Global Chemical Market Dynamics: Is the Future Better or Worse?

Supply continues to increase and the structure changed

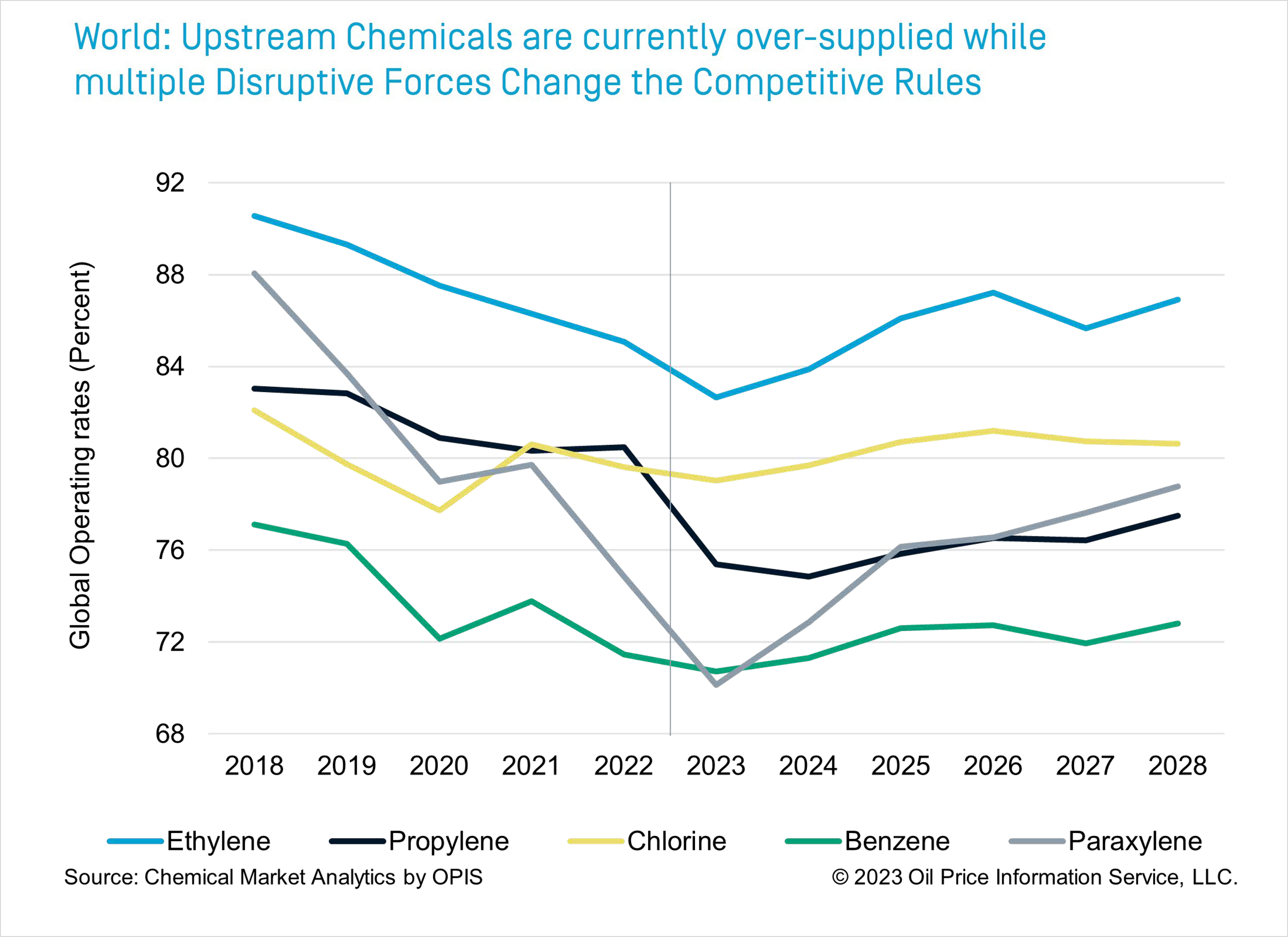

Major Chemical markets are in a downcycle with an oversupply trough in 2023-2025 while facing a new world reality of disruptive forces. Different Regional Dynamics (North America, Europe, the Middle East, and China) are explored while a New World order emerges with sustainability initiatives and new competitive dimensions. Shifting energy markets, government policies, and consumer attitudes will have a profound effect on market behavior outcomes.

While current market conditions remain challenged with depressed global operating rates and declining margins, market participants are actively engaged in the development of plans and initiatives to address the new world order in progress. North American participants look at continued investment expansion with near-term advantaged cost feedstocks but are faced with the uncertainty of incremental demand growth that exists outside the region. Somewhat similarly Middle East participants look for oil demand growth through chemical products while refined product demand is expected to significantly decline with the electrification of light-duty vehicles followed by heavy-duty vehicles. European participants seek a competitive niche while under pressure from volatile energy prices. While Asia chemical producers reside in the center of demand growth, feedstock supplies are typically at the marginal cost level (highest cost) and for some the pace of energy transition may be the fastest with higher electrification of automotive fleets.

Energy markets are highly uncertain with the tension of energy security versus energy transition. Different countries are expected to approach the energy transition at different paces with the availability of affordable energy. What is certain is that energy transition has profound effects on refining and petrochemicals as refining product portfolios shift heavily to petchem feedstocks but with dramatically higher pricing for chemical feedstocks (eg. Naphtha crack spreads over the crude rise from parity to $10-20 per barrel more aligned with historical gasoline crack spreads) as needed to support refining operating and capex margins. During the extended period of transition, transient supply-demand imbalances are likely to occur.

Government policies will continue to highly influence global chemicals. With the major building block chemicals functioning as highly efficient commodities, these chemicals have traditionally enabled a “Build to Export” model where production occurred where available low-cost feedstocks existed and were exported to demand centers. The geopolitical fractures and deglobalization efforts that are occurring threaten to significantly alter the competitive landscape through tariff and non-tariff trade restrictions such as strategic self-sufficiency initiatives, carbon border adjustments, and other trade barriers.

Plastics recycling continues to be a major challenge/ opportunity for the chemical industry. Plastics consumption is currently nearly 400 million metric tons per year and growing at a multiple of GDP growth rate. The current global recycling rate is 7 percent in the momentum case and is expected to improve to only 15 percent by 2050. Much work remains to address this critical issue. On the current base case trendline, the total volume of plastic waste generated will continue to rise, and “the waste problem will get worse before it gets better.” With that said plastics remain a miraculous material with compelling material benefits and a relatively very low carbon footprint.

Sustainable chemistry is in its nascent stage with opportunities for methanol as a fuel as well as a broader clean building block for downstream chemicals. Ammonia also is an efficient and easy-to-store hydrogen source to support sustainable initiatives.

Technology development across the industry continues to advance from new processes for olefins production to deeper integration of refining and petrochemicals to green feedstocks through chemical derivatives.

The new competitive world has arrived. Winners and losers are not yet apparent, but the new rules of competition are becoming more visible daily.

Author

Dewey Johnson

Global Business Lead

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving in profound ways and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on the specific trends shaping the market.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!

Learn How We Can Help You Prepare and Navigate Market Disruptions