World Soda Ash Outlook

Events in 2020 set the stage for where the Soda Ash industry is today

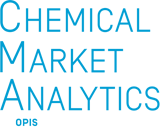

The COVID-19 pandemic has been a defining event that has had massive repercussions both on our personal lives and from a commercial perspective. But just as many countries around the world were tentatively emerging from COVID-19 restrictions, a war broke out after Russia invaded Ukraine. After February 24th, a lot has changed in the World in the midst of escalating sanctions against the Russian state. The impact of yet another major event on the soda ash industry and many other industries has been significant. Events in 2020 set the stage for where the soda ash industry is today. Soda ash is used as a raw material in the production of a number of basic goods such as architectural and automotive glass, glass packaging, sodium silicates and soaps and detergents, as well as a number of other smaller applications. As such, the temporary closure of large sections of many economies, in a bid to tame the spread of COVID-19 across the world, had a significant negative impact on demand. Despite some end use sectors faring better than others, overall demand for soda ash fell by about 5.5%, year-on-year, or a loss of 3.4 million mt. This was though followed by a strong recovery in 2021 with growth of about 8.2%, or 4.9 million mt. As such, demand in 2021 exceeded pre-COVID levels. Our expectation for 2022 was that growth would continue but we were aware that soda ash capacity was in decline with the total world capacity this year about 1.0 million mt less than the total in 2020. As such, we were anticipating tight market conditions this year. This has proved to be the case, but in fact, conditions are even tighter than anticipated following Russia’s invasion of Ukraine.

Events in 2020 set the stage for where the soda ash industry is today. Soda ash is used as a raw material in the production of a number of basic goods such as architectural and automotive glass, glass packaging, sodium silicates and soaps and detergents, as well as a number of other smaller applications. As such, the temporary closure of large sections of many economies, in a bid to tame the spread of COVID-19 across the world, had a significant negative impact on demand. Despite some end use sectors faring better than others, overall demand for soda ash fell by about 5.5%, year-on-year, or a loss of 3.4 million mt. This was though followed by a strong recovery in 2021 with growth of about 8.2%, or 4.9 million mt. As such, demand in 2021 exceeded pre-COVID levels. Our expectation for 2022 was that growth would continue but we were aware that soda ash capacity was in decline with the total world capacity this year about 1.0 million mt less than the total in 2020. As such, we were anticipating tight market conditions this year. This has proved to be the case, but in fact, conditions are even tighter than anticipated following Russia’s invasion of Ukraine.

Contextually, Russia is not a significant player in the world soda ash market, even less so Ukraine. Russia accounted for 4.3% of world soda ash demand in 2021 and Ukraine just 0.4%. The Russia/CIS region is traditionally quite self-contained and while Russia is a fairly significant exporter of soda ash, with volumes in the past three years averaging 720,000 mt, exports are primarily to countries within the CIS region. In 2021, 84% of Russian soda ash exports were delivered within the CIS, and 68% in 2020. However, in today’s market, when soda ash is extremely tight, diminishing exports from Russia places additional pressure on markets like the Indian Subcontinent and Africa, which traditionally purchase regular small spot volumes from Russia. None-the-less, while there has been some impact from the conflict on soda ash trade the main influence of the war in Ukraine is on energy prices and at times energy availability.

Trade

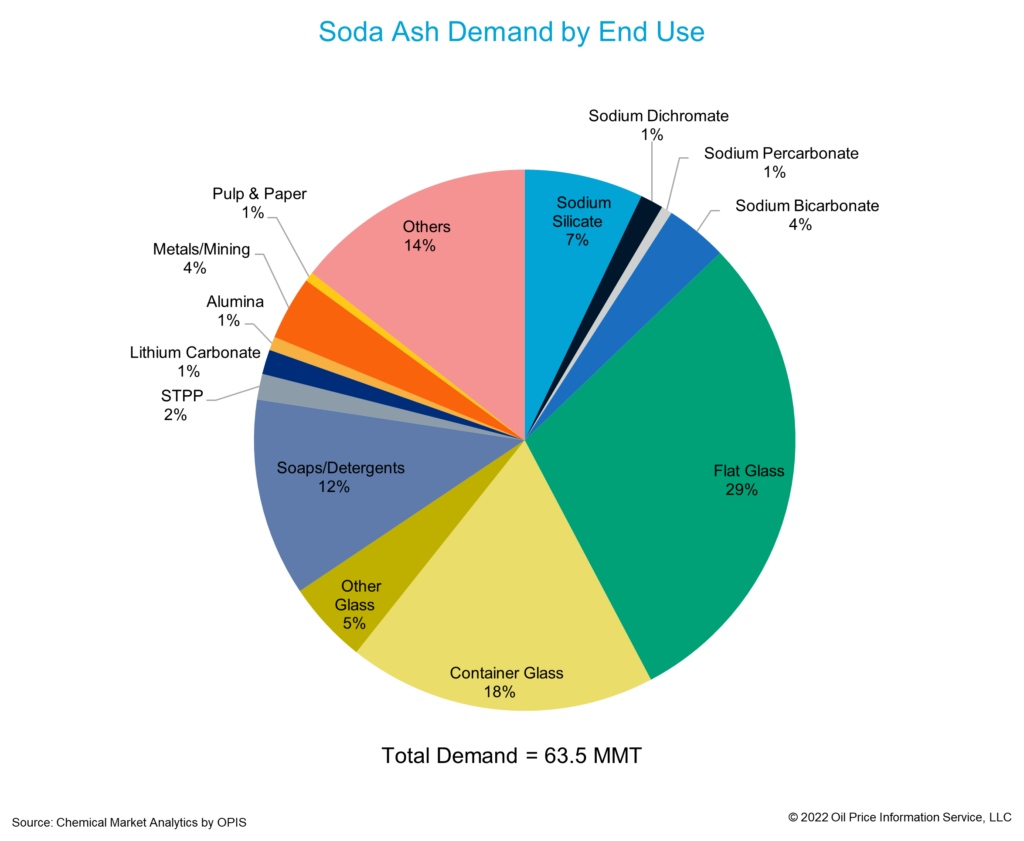

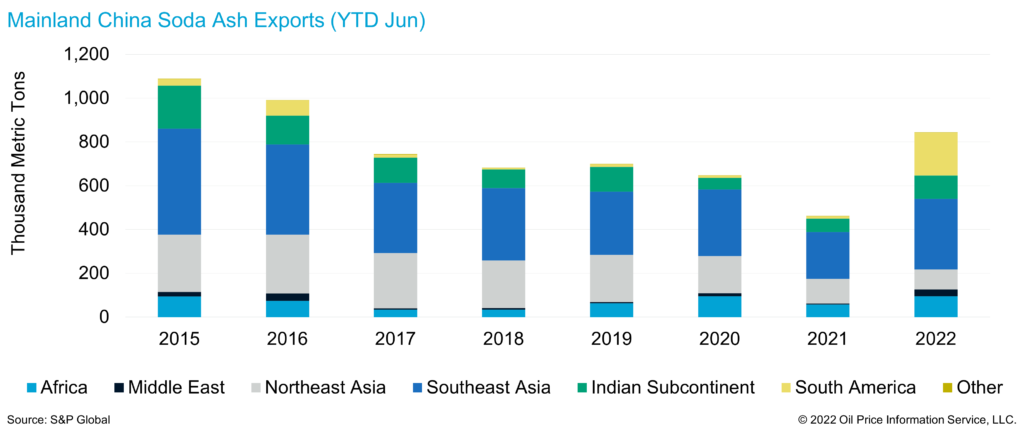

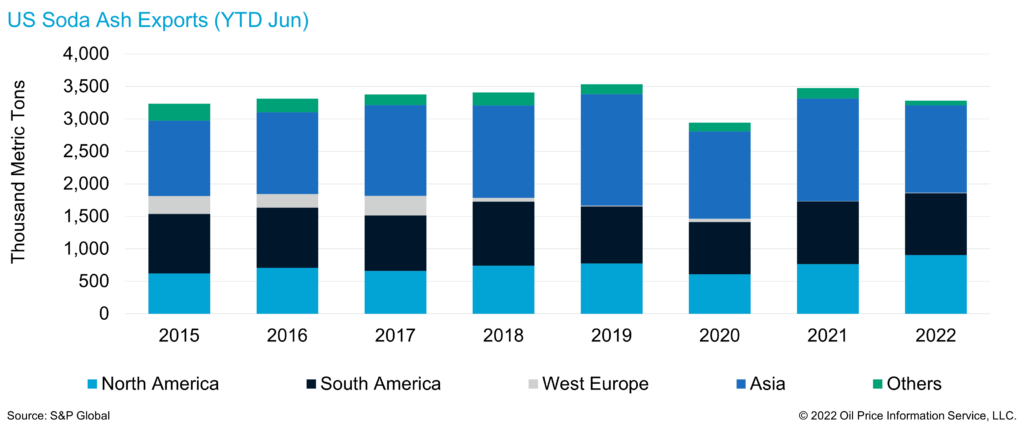

Trade is very important for the soda ash industry given that about a quarter of soda ash produced is shipped to another part of the world to be consumed. The US is by far the world’s biggest exporter accounting for about 40% of world trade, followed by Turkey in 2nd place with about 27%. China and Bulgaria vie for 3rd place due to the fact that Chinese export volumes can swing significantly from year to year. Chinese exports can switch form over two million in a year to under one million mt, as was the case last year. The Black Sea, is an important trade route for soda ash. Exports from Bulgaria via the Black Sea are at risk due to the Russia/Ukraine conflict, as well as imports from Turkey to Central Europe via the same route.

The trade patterns so far this year also help explain the global market tightness. To date exports from key sources are up by just 5% or 243,000 mt which is mainly due to increased availability from China. Exports from the US, to date are down by 3% or 66,000 mt, year-on-year, and exports from Turkey are flat, year-on-year. Another interesting observation in terms of trade is that for China the biggest increase in exports has been to South America, which is not a traditional destination for Chinese product. China’s exports to the region to date have totalled 123,000 mt, while in January-May last year the total to South America was just 7,000 mt. A lack of spot availability in South America has encouraged this shift in trade from China.

To get further insight into the outlook for soda ash please join us at our forthcoming conference. Chemical Market Analytics by OPIS, a Dow Jones Company (formerly IHS Markit), is hosting its annual World Soda Ash Conference on the 11th to the 13th of October. This year’s conference will be held in person in Sorrento, Italy, and will include speeches from some of the industry’s leading companies, as well as experts from Chemical Market Analytics.

To get further insight into the outlook for soda ash please join us at our forthcoming conference. Chemical Market Analytics by OPIS, a Dow Jones Company (formerly IHS Markit), is hosting its annual World Soda Ash Conference on the 11th to the 13th of October. This year’s conference will be held in person in Sorrento, Italy, and will include speeches from some of the industry’s leading companies, as well as experts from Chemical Market Analytics.

Marguerite Morrin

Executive Director, Global Soda Ash Services

Chemical Market Analytics by OPIS, a Dow Jones Company