A Landmark Moment in Singapore: What it Means for the Future of Marine Fuels

History was made earlier this year at Vopak’s Banyan Terminal in Singapore when the Fortescue Green Pioneer became the world’s first vessel to be fueled by ammonia. For an industry often regarded as conservative and slow to change, this moment sent a powerful signal: the transition to alternative marine fuels is no longer theoretical.

Methanol: The First Wave

The maritime industry is on the cusp of a major shift as it seeks to decarbonize its operations.

Although liquefied natural gas (LNG) initially led the alternative fuel space thanks to its infrastructure, methanol and ammonia have gained significant traction in the past two years.

Methanol has a clear lead with over 100 methanol-powered ships already in service, supported by commercial engines from MAN, Wärtsilä, and Rolls-Royce.

In addition, hundreds of methanol-ready vessels are on order for delivery by 2030, making methanol the most deployable low-carbon option today.

Its advantages are straightforward: mature technology; ease of integration; and a rapidly scaling supply chain. For shipowners needing a solution that works now, methanol offers a practical bridge toward lower emissions.

Ammonia: The Next Game Changer

Ammonia is still in its early stages but is quickly gaining momentum. Its main advantage is that it contains no carbon, eliminating carbon dioxide emissions during combustion. Several shipping companies are already committing to ammonia-ready fleets, positioning the fuel as a credible long-term option for deep decarbonization.

The potential supply base is strong. Large-scale projects in Australia, such as the Australian Renewable Energy Hub and the Western Green Energy Hub, are designed to deliver green ammonia at scale.

However, ammonia also comes with hurdles. It is toxic to handle, requires new engine designs that rely on pilot fuels like diesel, and raises concerns about nitrogen oxide emissions and ammonia slip. Beyond technology, safe bunkering operations, crew training, and community acceptance will all be critical for adoption.

Pioneering Ammonia Bunkering Hubs

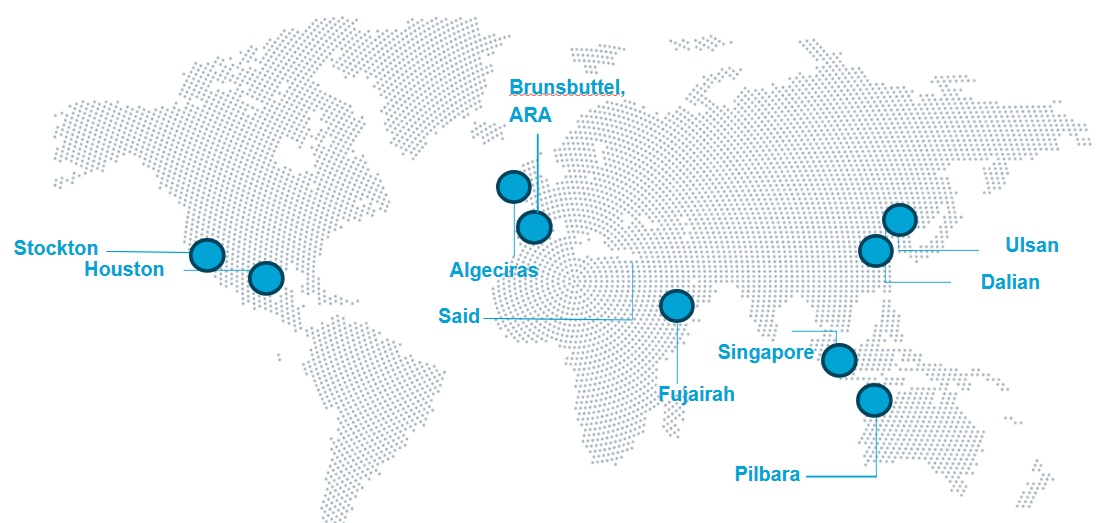

Ammonia infrastructure is beginning to take shape across key regions:

- Singapore hosted the world’s first ammonia refueling and is progressing with plans for dedicated bunkering facilities.

- Australia’s Pilbara region has demonstrated ship-to-ship ammonia transfers, showing operational feasibility.

- Mainland China’s Dalian port recently refueled an ammonia-powered tugboat, highlighting its capability.

- South Korea is laying groundwork through partnerships to secure future ammonia imports for bunkering.

Together, these initiatives signal that ammonia is moving beyond pilot projects into early commercial readiness.

Legislation Driving the Transition

Policy pressure is a central catalyst. The International Maritime Organization (IMO) has committed to net-zero shipping emissions by 2050 and is finalizing a global fuel standard to take effect later this decade.

Meanwhile, the European Union’s European Green Deal, Emissions Trading System (ETS), and FuelEU Maritime regulations are creating financial incentives for the adoption of lower-carbon fuels. The convergence of international and regional frameworks is accelerating investment in alternatives like methanol and ammonia.

The Road Ahead

The pathway for marine fuels will not converge on a single solution. Instead, a multi-fuel landscape will define the coming decades:

- 2025–30: Methanol adoption will grow rapidly, supported by available technology and expanding infrastructure.

- 2030–35: Ammonia will begin to scale up as vessel orders materialize and bunkering hubs come online, especially for larger, long-haul vessels.

- Beyond 2040: A diverse mix of fuels—methanol, ammonia, LNG, and others—will become standard, reflecting trade routes, vessel types, and regional supply chains.

This progression reflects the alignment of technology readiness, infrastructure build-out, and regulatory pressure, shaping when and how each fuel is adopted.

Conclusion

The fueling of the Fortescue Green Pioneer in Singapore is more than a milestone—it is a glimpse into the shipping industry’s decarbonized future. Methanol is the bridge that can already be crossed, while ammonia is the next frontier that promises even greater emissions cuts.

Together, these fuels mark a shift toward a multi-fuel future, in which shipping’s decarbonization will be shaped by technological readiness, regulation, and regional supply chains.

Explore More with OPIS and Chemical Market Analytics

We track timely changes in marine fuels—from the expanding methanol fleet, to the rise of ammonia-ready vessels, to evolving policy frameworks. Our services include:

- OPIS Global Marine Fuels Report: Daily bunker-fuel price assessments.

- Market Advisory Service – Methanol: Short-term pricing analysis; supply/demand; and trade.

- World Analysis – Methanol: Long-term forecasts and market outlook for grey and low-carbon methanol.

- Global Ammonia Analysis: Strategic insights into grey and green ammonia; supply/demand; and pricing.