Redefining possibilities with high-performance polyethylene (Part 3 – HDPE Pipe)

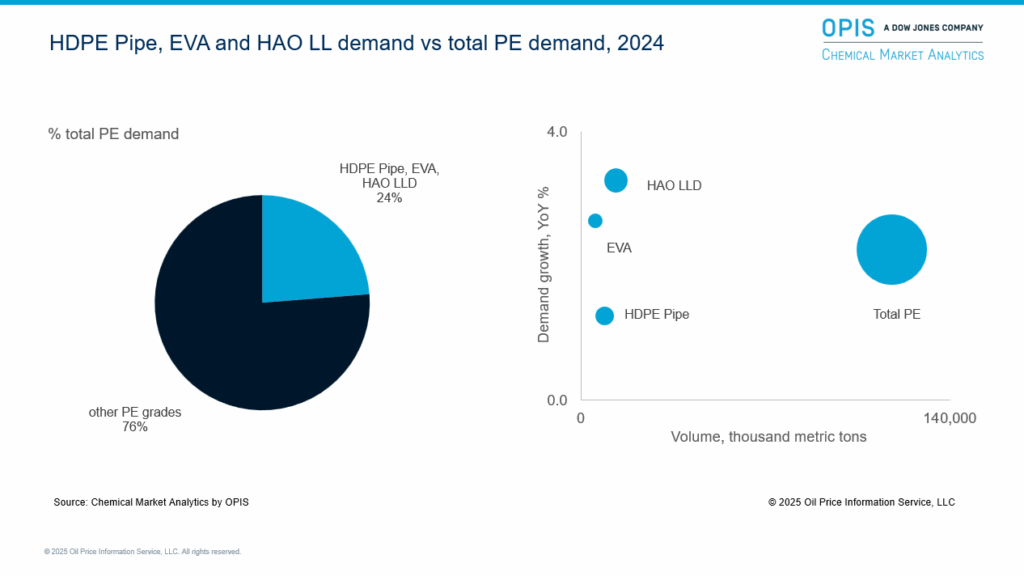

High-performance polyolefins are transforming industries with their unmatched strength, adaptability, and growing end-use applications. As sustainability demands rise, performance polyethylene is emerging as a key driver of modern living, industrial innovation, and next-generation product development.This piece highlights key market trends for select performance polyethylene (PE) products, namely ethylene vinyl acetate (EVA), higher alpha olefin (HAO) linear low-density polyethylene (LLDPE), and high-density polyethylene (HDPE) pipe.

Click to expand image

Specialty LLDPE grades’ premiums are narrowing

Commodity-grade LLDPE margins have been under pressure in regions outside of North America and the Middle East that have no low cost feedstock advantage. As a result, production has been diversified to make higher value-added grades. Asia’s predominantly naphtha-based producers have been at the forefront of producing differentiated grades. However, weak demand and the uncertain global economic environment have depressed margins.

The North American ZN octene premium over other LLDPE offerings peaked in 2024. It will drop by nearly 40% by 2026 before recovering near the end of the decade, with less octene capacity expected to come onstream regionally and globally.

HDPE pipe: Emerging markets drive demand

HDPE pipe is an HDPE sub-application. HDPE pipes are produced through a controlled extrusion process that transforms polymer resin into flexible, lightweight, corrosion-resistant, durable, and virtually leak-proof pipes. HDPE pipes are highly reliable, low-maintenance, and cost-effective over their lifecycle, making them suitable for water, gas, sewage, and industrial applications.

Unlike traditional materials such as steel, ductile iron, or concrete, HDPE offers a rare combination of excellent corrosion resistance, leak-free jointing through heat fusion, and lightweight handling, making it ideal for new installations and trenchless rehabilitation projects. Its flexibility allows it to withstand ground shifts, seismic activity, and freeze-thaw cycles with minimal risk of cracking or joint failure, while its smooth internal surface supports superior hydraulic performance over decades of use.

Overall, HDPE pipe is one of the most versatile and forward-looking piping materials available today, combining high performance with long-term economic and environmental benefits. The HDPE pipe business is complex and dynamic and fundamentally differs from other PE product businesses such as LDPE, linear low-density polyethylene LLDPE, and non-pipe HDPE because of its unique technical, market, regulatory, and infrastructure-driven characteristics.

This article is part of our Performance Polyethylene series. If you’d like to explore the other two stories, please click below:

HDPE non-pressure pipe set to grow faster than pressure pipe

HDPE pipe is the fourth largest HDPE segment, behind film and sheet, blow molding, and injection molding. HDPE pipe has a robust share of overall HDPE capacity, and this is forecast to rise further by 2050 due to planned HDPE pipe investments in the coming years. HDPE pipe has a low double-digit share of global HDPE demand, which will remain firm through 2050.

Our analysis categorizes HDPE pipe into pressure and non-pressure grades. Many HDPE plants can swing seamlessly between pressure and non-pressure grades. Our survey indicates that HDPE pressure pipe currently has a low double-digit share of total HDPE production, accounting for almost two-thirds of overall pipe-grade production. HDPE non-pressure pipe has a high single-digit share of total HDPE production and is almost one-third of total HDPE pipe production. HDPE pressure and non-pressure production shares are forecast to change in the coming years: Pressure pipe will still hold the majority share, but it is expected to slide marginally, while non-pressure’s share will creep up.

HDPE pipe demand growth is expected to be moderately high in the next 10 years, supported by macroeconomic growth, investment, and the expansion of new applications. HDPE pipe will benefit from being a durable material with a low carbon footprint, higher performance/weight ratio, long life, and better functionality, which will advance sustainability progress.

HDPE non-pressure pipe demand growth will be marginally higher than pressure pipe growth in the next decade, linked to macroeconomic trends and global evolution in the next few years.

HDPE non-pressure pipe demand growth will be marginally higher than pressure pipe growth in the next decade, linked to macroeconomic trends and global evolution in the next few years. HDPE pipe demand growth projections are especially strong for emerging and developing markets due to macroeconomic, demographic, and economic factors: Health, sanitation, and infrastructure development will drive pipe demand, a critical raw material. Irrigation, water management, utility line upgrading, and old network replacement will create HDPE pipe demand.

HDPE pipe technology has been advancing since the mid-1990s

Since its commercial introduction in the mid-20th century, HDPE pipe has evolved through advancements in resin technology, production methods, and global adoption. HDPE pipes are produced through extrusion, where molten polymer is pushed through a die to form a pipe profile.

Innovations such as multilayer co-extrusion, in-line thickness monitoring, and UV stabilization have enhanced pipe performance. PE100 and PE4710 resin classifications have become industry benchmarks, offering higher durability and thinner wall sections. There has also been significant innovation and development in cable joining.

Margins are narrowing, but HDPE pressure pipe premium will hold

There is a distinct commoditization trend for HDPE pressure and non-pressure pipe. Non-pressure HDPE pipe’s premium over the base grade, HDPE blow molding, has shrunk to a marginal level, but HDPE pressure pipe still commands a premium. That said, the outlook points to a shrinking premium, even for HDPE pressure pipe. Over time, HDPE pressure pipe will become a less differentiated product category.

Business is cyclical and seasonal, and this has indirectly driven premiums down. Because of this uneven demand, pipe converters may sometimes submit aggressive quotations: Although this makes for poor economics on paper, it allows them to recover variable costs and keep plants running when business is low. Other factors influencing the drop in the premium are government tenders and the increasing popularity of e-bidding, which incentivizes the lowest price over product or service differentiation.

Experts: Yi Ling Tan – Director Polyolefins, Chemical Market Analytics by OPIS; Kaushik Mitra – Executive Director Polyolefins, Chemical Market Analytics by OPIS; Joel Morales – VP Polyolefins Americas, Chemical Market Analytics by OPIS

Explore Performance Polyethylene with Chemical Market Analytics

A comprehensive analysis of EVA, HDPE Pipe and HAO-LLDPE (c6, c8), mLLDPE

- Delivers market projections and strategic insight into global and regional trends.

- Offers a comprehensive overview of resin production technologies and evolving capabilities.

- Analyzes product applications across end-use markets, highlighting key players, capacities, and competitive dynamics.

- Provides deep dives into individual products, including detailed supply/demand outlooks and long-term forecasts.