Will Methanol have a More Mainstream Position than Previously Forecasted?

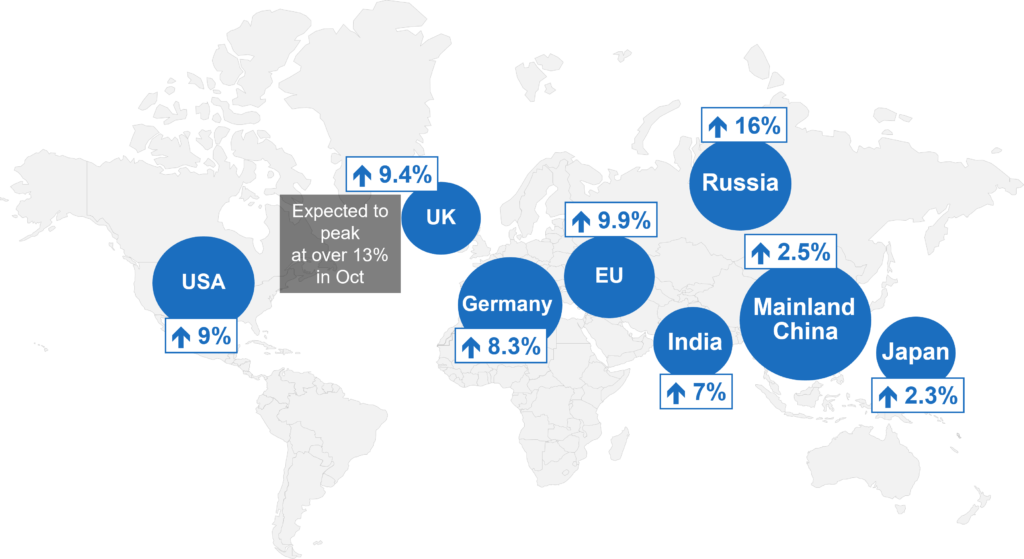

In our previous blogs, we touched on the beginnings of cost pressures squeezing consumers and the reduction of consumer spending. But we also need to view the various consumer price index (CPI) from crucial countries and regions. Not surprisingly, the increase is highest in Russia, but we are seeing high CPI increases in the UK, the EU, the US, and India.

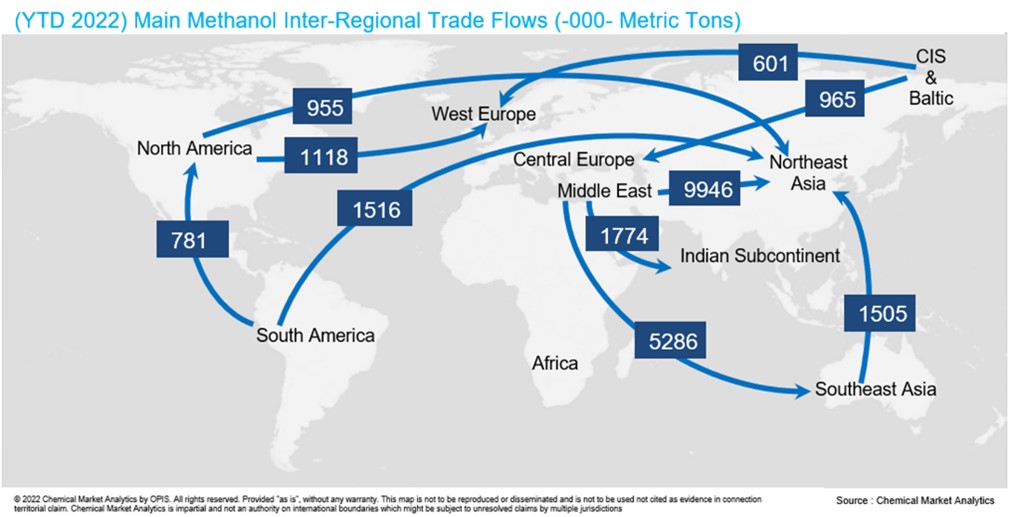

The key questions are: Will this significantly impact consumer demand, and how long will this downturn last? As we look at the main methanol trade flows, methanol is an internationally traded commodity, with more than a third of global volumes sold in a different region from where it is produced.

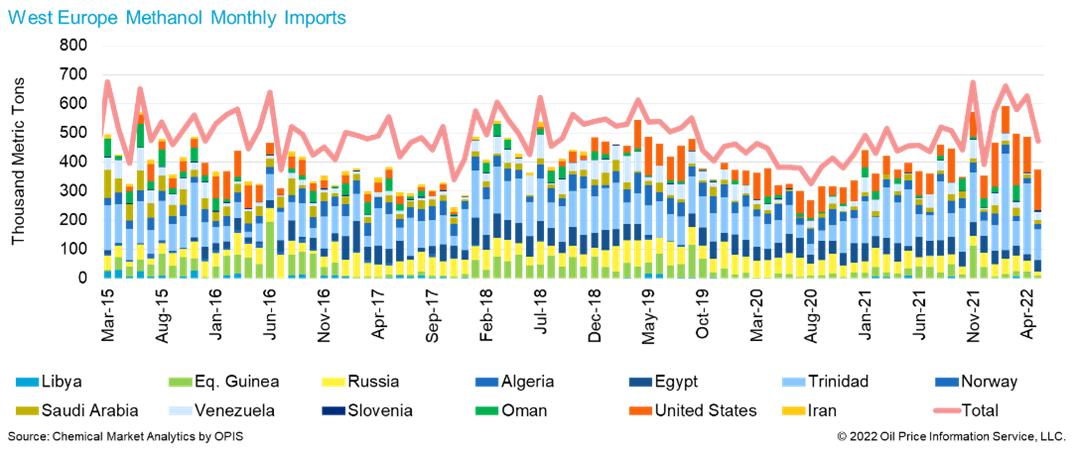

What are the key points to note here? US imports are down, and exports are up, reflecting the addition of the world-scale Koch methanol plant to US methanol capacity. Mainland China imports have risen on the back of higher demand. West Europe imports have risen, reflecting that some regional capacity has been idle since last year. Iranian exports are up and reflect capacity growth in that country. If we look specifically at methanol imports into West Europe, we can see that volumes have increased from mid-2021, and Russian volumes in yellow have decreased. Sources such as the US in orange and Trinidad and Venezuela in light blue have grown to make up for the shortfall in Russian imports.

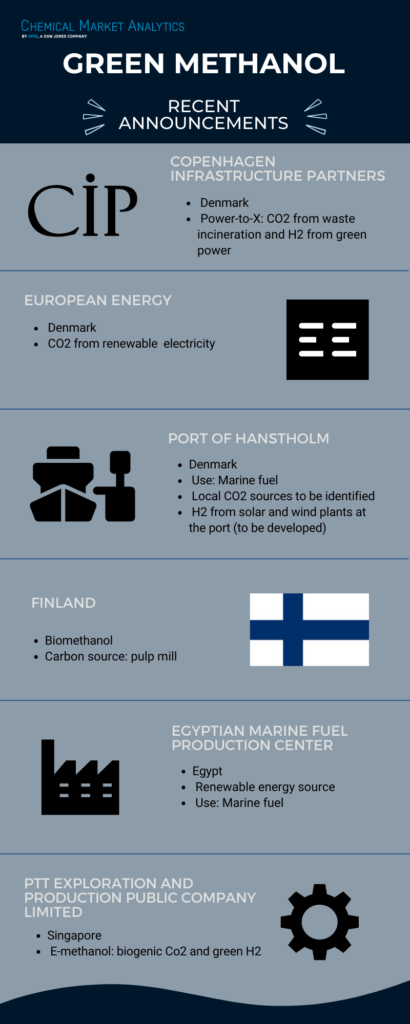

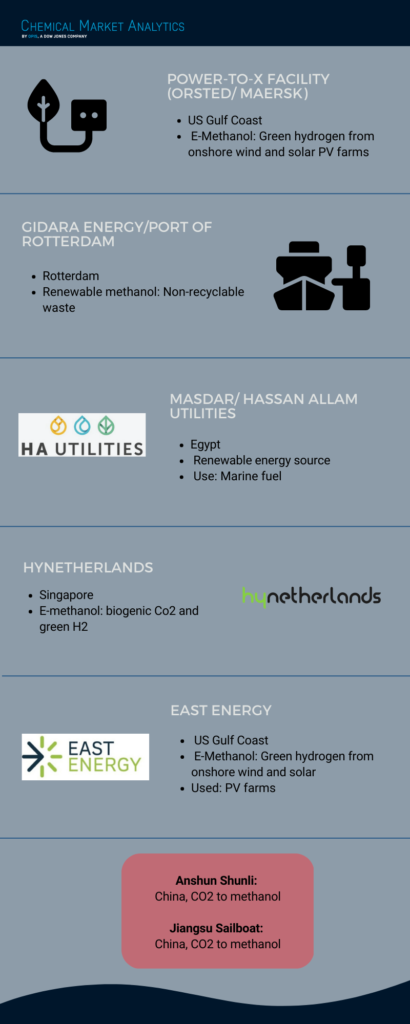

As we touch briefly on one of the hot topics in today’s methanol industry: low-carbon methanol production, you will see in the diagram below some of the recent announcements on a few Green Methanol projects.

I would like to draw your attention to the red box at the bottom: these are new plants in mainland China due to start up this year and next. These projects use technology from Carbon Recycling International or CRI. Utilizing byproduct hydrogen and carbon dioxide to manufacture methanol reduces emissions and produces a valuable commodity.

The other methanol industry hot topic is methanol as a marine bunker fuel or a fuel for ships. Due to methanol’s relatively low energy density, it was our previous view that it only had a limited role to play in the shipping industry in short-haul or inland use: ferries, barges, pilot vessels, etc. But the sustainability agenda has resulted in methanol having a potentially much more mainstream position than was previously forecast.

As a result, the forecast demand for methanol as a marine fuel has increased. It now seems to account for between 7 and 8 million tons globally by 2050, which could be a relatively conservative estimate. So, where is the new methanol capacity likely to be built? In the US, the long-term natural gas price is still competitive. In Iran, although the current sanctions regime is slowing down projects, the methanol produced can only be moved to China or India. Or mainland China, where new capacity is likely to be partially offset by the closure of some older, less efficient units.

Regarding the price forecast by month out to December 2023, two main factors are pulling in different directions. One is the high feedstock cost, such as natural gas in the west and coal in mainland China. The other is the very high levels in the consumer price index, which looks set to depress consumer demand. The result is a relatively flat price profile.

Mike Nash

Global Syngas Team Lead

Chemical Market Analytics by OPIS, a Dow Jones