Redefining possibilities with high-performance polyethylene (Part 2 – HAO)

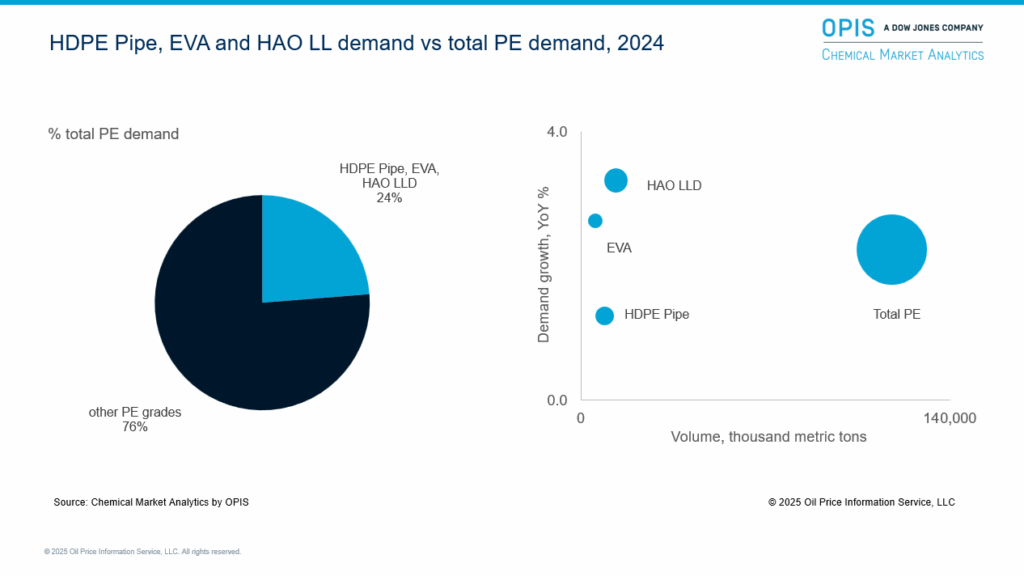

High-performance polyolefins are transforming industries with their unmatched strength, adaptability, and growing end-use applications. As sustainability demands rise, performance polyethylene is emerging as a key driver of modern living, industrial innovation, and next-generation product development.This piece highlights key market trends for select performance polyethylene (PE) products, namely ethylene vinyl acetate (EVA), higher alpha olefin (HAO) linear low-density polyethylene (LLDPE), and high-density polyethylene (HDPE) pipe.

Click to expand image

HAO: Lightweight and high recycle content applications drive growth

LLDPE is one of the most important groups within the polyethylene chain, growing globally at an average rate of 3.85% over the past five years. As demand expands, it has become increasingly critical to understand how higher alpha olefin LLDPE grades are used in end-use applications.

The LLDPE outlook by grade: ZN hexene, ZN octene, mLLDPE

Chemical Market Analytics by OPIS has recently launched a new HAO linear low-density polyethylene (LLDPE) analysis focusing on hexene- and octene-based LLDPE. Traditionally, LLDPE analysis has been grouped together under broad capacity, demand, and trade categories; our new analysis distinguishes between Ziegler-Natta (ZN) hexene, ZN octene, and metallocene/single-site catalyst LLDPE (mLLDPE). The study also includes analysis on operating rates and demand segmentation.

This article is part of our Performance Polyethylene series. If you’d like to explore the other two stories, please click below:

These products’ demand can be broken into major process segments such as film and injection molding. Notable end markets include stretch film and shrink film. Stretch film for higher alpha olefins is a key market in North America and is expected to grow by over 20% from 2024–30. Markets like stretch film are expected to benefit from higher alpha olefins that allow for lightweighting with the same or better performance properties.

Fast-growing mLLDPE: The recycle content and lightweight advantage

According to our forecast, mLLDPE capacity will grow from 9.5 million metric tons to 13.1 million metric tons by 2030, an increase of nearly 40%, growing at a faster rate than ZN hexene or ZN octene. mLLDPE’s greater growth stems from it being a potential leading-edge solution in various applications; its inherent physical properties allow for lightweighting and higher recycle content.

Our analysis also compares production methods across products, namely traditional ZN catalyst technologies compared with more advanced metallocene systems, highlighting the technical differences and their impact on product performance and commercial positioning.

Specialty LLDPE grades’ premiums are narrowing

Commodity-grade LLDPE margins have been under pressure in regions outside of North America and the Middle East that have no low cost feedstock advantage. As a result, production has been diversified to make higher value-added grades. Asia’s predominantly naphtha-based producers have been at the forefront of producing differentiated grades. However, weak demand and the uncertain global economic environment have depressed margins.

The North American ZN octene premium over other LLDPE offerings peaked in 2024. It will drop by nearly 40% by 2026 before recovering near the end of the decade, with less octene capacity expected to come onstream regionally and globally.

Experts: Yi Ling Tan – Director Polyolefins, Chemical Market Analytics by OPIS; Kaushik Mitra – Executive Director Polyolefins, Chemical Market Analytics by OPIS; Joel Morales – VP Polyolefins Americas, Chemical Market Analytics by OPIS

Explore Performance Polyethylene with Chemical Market Analytics

A comprehensive analysis of EVA, HDPE Pipe and HAO-LLDPE (c6, c8), mLLDPE

- Delivers market projections and strategic insight into global and regional trends.

- Offers a comprehensive overview of resin production technologies and evolving capabilities.

- Analyzes product applications across end-use markets, highlighting key players, capacities, and competitive dynamics.

- Provides deep dives into individual products, including detailed supply/demand outlooks and long-term forecasts.