Redefining possibilities with high-performance polyethylene (Part 1 – EVA)

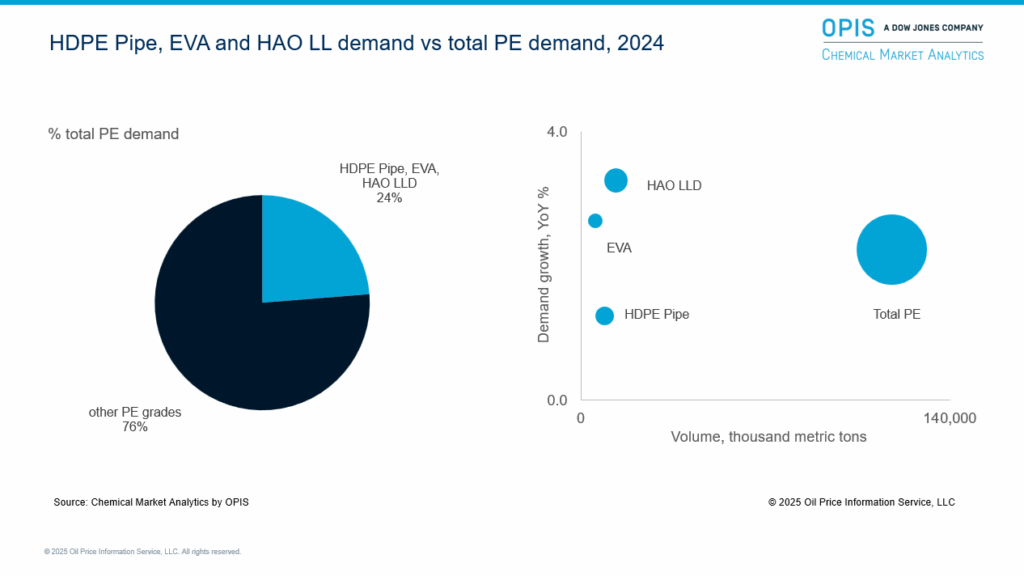

High-performance polyolefins are transforming industries with their unmatched strength, adaptability, and growing end-use applications. As sustainability demands rise, performance polyethylene is emerging as a key driver of modern living, industrial innovation, and next-generation product development.This piece highlights key market trends for select performance polyethylene (PE) products, namely ethylene vinyl acetate (EVA), higher alpha olefin (HAO) linear low-density polyethylene (LLDPE), and high-density polyethylene (HDPE) pipe.

Click to expand image

Long troughpushed Asian PE producers to diversify their portfolio

Traditionally, performance PE products—HAO LLDPE (LLc6, LLc8, mLLDPE), HDPE pipe, and EVA—yielded better margins than commodity PE. Interest in specialty products has grown, which is unsurprising given the global chemical industry’s struggles with overcapacity and heightened competition, pinched margins, and the longest trough in memory.

The performance PE market significantly expanded in Asia as producers sought to diversify their portfolios in the last few years to achieve better margins. Asian producers predominantly use naphtha as a feedstock, thus suffering from lower margins compared to lower cost, ethane-based producers in North America and the Middle East. Asian EVA producers outside of mainland China were gradually edged out as more mainland Chinese producers entered this market. As a result, the EVA market has becoming increasingly complex as Asian producers have attempted to navigate the downcycle in recent years while strategically evaluating whether diversification into these products can support their margins.

As a result, the EVA market has becoming increasingly complex as Asian producers have attempted to navigate the downcycle in recent years while strategically evaluating whether diversification into these products can support their margins.

Within HAO LLDPE, LLc6 and LLc8 were already established markets in the West, thus Asia focused on mLLDPE instead. Notably, the availability of comonomers and technology also restricted which performance PE grades could be produced in Asia. HDPE pipe is a more complex business, as countries have slightly different requirements. It extends more into the compounding business, and color grades vary in price. Despite yielding better margins, Asian producers lack competitiveness against cost-advantaged Middle Eastern producers that have grown their market share of this product.

EVA: Margins contract but finished products demand grows steadily

EVA is a copolymer of ethylene and vinyl acetate (VAM). EVA can be classified into resins, elastomers, and emulsions. Our analysis focuses on EVA resins with a VAM composition ranging from 5–40% by weight. EVA copolymer has properties like LDPE when the VAM content is lower, while it has properties similar to elastomers when the VAM content is higher. Because of its versatility, EVA is used in a wide range of applications. The most common applications are in solar encapsulation and footwear.

Anti-involution policy targets solar sector, the largest demand driver

Solar is EVA’s largest demand sector. EVAs properties—the ability to bond to various substrates, UV stability, and optical transparency—make it suitable for solar panel manufacturing. It is also widely used in foam applications, especially for footwear and apparel, which benefit from its flexibility and impact absorption properties. Other applications include wire and cable and hot-melt adhesives.

EVA demand has been growing across all its major applications. However, there is rising concern about the anti-involution policy in mainland China, as it targets the solar industry. If government-mandated supply curtailments are strictly enforced in the solar sector, which is struggling with oversupply, EVA demand into solar applications could be dampened. However, the negative impact from strict implementation of the anti-involution policy could be offset by decarbonization goals set by various governments globally as the energy transition progresses.

Nevertheless, most EVA demand is concentrated in Asia, particularly mainland China, which has become the global manufacturing hub. Supply is also concentrated in Asia, reinforced by further new upcoming capacity in mainland China. Overall, Asia remains relatively self-sufficient in EVA.

EVA’s premium is narrowing

EVA margins have been following commodity PE trends, where Asia has the lowest margins globally. This is not unusual: Prices are typically lower in markets with high competition. The EVA production cost in Asia is also higher compared to assets in North America and the Middle East, which benefit from an ethane feedstock cost advantage when making ethylene, which makes up a large proportion of EVA. Asian producers, predominantly naphtha-based, have traditionally tried to diversify their portfolios by producing value-added grades.

EVA used to yield higher margins than traditional commodity PE products. However, as more new capacity comes onstream, the EVA-commodity PE premium has narrowed. Historically, mainland China did not produce EVA in large volumes, but it has now caught up and is able to produce substantial amounts. Mainland China’s EVA capacity expansion has intensified competition in the market and reduced its reliance on imports, ultimately raising concerns that the country will shift from a net importer to a net EVA exporter.

Strategic Report – Performance Polyethylene

Uncover trends of EVA in supply, demand, capacity, pricing, costs, and margins

EVA-LDPE swing lines will become more desirable

There are currently two EVA production processes: autoclave and tubular. Autoclave is an older technology, and these plants are typically smaller and older than those using tubular technology, the prevalent choice for newer, larger assets. Going forward, the preference for large, tubular plants should remain, as new assets will likely be integrated into large cracker-PE complexes.

Notably, EVA and LDPE can be produced on the same line, although additional equipment is required to transport the other comonomer, VAM. Operating conditions can also vary, and higher pressure may be required. Despite the necessary additional investment, we expect producers’ interest in retaining swing flexibility between EVA and LDPE output to increase. As mainland China expands its EVA supply, premiums will narrow. Thus, producers are likely to want flexibility to swing between EVA and LDPE, depending on current market conditions and both products’ economics.

The decision to switch between LDPE and EVA also hinges on the type of EVA produced. For example, a higher VAM content grade may have a higher margin than a lower VAM content grade. As such, the evaluation of the switch will weigh on both LDPE and the different EVA grades, thus becoming a crucial strategic production decision because it determines which markets to target.

EVA finished products demand is growing steadily across all regions

Overall, EVA dynamics vary regionally. While there is investment and growth in some regions, other regions have stagnated, with no investments. As a result, there is something of an imbalance, but only for EVA resin. EVA finished products demand growth has been steady across regions and applications.

As the largest market globally – mainland China – slows, this is expected to impact EVA demand. The high EVA demand growth rates in the past decade may not continue over the next 10 years. That said, the energy transition’s solar pull and EVA’s many other applications will support steady demand growth.

Experts: Yi Ling Tan – Director Polyolefins, Chemical Market Analytics by OPIS; Kaushik Mitra – Executive Director Polyolefins, Chemical Market Analytics by OPIS; Joel Morales – VP Polyolefins Americas, Chemical Market Analytics by OPIS

Explore Performance Polyethylene with Chemical Market Analytics

A comprehensive analysis of EVA, HDPE Pipe and HAO-LLDPE (c6, c8), mLLDPE

- Delivers market projections and strategic insight into global and regional trends.

- Offers a comprehensive overview of resin production technologies and evolving capabilities.

- Analyzes product applications across end-use markets, highlighting key players, capacities, and competitive dynamics.

- Provides deep dives into individual products, including detailed supply/demand outlooks and long-term forecasts.