Polyacetal Resins Market Returns to More Balance

The production cash costs remain stable, and prices will be driven by costs and market patterns for polyacetal resins. Homopolymer and copolymer supply has improved in the recent years with no change in the domestic supply in North America. Capacity is rising in Northeast Asia, which increases the global capacity in the next couple of years. Domestic demand growth and demand momentum in Asia is critical for supply demand balance. The polyacetal resins or acetal resins market is driven by industrial and automotive applications globally.

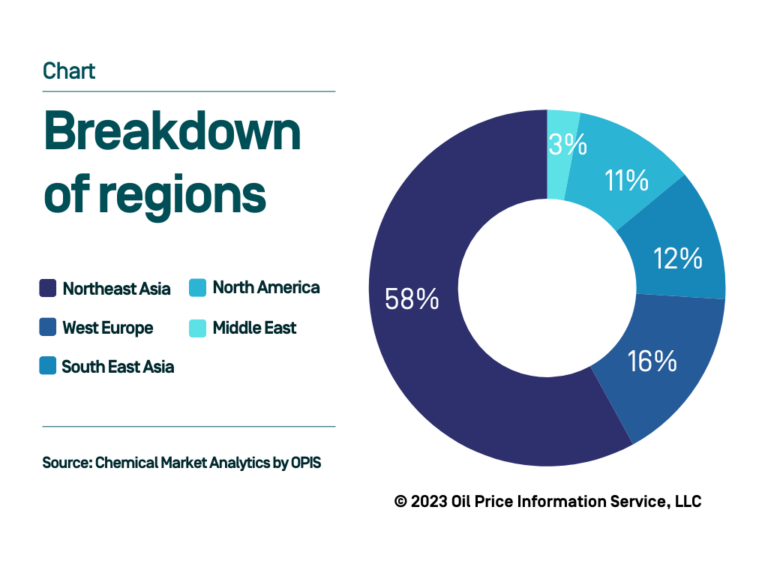

The applications of the market are varied as polyacetal resins stand out as the superior plastic in several applications due to their inherent lubricity and hydraulic stability. The homopolymer market represents nearly 10% of the market whilst the rest is represented by copolymer resins. The supply of acetal resins is largely driven by Asia as the capacity center. Northeast Asia alone represents 58% of the global capacity followed by Western Europe and North America which represent 16% and 11% respectively.

The polyacetal resins market conditions have tremendously improved from the tightness the past two years. Market sentiment remains positive as the global supply and demand continue to improve this year, retaining the momentum gained in 2023. Automotive demand continues to grow about 3-4% YOY in the United States, with a positive outlook for each quarter. Northeast Asia is a huge driver of demand for polyacetal resins representing nearly 60% of the global demand in 2023.

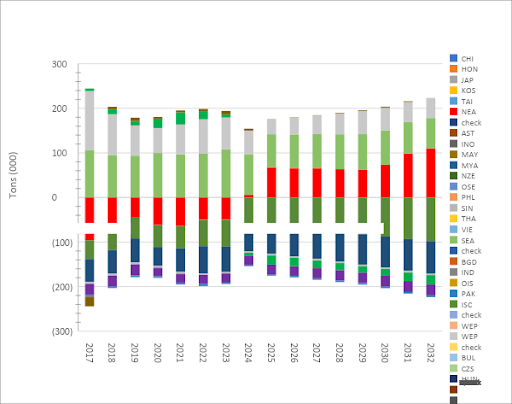

In 2023, global supply remained robust, with operating rates remaining stable. Global capacity estimated at 1.7 MMT in 2023, expected to grow in the near term. Global Freight costs for Asia – US routes have softened by over 80% from the previous highs which has incentivized imported resin. Some uncertainties in the global freight could add pressure on the fright costs. North America remains a net exporter of acetal resins in the foreseeable future.

Prices are determined by costs and market dynamics in North America. Production costs for homopolymer and copolymer acetal have softened from 2022 by 10-20 cents per pound. Currently, US imports are dominated by South Korea and US exports are dominated by China.

The chart shows net trade for polyacetal resins, with an outlook till 2032, with regional exports and imports. Northeast Asia will remain a large net exporter of acetal resins in the long term.

As we look forward to the rest of 2024, with tepid demand growth in the global economy forecast, the demand outlook for polyacetal resins continues to be an important criterion in pricing and supply/demand balance. The market has developed into a much lesser volatile one, with stable energy costs and raw material prices. Low-cost Asian imports into the United States and West European countries will put pressure on domestic pricing, although domestic suppliers with improved lead times and stable supply also protect their market share.

Author

Preeti Sriram

Director, Crystalline Plastics, North America