Are Global Chlor-Alkali Markets Nearing an Inflection Point?

The chlor-alkali industry manufactures products with many critical uses for the world’s continued population growth, with caustic and chlorine demand forecasted to up-cycle as the chlor-alkali market reacts to global economic conditions.Chlorine and caustic soda (“caustic”), produced through the electrolysis of brine, are critical molecules that support the world’s growing population, enhance health and safety, and provide everyday-life conveniences. Chlorine is a naturally occurring, abundant element that is highly reactive and widely used in commercial chemical applications to manufacture thousands of products, including safe drinking water, electronics, automotive and construction materials, and more. Caustic is a coproduct of chlorine and is also used across many industries, including metals refining, petrochemicals, pulp and paper, textiles, soaps, and detergents.

The chlor-alkali industry economic cycle is driven by chlorine and caustic supply and demand dynamics. Supply is set by an inalterable chlorine and caustic production ratio of 1 metric ton of chlorine to 1.1 dry metric tons of caustic. The 2.1 metric tons of combined co-products are called one electrochemical unit (ECU). Economic activity, population growth, energy costs, and the price of ethylene influence ECU value.

Economic growth affects chlorine and caustic demand. Still, their relative demands must be more aligned due to different end uses, especially when external factors such as extreme weather events or interest rates inhibit or catalyze construction activity. Chlorine demand closely correlates with construction activity; the caustic market correlates with general manufacturing activity and durable and nondurable goods consumption. Interest rates affect construction activity; thus, fiscal policy influences chlorine demand.

Chlorine and caustic supply/demand imbalance during economic cycles create an ECU value cycle. Historically, consumers hesitate to make “big ticket” purchases like houses during recessions, so construction activity slows and chlorine demand and value decline. At this point, chlorine is the “weak side” of the ECU. If producers control production to the “weak” chlorine side, then as chlorine supply declines, caustic supply decreases, tightening the caustic balance and leading to higher caustic values. But chlorine demand typically increases before caustic demand as the economic recovery begins. Central banks loosen monetary policy to stimulate recovery; hence, construction activity and chlorine demand increase. As chlorine demand increases, if the ECU supply balance is controlled by chlorine demand rather than by the “weak” caustic side of the ECU, the resulting loose caustic supply/demand balance weighs down caustic prices. Conversely, if producers restrain operating rates to prevent excess caustic supply, chlorine supply is limited, lifting chlorine prices.

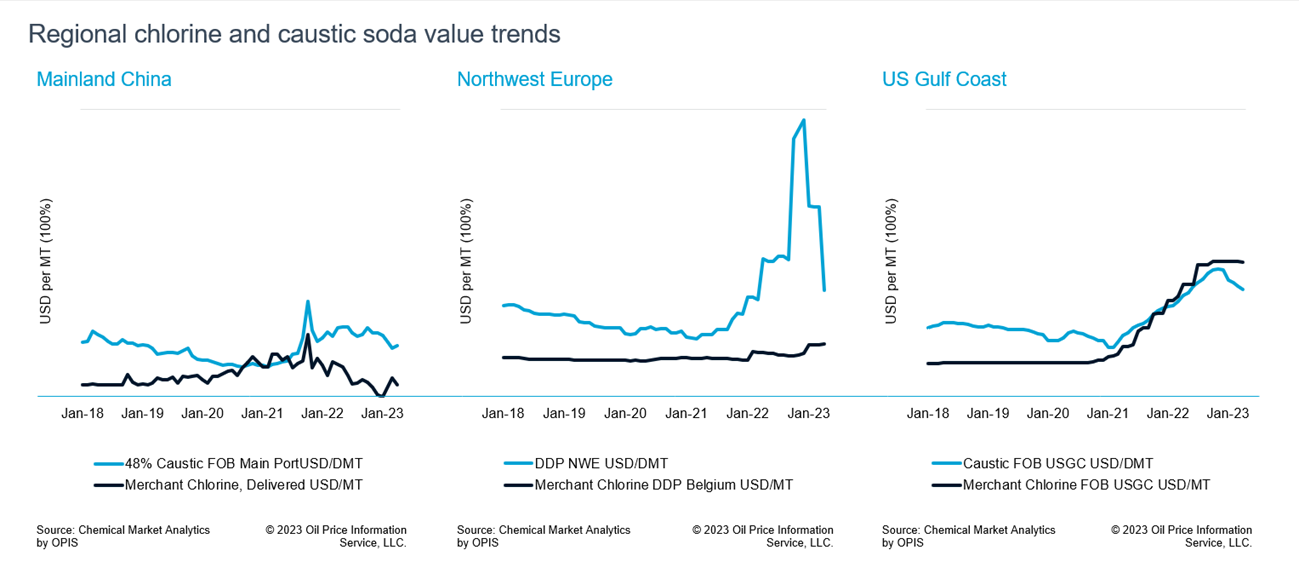

Chlor-alkali market dynamics during the post-pandemic economic surge and the recent inflation-induced economic slowdown contradicted the historical chlorine-caustic lead-lag relationship described above: caustic and chlorine values rose simultaneously. Why did that happen? Two key factors contributed to the simultaneous upward movement of chlorine and caustic values: the European energy crisis during the post-pandemic economic recovery and the contrast in the fungibility of chlorine and caustic.

Elemental chlorine is generally consumed near where it is produced. It is not traded intercontinentally and follows regional market dynamics. In contrast, caustic is traded intercontinentally in bulk chemical tankers, so caustic market dynamics in one region readily transfer to the other regions—accordingly, the effect of the European energy crisis on the European caustic market translated globally.

European energy prices skyrocketed in 2022 to a level where chlor-alkali costs exceeded ECU values. However, European chlorine contracts typically include lengthy fixed price periods, so producers had to adjust caustic prices to offset increased costs. Higher European caustic prices lifted caustic prices in other regions as traders recognized arbitrage opportunities. A simultaneous chemical tanker shortage resulting from increased demand in economic recovery and distortion of natural trade routes due to sanctions against Russia exacerbated global caustic dynamics. Caustic prices rose globally, and inter-regional price differences widened on elevated freight costs.

Today’s chlor-alkali markets differ considerably from the start of 2023. Central banks raised interest rates to cool rampant inflation. Higher interest rates stifled construction activity, chlorine demand decreased, and chlor-alkali operating rates declined. But caustic values have also declined. Why are chlor-alkali markets again bucking historical lead-lag norms?

Multiple factors set Europe again at the center of atypical market activity. Economic slowdown reduced demand for most goods. Global freight rates have declined, tempering interregional caustic price differentials. Additionally, record-high 2022 European caustic prices in Europe caused significant caustic and chlorine demand destruction. Finally, and perhaps most importantly, energy prices have fallen, allowing European producers to compete for domestic market share and participate in the spot export market while maintaining margins.

Europe is not the exclusive region that is challenging chlor-alkali markets today. The economic recovery in mainland China after reopening has failed to generate material chlor-alkali market demand recovery in the world’s largest chlorine and caustic markets. As chlorine and caustic demands fall concurrently, margins are compressed in higher production cost regions. Some high-cost producers’ margins are negative in mainland China. Producers have begun curtailing production except in the United States, the low-cost producing region.

US construction activity has slowed; US manufacturing activity driving caustic demand has been more resilient. But caustic demand is softening in the US, and international arbitrage erodes domestic US caustic values. Nevertheless, US ECU margins remain healthy compared to European and Asian margins, partly because scarce chlorine supply has elevated merchant chlorine prices to record levels. However, the global economic slowdown is beginning to affect even the US merchant chlorine market as it swings from “tight” to “balanced to soft.”

Global chlor-alkali markets are nearing an inflection point. Europe and Asia are likely at or near the bottom of the cycle, and the US is weakening. We expect that a unique situation will occur when the chlor-alkali market turns. Unlike many other base chemicals, we expect chlor-alkali to enter an up-cycle. After near-term demand grows into current and planned capacity, we forecast demand to grow faster than supply, creating an up-cycle.

As basic building blocks in society, the demand for chlor-alkali products in the traditional sector will continue to grow throughout the cycle. But how will electrification and decarbonization trends impact the chlor-alkali industry in the upcoming decade as the world enters the “electric chapter”?

Join us at the World Chemical Forum next week on September 12-14, 2023, in Houston, TX, for a comprehensive chlor-alkali market outlook.

Authors

Nick Kovics

Vice President, Chlor-Alkali

Learn how we can help you prepare and navigate market disruptions today.

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving in profound ways and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on the specific trends shaping the market.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!