Impact of Anti-dumping Duties on India Polyether Polyols Imports

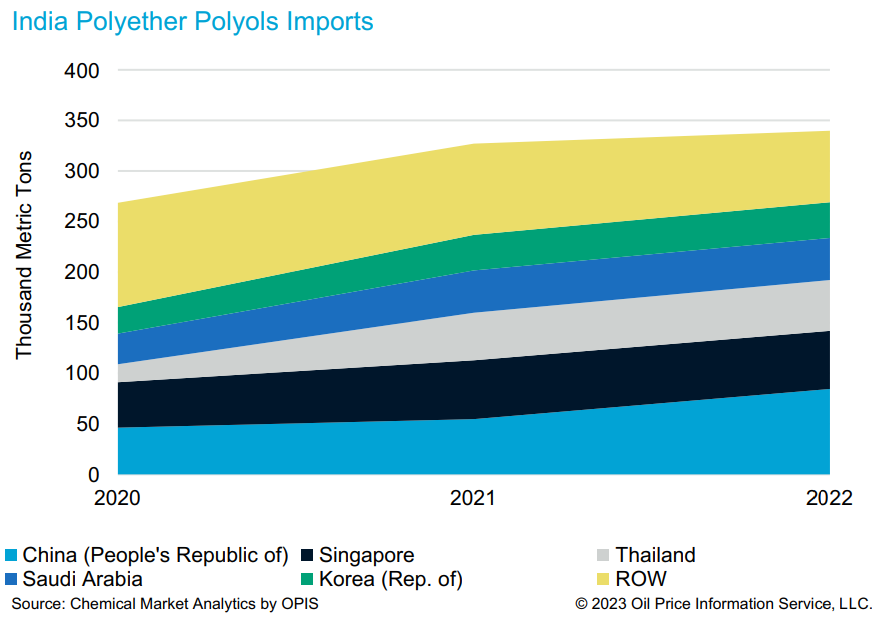

Close to 60% of the global polyether polyols capacity resides in Northeast Asia and Southeast Asia as of 2023, while the Indian Subcontinent’s share is just at 1% with all based in India. Following Turkey, India registered the second-highest import volumes in 2022, with nearly 80% of its imports coming from the top 5 exporting countries: mainland China, Singapore, Thailand, Saudi Arabia, and South Korea. Facing intense competition from these exporting countries, India’s domestic producers have submitted requests for anti-dumping investigation to the Ministry of Trade and Commerce.

On 29 March 2023, the Ministry of Commerce & Industry of India released a document stating that it has initiated an anti-dumping investigation concerning imports of flexible polyols originating in or exported from mainland China and Thailand. While this is the second time Thailand has come under anti-dumping investigation, this is a first for mainland China which overtook Singapore in 2022 to become the top flexible polyols exporter to India. In 2021, total imports of flexible polyols to India were 327,000 metric tons, with Singapore as the top source of imports at 58,200 metric tons followed by mainland China with 54,600 metric tons. In 2022, total imports increased nearly 4% year-on-year. Imports from mainland China increased to 25% of total volumes at 84,400 metric tons while imports from Singapore saw a slight drop to 57,500 metric tons.

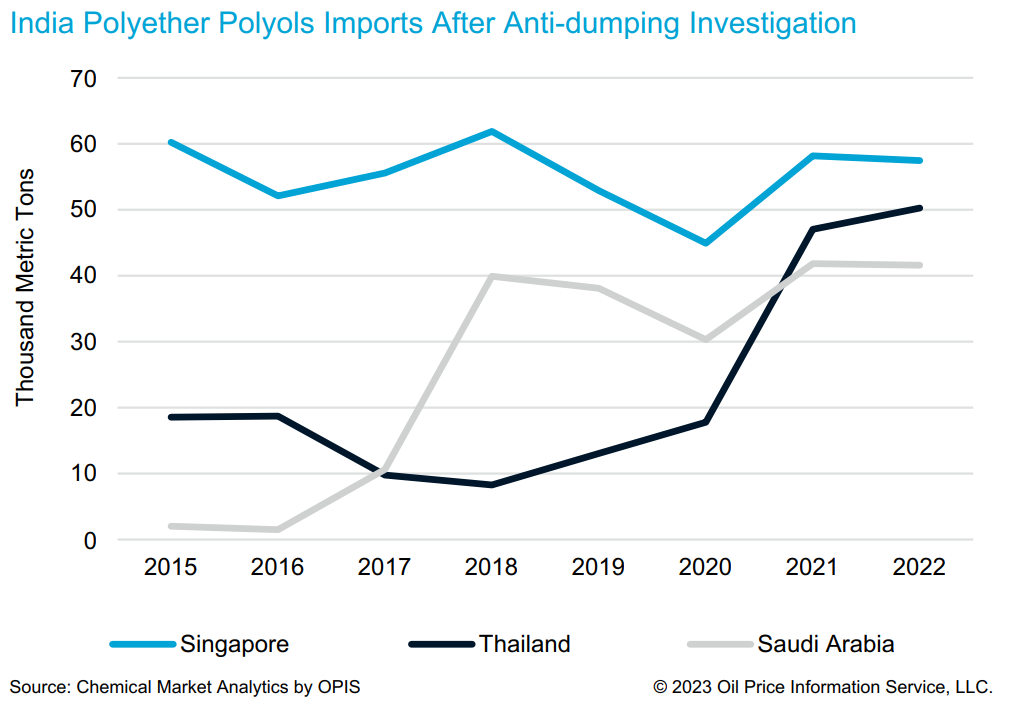

There have been three anti-dumping investigations initiated by India in the past ten years, concerning flexible polyols imports. In 2015, the investigation resulted in anti-dumping duties of $45.73-153.89 per mt imposed on exports from Singapore. Another investigation in 2017 resulted in anti-dumping duties of $135.40 per mt imposed on exports from Thailand. A sunset review investigation was initiated in 2021 upon Manali Petrochemicals’ request but they subsequently withdrew the request. The sunset review recommended that anti-dumping duties for Thailand be discontinued. In 2019, an investigation was initiated against material exported from Saudi Arabia and the United Arab Emirates and concluded with $101.81-235.02 per mt of duties levied.

Despite the imposition of anti-dumping duties, an examination of trade data suggests that the impact on export volumes from countries that have been met with new duties has been limited. The decline in exports mainly occurred during the year or the year after the investigation was initiated, with trade volumes showing recovery in the subsequent years. In some instances, import volumes in the following years exceeded the levels seen before the duties were implemented. This is likely due to cost advantages among major producers from the top exporting countries, allowing them to offer polyether polyols prices at more competitive prices compared to domestic producers. Also, some volumes may be imported to produce products that are re-exported, and no ADD is chargeable on these imports.

In the case of Singapore, export volumes to India decreased from 60,200 metric tons in 2015 to 52,100 metric tons in 2016 the following year but rebounded to 61,900 metric tons by 2018. For Thailand, the export volumes fell from 18,700 metric tons in 2016 to 9,800 metric tons in 2017 when the investigation was initiated and fell further to 8,300 metric tons in 2018. Import volumes steadily increased thereafter before surging from 17.8 thousand metric tons in 2020 to 47,000 metric tons in 2021 due to the start-up of GC Polyols, which added an additional 130,000 metric tons annual capacity. For Saudi Arabia, the trade volumes were 38,100 metric tons in 2019 when the investigation was initiated. The volume from Saudi Arabia decreased to 30,300 metric tons in 2020 but has subsequently picked up to reach around 42,000 metric tons in 2021 and 2022.

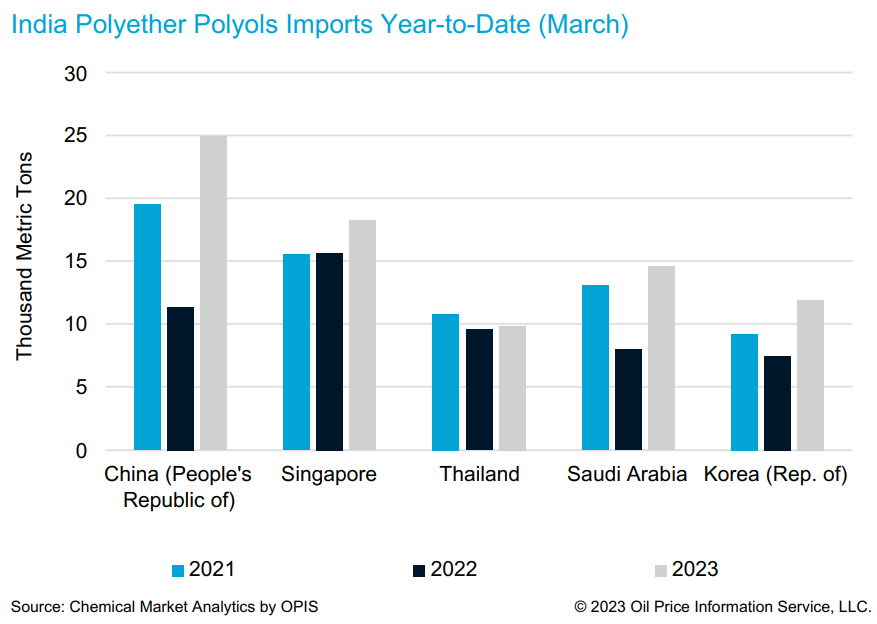

However, the reduction in import volumes from mainland China and Thailand is likely to be temporary and will recover in the long term as India will need to rely on imports to fulfill demand for flexible polyols. Demand for polyether polyols is projected to increase at an annual average growth rate of 3.9% in the next 5 years which would require additional imports given the current domestic production capacity. In the first three months of 2023, imports of flexible polyols into India have seen a 36% increase year-to-date, with imports from mainland China seeing a 120% year-to-date increase from 11.3 thousand metric tons in 2022 to 24.9 thousand metric tons this year. Other top 5 exporting countries to India: Singapore, Saudi Arabia, South Korea, and Thailand have all registered increases as well.

Apart from imports, increasing domestic production capacity could be an alternative as the reliance on imports stems from insufficient domestic production to meet the demand for polyether polyols. There are currently three polyether polyols plants in India with a total combined capacity of 190,000 metric tons. Manali Petrochemicals is the largest producer at 150,000 metric tons, having undergone capacity expansion in 2010, 2015, and 2019.

However, any investment decision will have to consider the supply of a key feedstock of polyether polyols – propylene oxide (PO) as transportation is difficult and expensive over long distances. Although Manali Petrochemicals currently has an in-house PO supply, the PO capacity of 49,000 metric tons is not enough to cover the requirement for its polyether polyols plant. While Bharat Petroleum was slated to have a new PO plant of 300,000 metric tons capacity starting up in 2024, that project has been put on hold. Furthermore, the rapid pace of PO capacity addition underway in mainland China could pose additional challenges to PO capacity addition plans in India.

In conclusion, overall import volumes of flexible polyols to India have been on the rise due to growing demand. Although anti-dumping duties first caused a decline in imports, they have recovered. To reduce imports, adequate domestic production capacity is necessary to meet the demand, suggesting that additional capacity is needed. However, any investment in a new polyether polyols plant should address the challenge of securing additional PO to produce more polyether polyols.

——————-

We are excited to share that the World Analysis Polyether Polyols is launched. Click to learn more.

Learn how we can help you prepare and navigate Polyether Polyols market today.