Is PET recycling in Europe on track?

PET recycling has been at the forefront of post-consumer plastics recycling in several regions and has increased tenfold in Europe since 2000. The demand for recycled PET from different markets has also increased at a similar rate. Various brand owners have unveiled goals for using more recycled PET and reducing their virgin plastic use substantially. They are outpacing targets set out by the EU Packaging and Packaging Waste Directives.

The directives are looking to recycle packaging waste by 50% by 2025 and 55% by 2030, while all packaging in 2030 will need to be 100% recyclable or reusable.

As the PET packaging sectors move towards higher levels of circularity, individual companies are demonstrating the possibilities of producing beverage bottles using 100% rPET from bottles. However, some EU member states are unlikely to achieve the desired collection targets.

A Deposit Refund System (DRS) is an efficient waste collection method for beverage bottles. It is widely considered the only way to meet ambitious collection targets for PET bottles in the coming years.

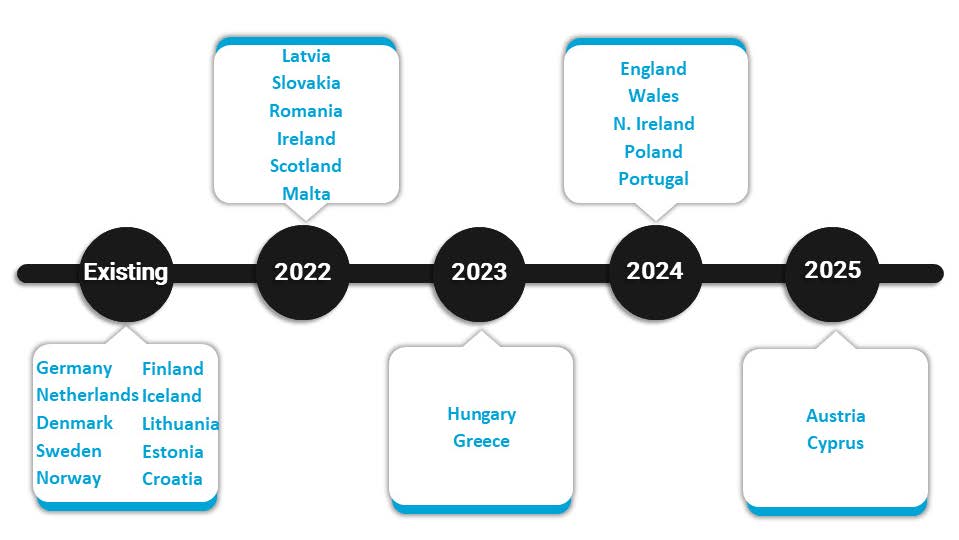

Recently, ten European countries have implemented DRS systems and typically achieve high collection rates, averaging above the 90% mark. In contrast, EU Member States without a DRS only achieve an average collection rate of 45-50%.

Timeline of DRS implementation in EU countries

By 2028, we estimate a collection volume of 3.2 million tons in Europe, up by 700,000 mt from 2021. DRS will enable achieving both the EU circular economy and climate objectives.

Consumer packaged goods companies, retailers, and packaging producers are committing to increasing the share of recycled PET.

The European PET recycling industry began long before the current targets were defined and provided economically attractive alternatives to virgin PET for selected primarily lower-value applications. Europe’s installed PET recycling capacity had increased to 2.9 million metric tons by 2021. The cost of recycled flakes and pellets has shot above virgin PET prices in 2022 as companies vie for limited supplies to meet the ambitious recycled plastic usage targets set by drinks and consumer goods groups.

PET recycling capacities in Europe by country

Mechanical recycling is the primary end-of-life route for PET bottles, but chemical recycling is attracting some interest as most likely will focus on the recycling of PET packaging. Recently Eastman and Canada’s Loop Industries have announced new investments in PET chemical recycling capabilities in France with a combined capacity of 230,000 metric tons per year.

Impacts on virgin PET

The increasing use of recycled materials will lower the demand for virgin materials, but the PET industry has already reacted to this change and is an active player in the recycling markets.

The demand for virgin PET in Europe may have already peaked but the increasing supply of collected bottles due to DRS schemes will support growth in recycled PET, but firm demand from brand owners will keep markets tight.

Join our Chemical Market Analytics thought leaders on 16 February at 3 pm GMT as they provide an in-depth overview of the challenges and future opportunities for the global polyolefins market. Start shaping your future strategy and business position through 2023 and beyond, register for your place at the live session below.

Register your place: Will global polyolefins have a breakthrough in 2023?

Martin Wiesweg

Executive Director, Aromatics and Ethylene Glycols

Chemical Market Analytics by OPIS, a Dow Jones Company

Learn how Chemical Market Analytics, Market Advisory Service enables you to optimize decisions with reliable price, cost and margin data to stay abreast the Chemical Industry.