The Potential Ban of PO Chlorohydrin and its Impact in China

The potential ban of PO chlorohydrin and its impact on China’s polyether polyol production

By Tobias Spyra, Director, Research and Analysis

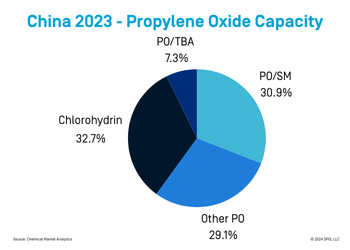

Propylene oxide (PO) is a key ingredient in producing polyether polyols and propylene glycols and is a key component of many surfactants and detergents. The Chinese ‘National Development and Reform Commission’ has recently made headlines by amending its ‘National Restructuring Guidance Catalogue’ to gather industry and university feedback on the potential ban of certain chemicals or production routes. The 2023 edition called for PO production using the “first generation” technology of chlorohydrination to be banned going forward in China. It is not the first time this move has been raised, and it indicates that PO chlorohydrin in China has been shrinking in production and nameplate capacity.

Transition from Peak Production to Advanced Technologies in Propylene Oxide Manufacturing

Despite these regulations being discussed since 2011, PO production via chlorohydrination peaked in 2017 at over 2 million metric tons in China. This proves that the guidance distributed by these journals takes time to digest and still takes longer to be acted upon by industrial participants. The other main contributor was that the peak of chlorohydrination production resulted from prior large investments in this sector, with the inauguration of projects coinciding at a time when the industry was supposed to move away from this production route.

Moving on from this peak in production, the rationalization of older and smaller assets paved the way for investment in new technologies, particularly the Propylene Oxide-Styrene Monomer (POSM) process—where both PO and styrene monomer are produced—and the Hydrogen Peroxide to Propylene Oxide (HPPO) process.

Process of Chlorohydrination

The process of chlorohydrination is three steps. Chlorination forms intermediate propylene chlorohydrin and hydrochloric acid by-products; this is followed by rectification or distillation, which allows the mixture to be purified and by-products separated using their various boiling points. The final step, saponification, involves caustic soda or lime milk treatment to generate the final PO product and a salt by-product.

One advantage of the PO chlorohydrin process is that PO is derived without any major co-product compared to the POSM or Propylene Oxide-Tertiary Butyl Alcohol processes (PO TBA), with the latter generating tertiary butyl alcohol (TBA) as a by-product. These production methods have been the subject of major investments in China and the United States. Another advantage that chlorohydrination has over more modern technologies is that it can use lower-purity propylene.

Even with these potential advantages, the process is much more complex due to the large amounts of chlorine, wastewater and base (caustic or lime) required. Over time, the nature of these components also leads to extensive equipment corrosion, requiring regular replacement and, hence, cost.

While attempts have been made to alter the reactants used, such as replacing lime milk with sodium hydroxide (NaOH) to reduce waste liquid through recycling steps, alterations have been too time/energy-intensive to warrant mass adoption. Dow Chemicals and Lummus are just two companies that tried to optimize this process to contain contaminated water, off-gases, and residues and curtail energy consumption. Yet the capital expenditure (CAPEX) of these adjustments is simply too high for many participants who might already be at their marginal limit.

With the Chinese government encouraging environmentally friendly production, closing older, smaller chlorohydrination assets has been considered ahead of rationalization waves that come through the market. However, this movement towards environmentally friendly routes could be overestimated, as production capacity via this route has decreased to 1.6 million metric tons in 2023. Although this accounts for 26% of Chinese production, with Chinese operating rates dropping to 50 % in recent years, the continuation of chlorohydrination as a prominent pathway is in doubt.

Shift in PO Production Methods

Companies are increasingly adopting new methods and phasing out the chlorohydrination process, with many licensing technologies such as POSM from firms like Repsol. In other cases, joint ventures have been formed, such as Shell and CNOOC’s partnership at the petrochemical complex in Huizhou, Guangdong Province, China, another POSM asset.

Hence, PO production is expected to decline further in China. Rationalization could possibly extend to other regions, as evidenced by Dow closing capacities in Freeport in 2022 and 2025. This will increase the market share for different methods of PO production. Despite the downtrend in capacity, the PO market remains oversupplied, affecting the polyurethane industry and upstream chlorine and caustic soda (chlor-alkai) sectors.

Gain comprehensive analysis into long-term outlooks:

Of the global polyether polyols markets

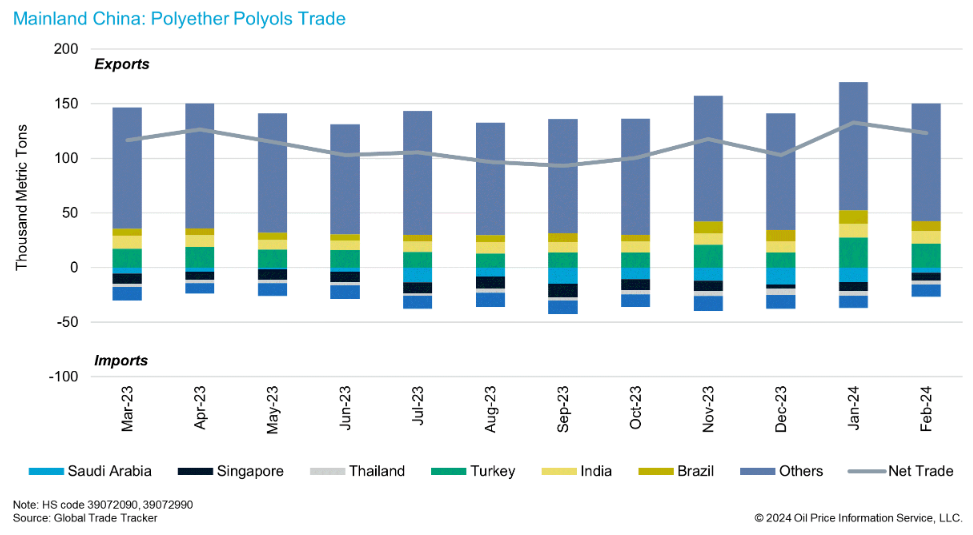

Another indicator of the declining interest in chlorohydrination is the derivative exports from China, primarily polyether polyols and propylene glycol. For polyether polyols production, the impact is minimal since the chlorohydrin route mainly serves propylene glycol production or PO itself. Larger companies and state-owned manufacturers have transitioned away from chlorohydrination for polyether polyols, reducing the impact on overall production, regional consumption, and global trade. Additionally, investments in polyether polyols and expansions in China occurred after the PO overbuild, leading to polyols capacity being built without upstream integration due to the existing feedstock abundance. Thus, the impact of the supply chain is minimal.

Technological Shifts and Global Implications

It is important to note that beyond advancements in PO technology or upstream integration, Chinese and Asian producers have increasingly focused on exporting their excess capacity. Adopting more environmentally friendly production methods—including reducing wastewater and CO2 emissions—has become a significant advantage for marketing their products globally. This trend is expected to continue and strengthen with compounding economies of scale.

China maintained a balanced import and export market before the COVID-19 pandemic, with net trade at 500 kilotons on each side. Since 2019, exports have nearly tripled to 1.5 million metric tons, turning all eyes to the country as the world’s preeminent production source moving into the future.

Larger companies and state-owned PO manufacturers have switched technologies or built new complexes while closing chlorohydrin routes. This is expected to have a limited impact on polyether polyols production, regional consumption, or global trade. The path forward for Chinese and Asian players is to export excess capacity to the rest of the world. Offering an environmentally friendlier route, with lower water and CO2 emissions, will help promote these products in the global market. This trend is expected to strengthen due to economies of scale.

The impact of such technological shifts on PO and polyol production in other regions should also be considered. Dow has closed PO chlorohydrin capacity in the United States and will do so again in 2025, affecting the local market. LyondellBasell, a major PO producer integrated into propylene glycols, has published a strategic review of its European assets, which may suggest further divestments or idling of capacity linked to the PO chain.

——————-

We are excited to share that the World Analysis Polyether Polyols is launched. Click to learn more.

Learn how we can help you prepare and navigate market disruptions today.