Partnering for Progress: Cross-industry Collaboration in South American Lithium Production

Lithium is essential to the renewable energy sector, and it is a key component in EV batteries. The lithium sector is poised for growth as we navigate the energy transition, and it is a must-watch sector for some chemicals markets.

More than 50% of the world’s known lithium reserves are in Chile, Argentina, and Bolivia’s salars, the Lithium Triangle. South America is estimated to account for just under two-thirds of the known global reserves, including Brazil’s known reserves. Despite this, South America was responsible for just under one-third of global lithium output in 2023.

There are several reasons why the South American lithium output is somewhat falling short of its potential. This piece will focus on the logistical challenges facing the provisioning of necessary chemicals for mining and refining operations.

Is the lithium sector past its prime?

Lithium prices are currently down nearly 90% from their peak in 2022. These low prices are linked to the surge in Chinese lithium production over the last couple of years, combined with a slowdown in electric vehicle (EV) sales, especially in the United States and Europe. In the medium term, delayed EV investment announcements by major automakers and the increasing use of lithium iron phosphate/lithium manganese iron phosphate (LFP/LMFP) batteries, rather than higher lithium-content NCM cathode batteries, are major factors contributing to a downgraded lithium demand outlook.

China is emerging as the leading lithium supplier and is expected to be responsible for nearly one-third of global LCE production by 2025.

Steady growth is still expected for EV adoption—just at a slower pace than initially anticipated. According to Fastmarkets, total EV sales should hit close to 150 million by 2034 (including passenger and commercial vehicles), compared to about 40 million in 2023. EVs are not the only growing end use for lithium: energy storage systems (ESS) lithium carbonate equivalent (LCE) demand is forecast to grow at a 21% compounded annual growth rate (CAGR) from 2023 to 2034.

Weaker lithium prices and the revised EV demand outlook are, in turn, causing some lithium supply chain participants to reduce production, cut costs, and reassess new investments. This trend is particularly evident outside of China, where companies are committed and incentivized to develop new capacity. As a result, China is emerging as the leading lithium supplier and is expected to be responsible for nearly one-third of global LCE production by 2025.

However, a potential scale-down in lithium investments in the medium term is likely to pinch supply by around 2027, which should keep prices high for a few years beyond, supporting better margins. Despite recent price challenges, the lithium market is expected to grow steadily in the long term.

Inorganic chemicals–the most sensitive to lithium mining dynamics

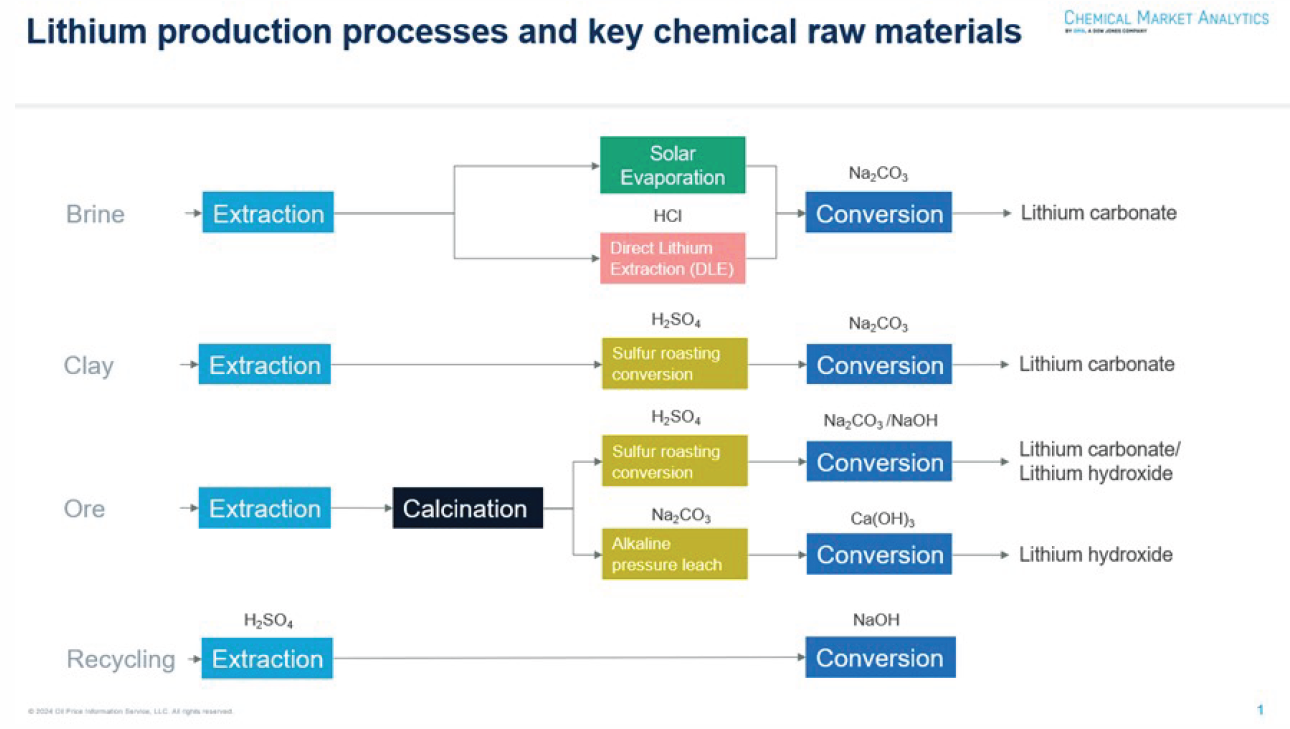

Lithium comes from multiple sources. Hard rock (mainly spodumene and lepidolite, but also petalite, clay, and others) and brine are currently the main sources, accounting for 60% and 39%, respectively, of 2023 LCE supply in 2023. They are processed differently, and raw material requirements differ depending on the process and the source. Lithium carbonate or lithium hydroxide is typically the end product.

When it comes to chemicals, few commodities are directly involved in lithium extraction and processing. In South America, lithium is typically extracted from brine and converted into lithium carbonate. Soda ash (Na₂CO₃) is one of the primary reagents in this process, and hydrochloric acid (HCl) and caustic soda (NaOH) are also used, though on a much smaller scale.

For the chlor-alkali supply chain, lithium brine mining in South America tends to use more HCl than caustic soda, depending on the quality of the brine and the recovery technology. Caustic soda consumption is currently very low, even in the largest lithium production sites in Chile; so low that it is sometimes used in flake form. Indeed, according to World Analysis data by Chemical Market Analytics, only about 8,000–9,000 dry metric tons (dmt) of caustic soda is consumed annually by the South American battery materials sector.

That said, lithium mining is a relevant caustic soda demand driver in the region, with just over 11% average annual growth expected between 2024–29. It is still unlikely to become a significant regional demand sector, however, compared to other major segments like pulp and paper.

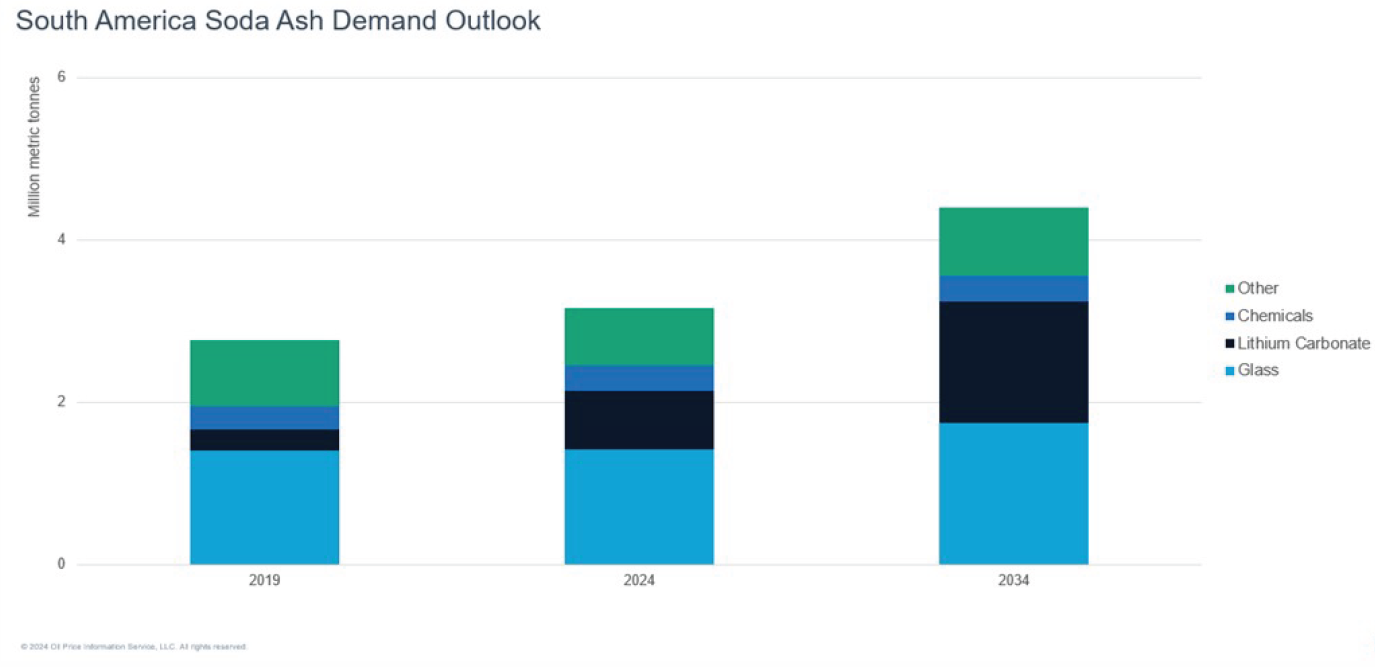

Meanwhile, lithium extraction is rapidly becoming a key sector for soda ash demand in South America. The region currently accounts for over one-third of global soda ash demand into lithium carbonate, with just under 1 million metric tons (mt) expected to be consumed regionally this year for this purpose.

The future remains promising: Soda ash demand into South America’s lithium sector is projected to grow at an average of 16% yearly between 2024–29. Lithium accounted for 9% of total South American soda ash demand in 2019, and demand is projected to reach 23% in 2024 and 34% in 2029.

We forecast strong soda ash demand growth into this sector in South America. But the region is not yet reaching its full potential: If investment in the region picks up, the upside to our base-case scenario could be significant.

Bolivia and Chile lead on reserves, but not on production

According to Fastmarkets, global lithium production is growing steadily, with lithium carbonate equivalent (LCE) production volume projected to increase by 289% by 2034 compared to 2023.

Despite nearly two-thirds of the known global lithium reserves being located in South America, output from Chile, Argentina, and Brazil accounted for less than one-third of global LCE production in 2023. Australia surpassed Chile as the largest producer in 2017 and has remained the leader since, contributing 41% of global LCE production in 2023, while Chile accounted for 24%. Together, Australia, Chile, Argentina, and China produced 94% of global LCE in 2023.

However, supply is diversifying. Fastmarkets projects South America’s share of global LCE production to decline slightly, from 29% in 2023 to 28% by 2034. Even so, this reduction in market share corresponds to more than double the annual LCE output between 2023 and 2034, indicating positive growth for the region.

Conversely, Australia’s share of global production is expected to drop significantly, from 41% to 25%, as new projects in East Asia (mainly China), Africa, North America, and Europe expand their production capacity.

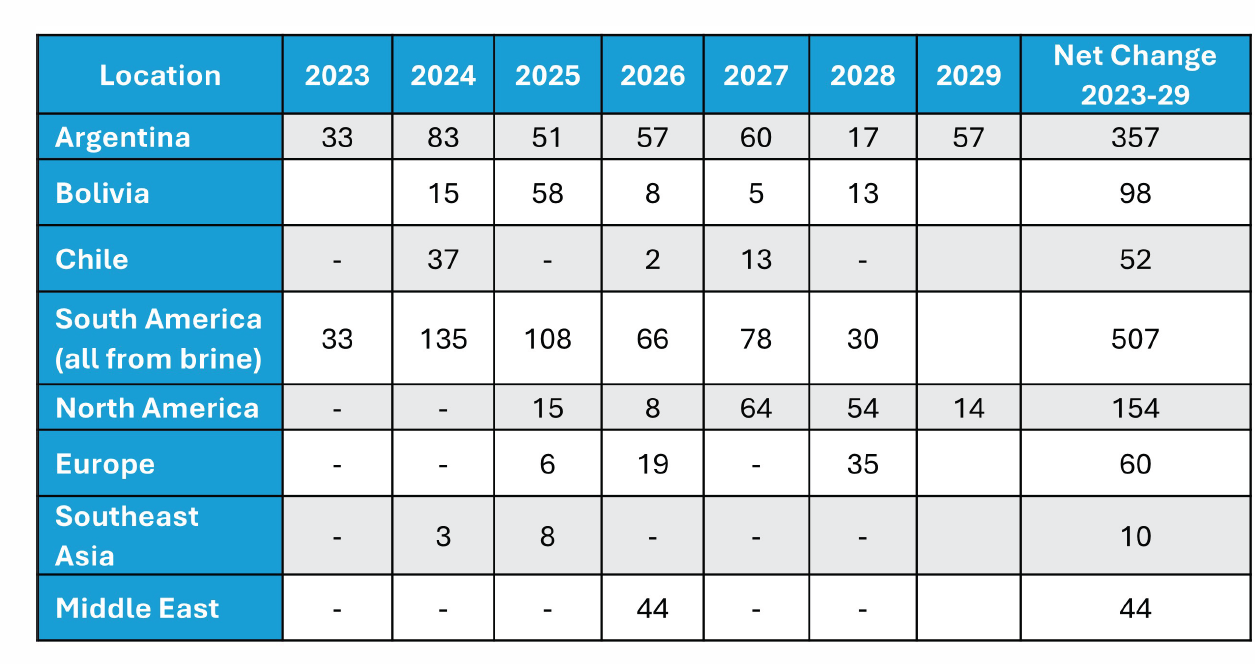

The table focuses on lithium carbonate projects, which are the most relevant for soda ash demand.

Argentina and Bolivia are positioned to significantly boost lithium carbonate equivalent (LCE) output. Lithium extraction projects in Argentina are ramping up in 2024, with new capacity planned for the end of 2025. Bolivia also has significant capacity plans, targeting 100,000 metric tons of lithium carbonate production from the Uyuni, Coipasa, and Pasto Grandes salt flats in 2025.

Several projects in South America are opting for direct lithium extraction technology (DLE) rather than solar evaporation, mainly due to the faster extraction time compared to traditional processes. That said, this emerging process is still relevant for inorganic chemicals, as DLE can consume hydrochloric acid (HCl), and soda ash is still required to convert lithium chloride into lithium carbonate.

Despite being positioned for success and having many lithium projects in the pipeline, South America has been plagued by structural issues common to many industries:

- Economic and political instability: Several countries in the region have experienced periods of inflation, currency devaluation, and debt crises, which can hinder long-term investment. Polarized governments with alternating terms in office often lead to instability.

- Regulatory and financing challenges: Limited access to financing and investment combined with inconsistent regulatory environments and bureaucratic inefficiencies can create obstacles for companies.

- Infrastructure limitations: Adequate infrastructure is crucial for the chemical industry, which relies on efficient transportation networks, reliable energy supplies, and robust supply chains. In many parts of South America, infrastructure development has lagged.

Regional market participants point to inadequate infrastructure as one of many challenges they face, particularly in the chemicals supply chain. Logistics infrastructure is crucial for operations in remote locations, and this is the case for lithium brine salars. Logistics for moving hydrochloric acid, caustic soda, and soda ash are particularly challenging, especially in the Antofagasta area, affecting deliveries into both Chile and Bolivia.

Moving chemicals into remote locations

Though infrastructure is not the primary challenge to lithium output growth in the region, it is a problem the chemical industry can help resolve. One option is to expand the logistics infrastructure to handle the growing import volumes of these chemicals. Another option is to build new chemical production capacity in the region to supply the lithium sector. Both approaches require significant investment.

One current solution involves establishing local small-scale facilities specifically designed to supply chemicals to the lithium sector. Plans for chlor-alkali plants (producing chlorine/HCl and caustic soda) in the Andean region have already been announced. These plants aim to meet specific operational needs while offsetting logistical challenges. For example, in 2023, Tsingshan signed an agreement to invest $120 million into a chlor-alkali plant at the Perico Industrial Park in Jujuy Province, Argentina. During its first stage, the plant will produce 35,000 dmt per year of caustic soda and 100,000 metric tons per year of hydrochloric acid (32% HCl).

Meanwhile, larger-scale projects are also being developed to address the chemical needs of Bolivian lithium operations. In 2024, East China Engineering Science and Technology, an engineering construction services provider, announced it had secured a contract to build Bolivia’s first large chemical plant. Located in Uyuni, Antonio Quijarro Province, and owned by Química Industrial Bolivia, a state-owned enterprise, the plant will produce 80 kilotons per year of sulfuric acid, 53,000 metric tons per year of 34% HCl, 20,000 dmt per year of caustic soda, 375,000 metric tons per year of calcium hydroxide, and 150,000 metric tons per year of soda ash.

Cooperation among market participants could facilitate investment and ensure a steady chemical supply. The region has a history of successful cross-industry collaboration, as demonstrated in the pulp and paper industry. Many pulp mills support “chemical islands,” symbiotic bleaching chemical projects that supply sodium chlorate, hydrogen peroxide, sulfuric acid, and chlorine dioxide directly to the mills through long-term contracts, often exceeding 20 years.

Lithium will continue to drive demand for South American inorganic chemicals

Despite these structural challenges, the chemicals projects driven by existing and projected lithium extraction demonstrate confidence in South America’s market potential. Recent mergers and acquisitions (M&A) activity in the mining sector further highlights that lithium extraction in the region remains highly attractive. For instance, in October 2024, Rio Tinto announced its $6.7 billion acquisition of Arcadium Lithium, positioning itself as one of the largest lithium suppliers alongside Albemarle and SQM. Arcadium Lithium operates extraction sites in both Argentina and Australia, with downstream conversion assets in the United States, China, Japan, and the United Kingdom. It also has four new projects underway in Argentina, along with several other global initiatives.

Those who invest while lithium margins are low will likely be well-positioned to benefit when a supply crunch emerges later in the decade.

Overall, South America is poised for growth as a key player in the lithium market, and the inorganic chemicals industry stands to benefit significantly from this expansion. However, challenges remain on the horizon. The sector will struggle without substantial further investment, particularly in financing the infrastructure needed to support remote lithium operations and constructing new chemical production facilities closer to these locations.

Collaboration between lithium and chemical producers is crucial for scaling up the sector. Establishing chemical production assets within the Lithium Triangle would help alleviate logistics constraints. Strong partnerships could also facilitate much-needed investments, a persistent challenge in South America, especially given the current unimpressive lithium prices and waning hype around the commodity. Those who invest while lithium margins are low will likely be well-positioned to benefit when a supply crunch emerges later in the decade.

Get ready for the Global Chlor-Alkali & Vinyls Conference 2025 to delve into the path to recovery in the chlor-alkali and vinyls markets, exploring different strategies to chart the optimal course for navigating this evolving landscape. Register now and save €500 off the standard conference fees. Advance rate ends 14 Feb 2025.