Oversupply and Rationalization—What’s on the Other Side of the Valley?

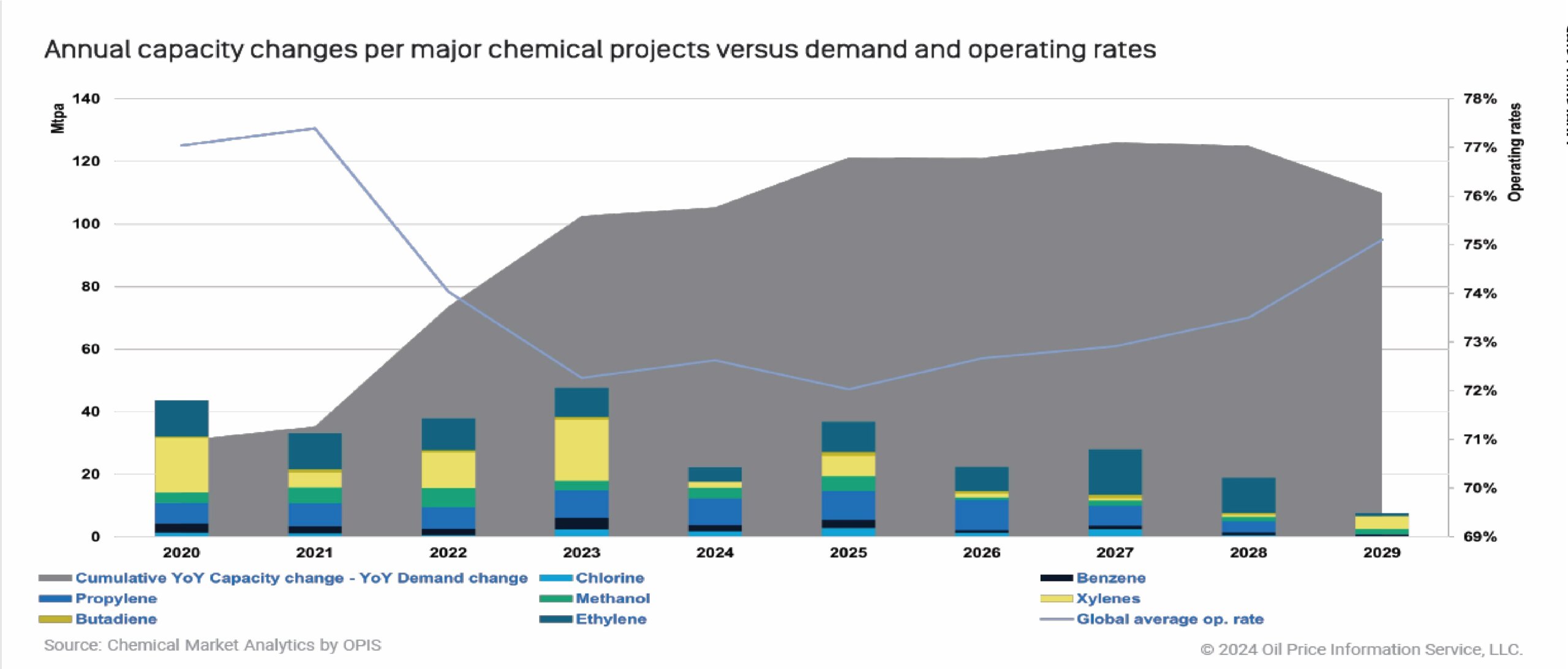

The chemical industry is no stranger to overcapacity; however, it is presently facing a rather prolonged oversupply cycle, which has exacerbated critical challenges. Notably, the current overcapacity cycle is expected to last for several years, thus overlapping with some key timelines established for energy transition (ET) targets and mandates. The upside? Challenges often come hand in hand with opportunities.

The effects of this prolonged down cycle ripple through the chemicals supply chains, affecting most chemicals markets in one way or another.

How did we get here?

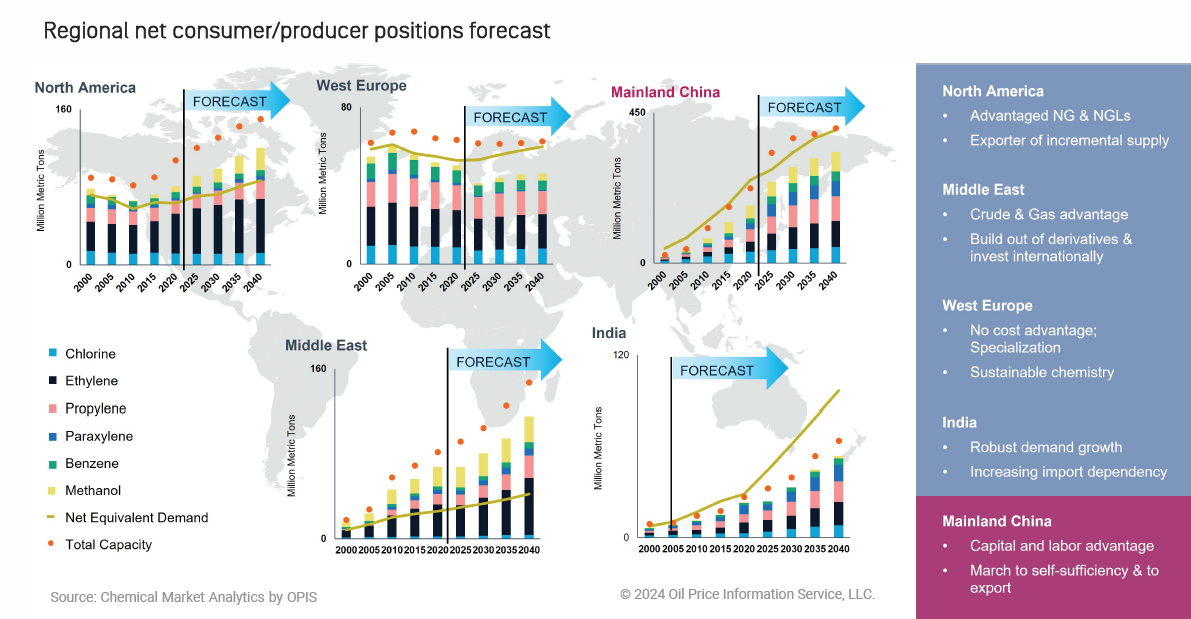

The current oversupply cycle is a joint result of large-scale capacity additions in China (and, for some markets, also in North America) and a contraction of demand growth rates. The situation spans multiple building blocks of the chemical industry, including olefins, aromatics, and polyolefins. As such, the effects of this prolonged down cycle ripple through the chemicals supply chains, affecting most chemicals markets in one way or another.

What will happen as we cross the trough?

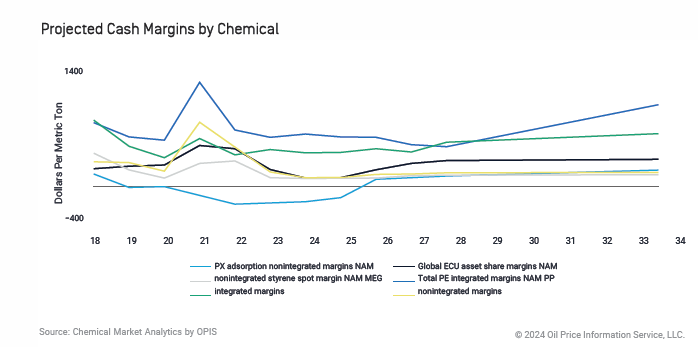

The main consequence of this oversupply cycle is the low industry margins felt across these key sectors. Subdued (or even negative) margins are likely to become the new normal in the midterm. As a result, persistent trough conditions will delay recovery, opening the door to a changed market environment.

In an increasingly competitive environment, the distinction between “winners” and “losers” becomes crystal clear. Feedstock advantage, already historically a key differentiator, becomes even more relevant in an overcapacity supercycle; those without advantaged energy feedstocks will struggle and likely face significant rationalization. The weak will get weaker, and the strong will get stronger.

From Energy Policy to Trade: Strategic Insights on Trump’s Return

Complimentary Webinar on Jan 22, 2025

The regional market polarization we have witnessed will evolve even faster. Feedstock-advantaged regions will grow their export positions, while those at a disadvantage will require further imports as domestic production loses competitiveness. Marginal players will likely crumble, setting the bar for survival increasingly higher as we move through the trough.

Noncompetitive producers in Europe and Asia are particularly vulnerable. Asian non-integrated producers will be at the top of the list for curtailments as new “mega” chemical commodity plants integrated into the refinery and downstream assets in China flood this regional market with highly competitive products.

Meanwhile, a host of European producers are restructuring their business models completely. The regional market has seen demand erosion in recent years, combined with escalating energy costs, a lack of competitiveness in international markets, and growing pressure to decarbonize existing operations.

Unsurprisingly, we are already witnessing rationalization and feedstock changes in Asia and Europe, where companies are selling, closing, or retrofitting assets to use cheaper raw materials, such as ethane over naphtha. A growing wave of rationalization is a major concern for oil markets, which are already expecting further demand erosion in the transportation sector as electric vehicle adoption advances and alternative aviation fuels are adopted.

Olefins markets will experience a deteriorating market balance for several years, in line with new Chinese and Middle Eastern assets yet to come online, even as Chinese GDP growth remains subpar. The market will see further consolidation of ethylene and propylene capacity.

The story does change for other commodities, depending on the regional context: For example, US vinyls and syngas production is advantaged due to cheap NGLs supply.

Overall, in our base case outlook for multiple chemical building blocks, we often project compressed margins. For producers, cost control, cash flow, and production discipline will become even more critical, and it is likely that a self-correcting mechanism will develop, be it through idling or rationalization. Production cutbacks, shutdowns, and new start delays would result in an upside risk to our compressed margins base case scenario.

As disadvantaged players struggle over the next several years, major strategic decisions will have to be made for the assets at risk. According to Young & Partners investment banking at the World Chemical Forum, key points to consider include:

- Operating expenses assessment. Is process optimization and/or feedstock switching to a lower cost product viable?

- Market served. What is the current balance and price position in the domestic market? Is arbitrage open to more attractive growth markets?

- Product portfolio. Could other products be integrated or fully pivoted into that have better growth/margin prospects?

- Integration. Can existing operations be further integrated upstream and/or downstream, and how would that impact margins?

- M&A. Could merging with complementary operations and/or competitor operations improve competitive position?

One major downside to keep in mind when applying for funding of these projects is that median chemical valuations have been falling dramatically since early 2023. Persistent uncertainties in these industries will hold valuations at a depressed level, hindering the number of concluded M&A deals. According to Young & Partners, 20 M&A deals closed in the first half of 2024, a major slowdown on an annualized basis, from 75 in 2023 and 86 in 2022.

Speak to our experts to get a demo of Chemical Market Analytics Platform

There are clear regional differences regarding M&A activity in the chemicals space. Asia dominates in the number of deals in 2024, followed by the US. Meanwhile, in Europe the number of deals is falling annually. Buyer interest is lacking for chemical commodity assets, especially in Europe, where only speciality chemicals deals concluded this year, but also globally. Typically, 50% of M&A deals in the chemicals space would be allocated to commodity assets; however, the ratio has been decreasing since 2023, to about 35% in the first half of 2024.