Asia Merchant Ethylene Market Overview – Northeast Asia Excluding Mainland China

Lucrative profits during 2014 and 2019 spurred massive new ethylene capacity investment in Asia, with overall ethylene capacity in Asia rising from 68 million metric tons (mt) at the end of 2019 to 91 million mt by the end of 2022. The ethylene capacity buildup cycle is expected to continue in Asia until 2023, and the increasing capacities of each country will impact the merchant ethylene market in Asia accordingly.

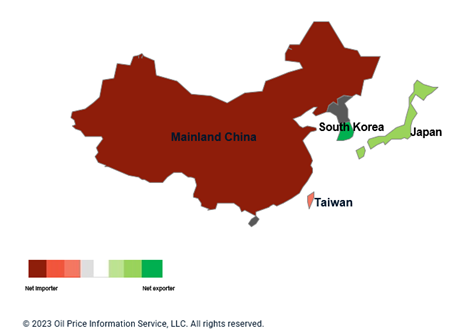

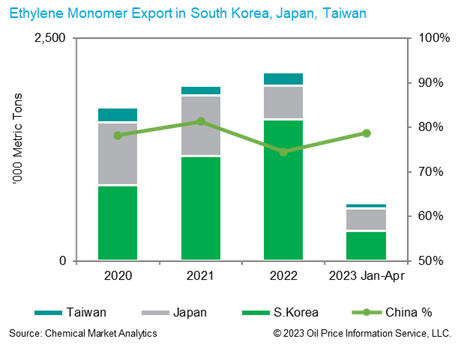

In Northeast Asia, mainland China remains the main ethylene-importing country. In 2022, mainland China imported approximately 2.1 million mt of ethylene monomer—similar to its import volume in 2021, despite the increased nameplate capacity in the region. South Korea is the largest exporter of ethylene in Northeast Asia, exporting approximately 1.2 million mt in 2022, followed by Japan with 0.38 million mt of ethylene exported last year. The ethylene trade volume within Northeast Asia was growing until 2022 with the steady import demand in mainland China. However, the rapid growth of domestic capacity in mainland China is likely to limit further growth of the ethylene trade volume in Asia from 2023 onward.

Ethylene merchant market in Northeast Asia excluding mainland China

In Northeast Asia excluding mainland China, regional crackers that are in a net selling position usually clear their excess capacity either through contracts with nearby downstream units connected via pipelines or by concluding term contracts with regional traders for exports. Term conditions for pipeline deliveries differ across different countries and include the spot CFR Northeast Asia price with adders, a formula linked to the CIF Japan naphtha price, or a mix of these plus some other factors. In the case of exports, most term contracts use the spot ethylene CFR Northeast Asia price index with minus adders to set the FOB price selling to regional traders. The regional traders then conclude term contracts with net buyers in the region for their offtake cargoes with the price linked with the regional CFR spot price with adders. Most ethylene transactions, including pipeline deals and intra-regional trades, are done in the form of term contracts—especially in 2022 and 2023 when the available FOB spot offer level has remained higher than the CFR spot price level that buyers can afford.

Ethylene merchant market in Northeast Asia excluding mainland China

In Northeast Asia excluding mainland China, regional crackers that are in a net selling position usually clear their excess capacity either through contracts with nearby downstream units connected via pipelines or by concluding term contracts with regional traders for exports. Term conditions for pipeline deliveries differ across different countries and include the spot CFR Northeast Asia price with adders, a formula linked to the CIF Japan naphtha price, or a mix of these plus some other factors. In the case of exports, most term contracts use the spot ethylene CFR Northeast Asia price index with minus adders to set the FOB price selling to regional traders. The regional traders then conclude term contracts with net buyers in the region for their offtake cargoes with the price linked with the regional CFR spot price with adders. Most ethylene transactions, including pipeline deals and intra-regional trades, are done in the form of term contracts—especially in 2022 and 2023 when the available FOB spot offer level has remained higher than the CFR spot price level that buyers can afford.

South Korea was the largest ethylene exporting country as of 2022, with several new cracker additions during 2019-2021. With increasing spare capacity and consistent demand in mainland China, South Korea’s ethylene exports were historically destined mostly for mainland China, with more than 84% of exports shipped to mainland China since 2013. Most of the trades from South Korea to mainland China have been through regional traders, but some crackers use their vessels for shipping ethylene to their downstream units in mainland China. Japan’s ethylene exports did not see robust growth during the past five years amid limited capacity expansions, although most of Japan’s ethylene exports went to mainland China. There has been consistent trade flow from Taiwan to mainland China, even though Taiwan is a net importer of ethylene monomer. These Northeast Asian countries increased their exports to mainland China until 2022, but their exports to mainland China in the first quarter of this year declined due to the weakening demand from mainland Chinese net ethylene buyers, a growing appetite for domestic ethylene sources, and ample supply availability from the ethane-based crackers in the United States and the Middle East.

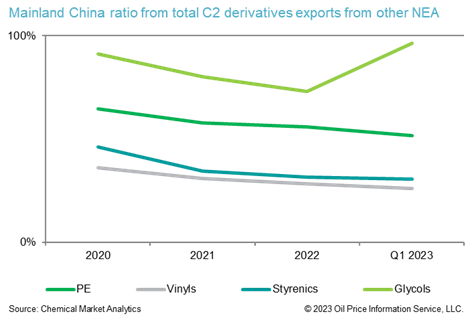

In addition to ethylene monomer, the crackers in other Northeast Asian markets have struggled to find alternative destinations for their downstream products as import demand in mainland China has softened. The chart here shows the percentage of total derivative exports from markets in Northeast Asia outside mainland China that have headed to mainland China; these percentages have declined since 2021 as new downstream capacities have started up with upstream olefins production sites in mainland China.

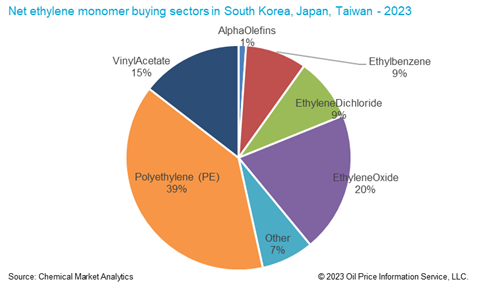

As most of the downstream capacities come with upstream crackers in Northeast Asia outside mainland China, the merchant ethylene demand in these markets has remained rather stable and is expected to remain stable in the next few years. Meanwhile, the ample spot cargo availability and low monomer prices could attract net buyers that can import to source more ethylene from the spot market during the second half of this year.

Conclusion

Mainland China’s ethylene net equivalent self-sufficiency has been increasing and will reach up to 80% this year. After a short pause of capacity addition between 2024 and 2025, another wave of new crackers will start from 2026 onward, which we referred to in a FOCUS piece earlier this year: A Second Wave of Mainland Chinese Crackers is Looming. Mainland China is likely to continue to import ethylene monomers considering its massive downstream demand and potential low-price offers from the ethylene producers in other regions. Meanwhile, the increasing nameplate capacities in mainland China will weigh on the import demand from buyers in mainland China, and the regional trading volume is expected to decline until the end of the decade.

Authors

William Chen

Executive Director

Mike Park

Director

Zengwei Yin

Principal Research Analyst

Learn how we can help you prepare and navigate market disruptions today.

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving in profound ways and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on the specific trends shaping the market.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!