Where Grey Meets Green: The Evolving Global Methanol Market

As the demand for methanol in the market continues to rise, methanol as fuel demonstrates an increase in green methanol projects around the world.

Global methanol market demand was approximately 90 million metric tons in 2022. Methanol goes into a wider variety of end-use applications, including chemical applications such as formaldehyde (for man-made boards) and acetic acid for paints and coatings. In mainland China, it is a gateway to olefins and polyolefins via Methanol-to-Olefins or MTO. It goes into various fuel applications as a direct blendstock into gasoline, mainly in mainland China; MTBE; FAME or biodiesel; and DME, to be blended into LPG or for us as an aerosol propellant.

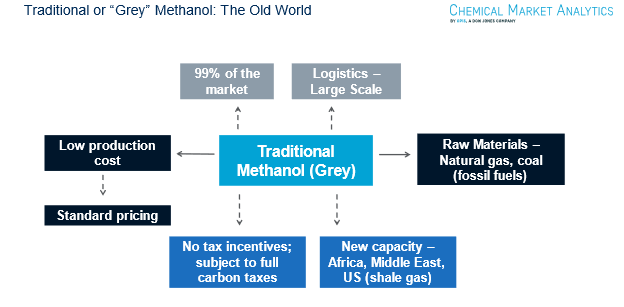

Grey Methanol: 99% of the Current Methanol Market but one of the Most Heavily Transported Chemicals in the World

The existing or “old” world of methanol comprises world-scale production units, with a capacity of between 1 and 2 million metric tons per annum, with the accompanying economies of scale. The feedstocks for methanol production are generally coal (almost exclusively in mainland China) and natural gas in the Middle East, Americas, Southeast Asia and other basins around the world. In mainland China, coking gas can also be a low-cost feedstock for the production of both methanol and ammonia. Still, as a by-product of steel manufacture, its availability depends on the state of the national and global steel industry. In Europe, several relatively small refinery-based units use by-products such as heavy liquids and off-gases; these are not subject wholly to the economics of the methanol industry but are driven by complex, integrated refinery economics.

Many methanol plants are located in clusters where stranded or low-cost raw materials can be sourced, such as in Saudi Arabia, mainland China, the US Gulf coast, Trinidad, Iran and Malaysia. With so much methanol being sourced in locations driven by abundant feedstock availability, millions of tons of methanol are shipped to the global demand centers every year. Around 35% of methanol, or 32 million metric tons, is sold in a different region from that in which it was produced, making methanol one of the most heavily-transported global chemicals.

Methanol production routes can be categorized by various colors, although many of these are used quite loosely with no universally accepted definitions. Around 99% of the current market is “grey” methanol, manufactured from traditional hydrocarbon feedstocks, although coal-based methanol in mainland China is referred to as “brown” methanol. Standard prices apply to grey methanol, subject to any carbon taxes.

What is Green Methanol, and Why is it Growing Fast?

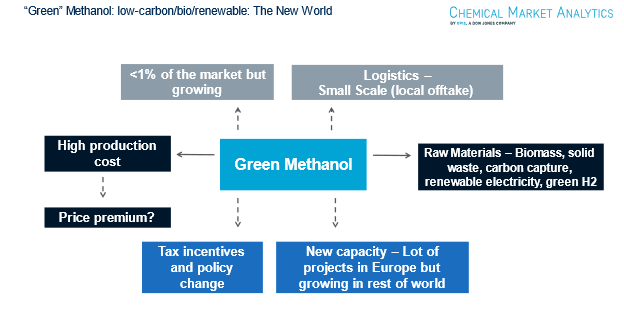

On the other hand, the “new” world of methanol is focused on production via more sustainable methods. Few existing units are capable of producing less carbon-intensive methanol, so this market is currently not material in the context of the global methanol industry. Still, it has grown fast and generated considerable interest in the last few years. Various terms also categorize this developing segment of the industry. Green methanol is a term that defines methanol produced in a lower-carbon manufacturing process. Blue methanol generally refers to methanol production that utilizes carbon capture and storage. Biomethanol can be made from feedstocks such as biomass and municipal waste. Renewable methanol combines hydrogen generated from renewable electricity (from sources such as solar or wind) with carbon dioxide, a waste stream from an industrial process such as cement production or direct air capture.

Green Methanol vs. Grey Methanol: How Methanol as Fuel is Driving Market Trends

Green methanol production is significantly higher than grey methanol production on a unit-cost basis. This differential is expected to diminish over time as green methanol production units become more extensive and more efficient and as the cost of carbon increases. It is possible to secure price premia for green methanol—these tend to be a closely guarded commercial secret—but only for limited volumes into specific end-use applications. Whereas grey methanol may target demand centers in other regions, green methanol output is generally more focused on local off-takers.

Methanol market demand growth over the last decade has been pushed up to a level well above that of GDP growth by an increase in demand for MTO, or Methanol-to-Olefins; these units, all in mainland China, purchase merchant methanol for production of ethylene and propylene and various derivatives. Long-term demand growth into fuel applications such as direct blending into gasoline and MTBE is set to decline, impacted by improved vehicle efficiency standards and the move to vehicle electrification. As a result, methanol demand growth is more dependent upon traditional chemical applications such as formaldehyde, acetic acid, MMA and solvents.

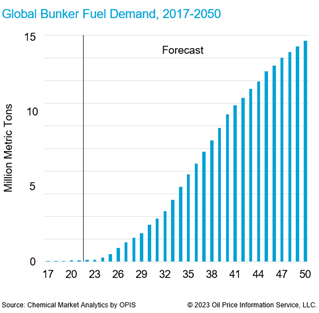

However, there is some potential upside for green methanol market demand: into biodiesel, boosted by national mandates; into fuels used in mainland China, such as methanol-fuelled boilers, kilns and cooking stoves; and methanol as a fuel for marine vessels. Chemical Market Analytics was of the view that methanol’s relatively low energy content made it unsuitable for deep-sea shipping movements – apart from when used as a fuel by methanol producers on their vessels – and, therefore, that it had a relatively limited role for short-haul or inland shipping – e.g., barges, ferries, pilot vessels etc.

In the last two years, major shipowners such as Maersk, CMA-CGM, Stenaline, Höegh Autoliners, Ocean Network Express and Cosco have announced many orders of methanol-ready vessels. As a result, green methanol as a fuel seems to have a more mainstream role in the world of shipping than previously anticipated. From a very low current base, Chemical Market Analytics’ latest supply-demand balances will show demand for methanol as a marine fuel rising fast, to close to 15 million metric tons by 2050.

Green methanol projects have been announced in many locations, with West Europe leading the list. Still, projects are being planned in the US, mainland China, Egypt, Uruguay, Australia, and the UAE, to name but a few. Most offtake from these units is targeted at methanol as fuel, although chemical consumers are also interested. Some shipowners are forcing the issue, trying to solve the “chicken and egg” problem of supply being insufficient to meet demand that isn’t necessarily confirmed. Maersk, for example, is aligning itself with various green projects worldwide, not as an equity stakeholder but as an off-taker.

Chemical Market Analytics will explore this topic in more detail at the company’s World Chemical Forum, which will be held from 12 to 14 September in Houston, TX, US, and will extensively cover green methanol and methanol as a marine fuel at the World Methanol Conference, which will be held from 25 to 26 September in Vienna, Austria.

Authors

Mike Nash

Vice President

Xiaomeng Ma

Director

Javier Ortiz

Director

Shreya Kansara

Senior Research Analyst

We can help you prepare for and navigate methanol market disruptions –

Learn how by watching the video below or contacting us today.

Talk to an expert

Embracing the Infinite Possibilities

Chemical Market Analytics by OPIS, a Dow Jones company, with participation from The Wall Street Journal, Barron’s, and Factiva, presents the 2023 World Chemical Forum, a new event that redefines comprehensive exploration of the future of chemicals and energy, their inter-relationships, and how both markets will address global challenges this century.

Energy and chemical markets are evolving profoundly and ushering in a fourth historical industrial and social revolution with Infinite Possibilities. Leading global experts and industry executives from all market sectors will convene to hear expert forecasts for key chemical and energy markets and discuss pivotal initiatives, including chemical sustainability, the evolving logistics landscape, risk management strategies, and the future impact of Asia on the world.

The comprehensive agenda includes one day dedicated to a global view of the current and future chemical market and two days of guidance on specific market trends.

Don’t miss any of it: register now and ensure your attendance at this exciting inaugural event!