Soda Ash: When Will Demand Catch Up to New Capacity?

Soda ash is a fundamental ingredient in many everyday products, from glass to batteries to detergents. In 2025, glass production is projected to account for 57% of global soda ash consumption.

Glass can be broadly classified as flat glass, container glass, and solar glass. Flat glass remains the main soda ash demand sector by volume, followed by container glass. However, solar glass is the fastest-growing segment, fueled by rising investment in solar energy, but this trend may shift in 2025.

In 2025, glass production is projected to account for 57% of global soda ash consumption.

Last year, the global soda ash market faced a paradox that is affecting producers’ margins. While demand rose, driven largely by the clean energy sectors, capacity also expanded significantly, particularly in mainland China. The net result is an oversupplied global soda ash market in 2025. But how long will it take to become balanced again?

The mainland China effect: strong cleantech demand vs huge capacity additions

Mainland China continues to dominate the global soda ash narrative, in terms of both supply and demand. Today, mainland China accounts for some 50% of global soda ash demand and production. Global soda ash demand has been driven by new energy sectors, namely solar glass and lithium. These fast-growing demand sectors are most prevalent in mainland China and Southeast Asia, mainly Chinese-owned companies.

Conversely, other traditional end uses are facing pressure globally. Container glass is competing with materials like aluminum cans, as well as struggling with changing consumer behavior regarding alcohol consumption, mainly in traditionally strong demand markets such as Europe and the US. Flat glass demand is strongly linked to automotive and construction sector performance, which are both expected to struggle in the current geopolitical and trade environment in 2025.

As such, cleantech demand sectors in mainland China and other Asian regions have been of particular interest, as this is where soda ash demand growth is expected. Mainland China is the obvious leader in this space, and, unsurprisingly, the country recorded record-breaking 18% domestic demand growth in 2024, after 10% in 2023, primarily driven by solar glass production. Growth in 2024 translates to an additional 5.6 million metric tons consumed in mainland China last year.

However, this momentum hasn’t persisted into 2025. In the first quarter, demand decreased by 1% year on year, and solar glass production decreased by 10% for the year to date in April. Mainland China’s solar glass capacity is expected to increase from 52 million metric tons in 2024 to approximately 56 million metric tons in 2025.

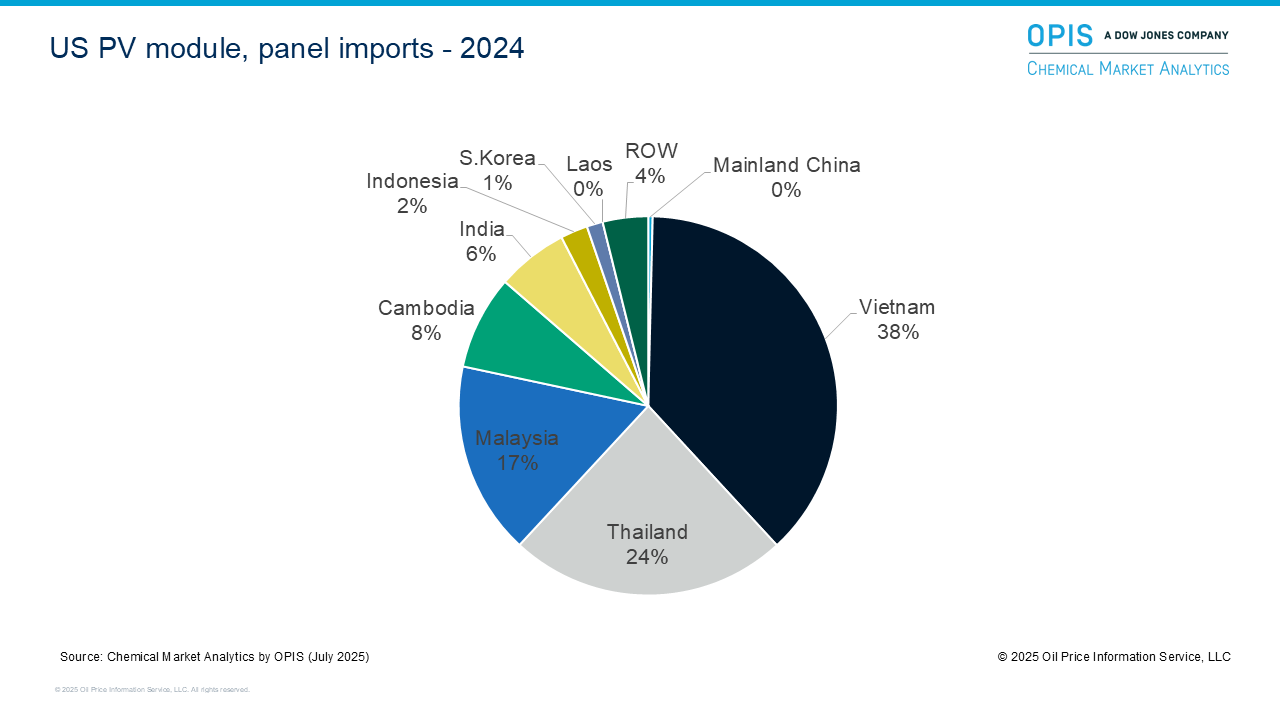

Mainland China’s rapid solar glass capacity expansion since 2022 has raised questions about whether there is excess capacity. This concern has been exacerbated as the current geopolitical situation has taken strategic center stage and investment has been diverted from the energy transition. Additionally, mainland China is an important solar glass supplier to the US. The situation has been further complicated by new US tariffs and antidumping duties (ADDs) targeting solar PV module producers in mainland China and Southeast Asia, many of which are Chinese owned. This is casting further uncertainty over the solar glass outlook in mainland China and the broader region.

On the supply side, mainland China has added more than 7 million metric tons of soda ash capacity since 2023. By 2024, mainland China had the largest annual capacity increase in its history: The Inner Mongolia Berun natural soda ash project finalized its ramp-up and reached 5 million metric tons of capacity, and in the same year, mainland China also expanded its Hou-based synthetic soda ash capacity by more than 5.5 million metric tons.

Robust domestic demand initially absorbed this new supply, keeping the global market relatively balanced through most of 2024. However, since the start of this year, pressure from excess capacity has begun to weigh on the market.

Further bolstering Mainland China’s supply, a newly discovered trona reserve in Naiman Qi, Tongliao City, comes with a clear mandate: the successful bidder from the June 2025 process must achieve 5 million metric tons of annual production within three years, as stipulated by the bidding documents.

Notably, capacity was also added in the US: In 2023–24, Genesis Alkali (now WE Soda, the largest soda ash producer as of 2025) added 1.2 million metric tons of natural soda ash production. Solvay is expected to add a total of 600,000 metric tons by the end of this year.

Mainland China’s on-and-off soda ash trade position and its reflection on prices

Trade remains essential: Around 25% of soda ash is shipped globally, so US producers are export-oriented, with more than 40% of the world’s soda ash exports shipped from this source, the second-largest exporter being Türkiye. Mainland China is also important in terms of trade, but its position is highly volatile, and this volatility has a significant influence on the global trade balance.

Mainland China typically has a fairly big trade surplus. However, in 2024 it ended the year almost balanced on trade, although for much of the year it was running a deficit. Due to the current overcapacity in mainland China, the traditional surplus has returned this year. During the first five months of 2025, exports from mainland China more than doubled, while imports fell by 98%.

In 2024, US soda ash exports rose 11% year on year, led by a 72% increase in shipments to mainland China. However, the trend reversed in early 2025: US exports declined by 3% through May, with no shipments recorded to mainland China.

As global demand growth has lagged supply, contract and spot prices have been declining since 2024. Export prices in mainland China are the most volatile, as the country exports more on a spot basis than other key suppliers. As such, an assessment of export prices from mainland China provides some insight into underlying global trends. This assessment shows that mainland China’s export price started last year at $301 per metric ton FOB but fell sharply to $187 per metric ton FOB by May 2025.

Can global demand growth rapidly fill new capacity?

In 2025, global soda ash demand is expected to increase by 1.2%, adding more than 800,000 metric tons. This suggests that global demand growth will slow in 2025 to levels not seen since after the pandemic. This follows an 8% increase in 2024, which was driven primarily by strong demand from mainland China. In contrast, demand in the rest of the world, excluding mainland China, remained flat last year. Looking ahead, soda ash demand trends are mixed depending on the region.

Other Asia (excluding mainland China and the Indian Subcontinent)

The other Asia region is the largest seaborne market, relying almost entirely on imports. Imports to the region increased by nearly 10% in 2024, reflecting strong demand, particularly from the solar and flat glass sectors. However, US tariffs targeting certain Southeast Asian solar PV module exporters have created uncertainty for 2025, especially as Southeast Asia is a significant solar glass and panel supplier to the US.

Despite uncertainty about the glass outlook for the region, several mainland Chinese and South Korean flat and solar glass investments are being developed in Indonesia and Malaysia, and some have started production during the first quarter of this year. This new glass production supported a 30% increase in soda ash imports to the other Asia region in the first quarter of this year.

The Americas (excluding the US)

Outside the US, the Americas are heavily reliant on soda ash imports. In 2024, imports to North America declined by 11%, led by Mexico, where soda ash imports, mainly for container glass, decreased by 10%, or 138,000 metric tons. In contrast, South America’s apparent demand was fairly flat.

In South America, growth is expected to come mainly from lithium, particularly in Argentina and Chile. While lithium carbonate currently accounts for 3% of global soda ash demand, it represents 20% of demand in South America and is projected to become the region’s largest end use in 2025. In the first four to six months of this year, soda ash imports to South America increased by 11% year on year. That said, battery technology shifts are risking the long-term soda ash demand outlook for this sector, especially linked to competition between lithium iron phosphate (LFP) and nickel manganese cobalt (NMC) and sodium-ion battery developments.

India

India’s soda ash demand continues to grow steadily. In 2024, consumption increased by around 4%. While powder detergents remain the largest end-use segment, raw material demand in this sector is starting to be reshaped by a faster than expected consumer shift to liquid detergents, which do not use soda ash.

Despite having domestic soda ash capacity, India remains a net importer and has ranked as the world’s third-largest soda ash importer for the past two years. Imports currently account for around 20% of India’s total soda ash supply. In 2025, demand is projected to increase by 6%, or approximately 300,000 metric tons, driven mainly by solar glass as well as sodium bicarbonate, which is used for flue gas treatment and food applications. Over the next five years, India is expected to be the third fastest-growing soda ash market globally, after Southeast Asia and South America.

Capacity rationalization and technological shifts ahead

The global soda ash sector is undergoing structural changes on a global scale. As is the case for many chemical commodities, European soda ash producers have historically had cost pressures. As a result of hefty capacity additions elsewhere, a total 1 million metric tons of European synthetic capacity has closed between January through July this year.

That said, Europe is still looking to the future for its remaining soda ash assets. Synthetic soda ash production is historically energy intensive, and European producers are paving the way for less carbon-intensive, synthetic soda ash, mainly focusing on switching from coal-based to biomass-based energy supply.

Despite the general, global trend of corporate focus shifting away from net zero targets, some companies still have the drive for sustainability, and a few have even established new goals. One example relating to soda ash is Solvay, which pledged to phase out coal as an energy source at all its sites by 2030.

The soda ash industry’s technology profile is also changing, as natural soda ash’s supply share is increasing. For context, there are two types of commercial soda ash production processes: natural (mined from trona) and synthetic (Hou and Solvay processes).

Natural soda ash projects are attracting more investment, as they boast lower associated cash costs and a lower carbon footprint than synthetic production. This makes natural soda ash very competitive and particularly interesting in the long-term context of net zero targets. The downside? Trona can only be found in specific locations.

Mainland China, especially Inner Mongolia, is one of the few geographies with this mineral resource. While traditionally only 10% of soda ash capacity in mainland China was natural, the nation is on its own energy transition journey and is targeting harmful emissions. This is shifting mainland China’s domestic soda ash investments towards natural soda ash, which today represents nearly 20% of total capacity, which should increase further. Indeed, despite the obvious capacity overhang, mainland China just announced another large natural soda ash project. Notably, all US soda ash capacity and close to 80% of soda ash capacity in Türkiye is based on natural soda ash.

Uncertainty, uncertainty, uncertainty: When will the market rebalance?

Three major uncertainties are affecting the soda ash sector:

- Weak macroeconomic environment: Economic growth affects soda ash demand across several sectors. GDP growth is subpar this year, mainly due to US trade policies, and it is falling well below the projections that supported new soda ash investment decisions in the last 5–10 years. New capacity that has started up since 2023 assumed better global market performance than at present, contributing to a long market balance.

- Geopolitical tensions: Armed conflicts and trade tensions will continue to add uncertainty to trade and investment flows. In many cases, extremely volatile trade policies and energy market fluctuations are holding back business decisions, causing buyers to source goods and materials based on immediate needs.

- Political shifts to more conservative agendas: Geopolitical tensions are steering attention away from the environmental drive in the short term, but the recent shift to more right-wing governments will have an impact on long-term government agendas. Cleantech investments, such as EVs, batteries, and renewables adoption, are now in question. These new energy sectors were a major soda ash demand growth driver in recent years via solar glass and lithium consumption, but growth should begin to slow in the coming years.

As a result, the potential for soda ash industry overcapacity is likely to persist in the short to medium term. Nonetheless, some supply-side adjustments are underway and how quickly the market rebalances will be critical for the health of the industry going forward.

Tune in for our upcoming World Soda Ash Conference in Palma de Mallorca, Spain, and gather strategic views from key stakeholders regarding the industry’s direction moving forward.