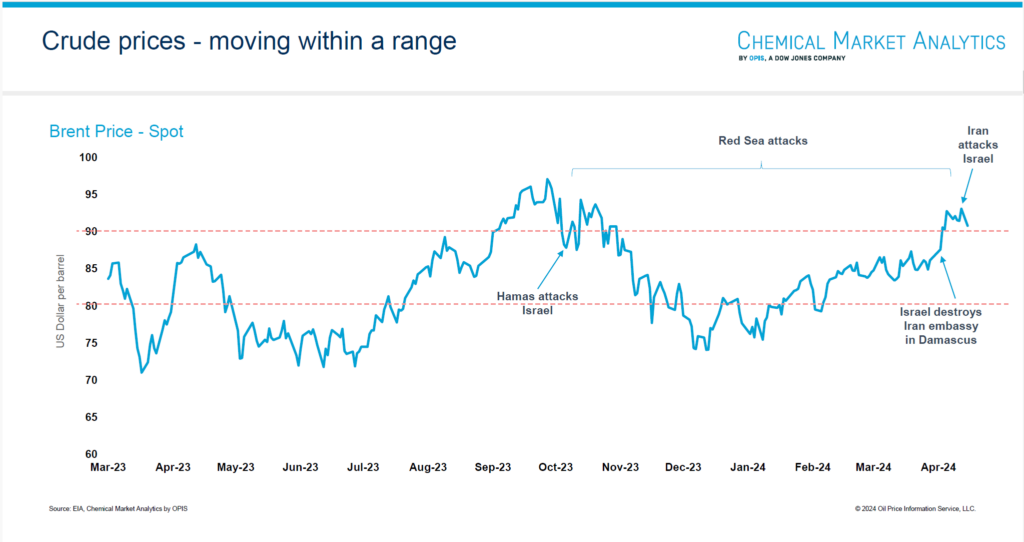

Surprisingly Stable Crude Prices

Despite geopolitical tensions, Brent crude oil prices have remained stable, hovering between $80 and $90 per barrel for the past few months. This is a significant shift from historical patterns where such events caused price fluctuations. The change can be attributed to evolving investor participation in the crude futures market, with decreased activity from some financial participants due to rising US interest rates.

Threats to Stability

However, this stability could be temporary. Persistent geopolitical tensions, upcoming US elections, and the existing shortage of heavy crude could all trigger price volatility.

Additionally, a potential return of summer gasoline demand paired with lower refinery runs due to heavy crude shortage could push prices up and impact inflation.

Natural Gas Market: Oversupply and Weak Demand

A Sluggish Market

The natural gas market is currently characterized by oversupply and weak demand due to unseasonably warm temperatures and high storage levels. However, there are some signs of momentum. Less than anticipated underground storage injections in the US and consistent operations at Freeport LNG have caused Henry Hub gas futures to rise. In Europe, despite recent events, high storage levels are expected to maintain stability throughout winter.

For more analysis on crude oil, natural gas and feedstock prices

Our webinar is available via on-demand

The US: Epicenter of the Global NGL Market

The substantial increase in US natural gas production, particularly in regions like the Permian and Haynesville, has led to a surge in byproducts like propane, butane, and ethane. As the US can’t consume all these products, a significant portion is exported, impacting the global market. This has established the OPIS Mont Belvieu index as the global industry benchmark, with 90% of all NGL contracts being closed using this US benchmark.

Gain a Deeper Understanding

The energy and feedstock landscapes are constantly evolving. Staying informed about these trends is crucial for the chemicals industry to adapt and thrive.

Request a sample report of our Energy Macro Service and see how our comprehensive analysis of the crude, natural gas, and gasoline markets provides a forward-looking view to help you navigate the ups and downs of the upstream landscape.

Chemical Market Analytics can help by providing powerful insights and actionable intelligence.

Make Informed Decisions

- Watch the on-demand webinar to hear our experts share a deeper analysis of the energy and feedstock markets.

- Get a competitive edge in the NGL & Naphtha markets. Request a sample report to see how our market insights cut through the noise and help you understand how shifts in feedstock dynamics will impact your chemical business.

A Dynamic Future Demands Constant Awareness

By closely monitoring energy market trends, validated by the downstream market insights available from Chemical Market Analytics by OPIS, we provide a tailored and holistic suite of intelligence to make strategic decisions that contribute to the stability and growth of the entire chemicals value chain.