Is the Global Propylene Market on the Rise?

In the last two years, the European propylene oxide (PO) market experienced a record high domestic operating rate, compared to historical averages of between 75-80%. This was caused by lower exports from the United States to Europe due to planned and unplanned outages, capacity cuts and strong global consumption.

The market faced challenging conditions in 2021 and the first half of 2022, which created tight global supply chains for propylene oxide, polyether polyols, and isocyanates. At the same time, nearly all end-uses outperformed historical levels. The automotive industry in Europe was the only exception.

However, the situation changed dramatically during the second half of 2022 as natural gas and electricity prices rocketed in Europe, heaping variable cost pressures on producers.

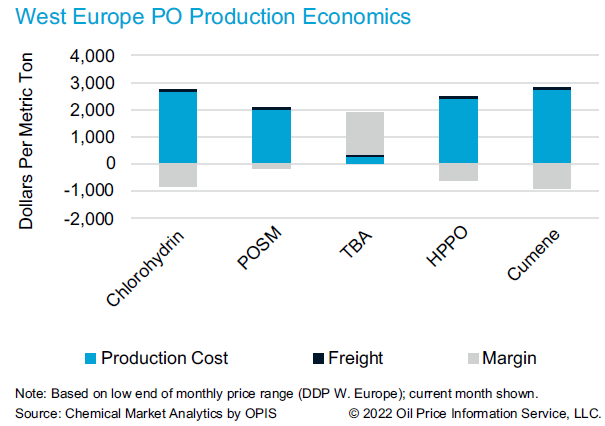

There are five commercially available production routes for producing PO; the chlorohydrin process, PO/styrene monomer, PO-tertiary butyl alcohol, the cumene route, and hydrogen peroxide-propylene oxide (HPPO). Irrespective of the process, all PO units have been under pressure, and some have been idled for an unforeseeable time. No restarts are expected till mid-February 2023 at the earliest.

The energy portion of the cost of PO production has risen substantially, reaching 40-50% of the total cash cost at the peak of the energy spike last summer. This led to a fall in local production and greater reliance on imports from Asia and the United States to feed European demand.

The changing face of global PO capacity adds to the ongoing challenges facing European PO operations. LyondellBasell is expected to bring online a new 470 kta PO/TBA plant in the US in early 2023, while MOL in Hungary is expected to bring 200 kta of HPPO capacity in the summer of 2023. These new units will put even more pressure on European producers.

The rationalization of European and global assets has been discussed but is not straightforward.

In the HPPO, cumene, and chlorohydrin processes, chlorine is oxidized, but chlorine is the precursor of PO production and drives the market. However, the chlorine market is also influenced by caustic soda, which is a co-product of chlorine production. All these factors will need to be considered before rationalization takes place. For other processes, the strength (or weakness) of co-products also plays a role.

Integration, cost positions in individual European countries, economies of scale, location, global PO footprint versus local, and co-product margin development will all play a role going into 2023. Chemical Market Analytics will continue to provide high-quality insight on the evolving situation.

Tobias Spyra

Director Styrenics and Polyurethane Feedstocks EMEA

Chemical Market Analytics by OPIS, a Dow Jones Company

——————-

We are excited to share that the World Analysis Polyether Polyols is launched. Click to learn more.

Learn how we can help you prepare and navigate market disruptions today.