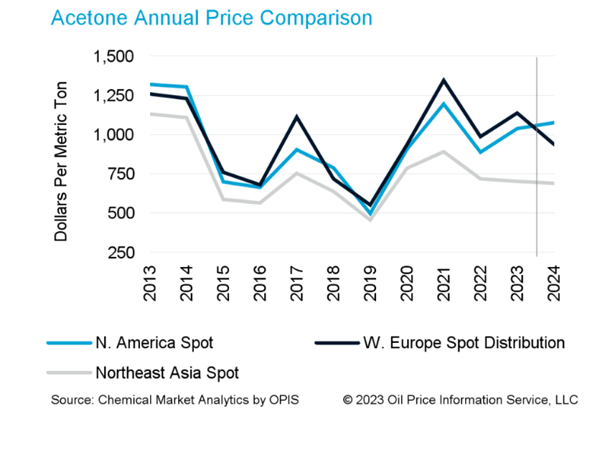

How Has the Global Acetone Market Evolved on the Backdrop of an Oversupplied and Weak Demand Climate for Phenol?

The relationship between phenol and acetone has always been a key element in market dynamics, with producers having to consider the supply/demand balance of both products.

Phenol is generally considered the main product; common wisdom says that phenol/acetone production units are operated with phenol demand in mind, and that acetone supply must be managed as efficiently (and economically) as possible. This leads to regular cycles in regional and global markets where phenol can be in strong demand with better margin contribution, but acetone length means weakness on that side of the market.

Producers will typically sustain operating rates for as long as overall economics allow, but cuts will be made if acetone pricing becomes so weak that margins are eroded. Conversely, when phenol demand drops and price and margins weaken, the subsequent cut in production often creates a much tighter acetone balance and stronger pricing that supports overall economics and sustains the asset’s profitability. In the following excerpt, while this overarching principle applies globally, we also highlight the unique challenges the respective regions face.

North America

Barge and distribution prices sharply increased for the second half of October 2023. The availability of acetone slightly improved in August with the significant imports arriving from Taiwan, but a large volume was sent to Mexico in August and recent imports have been low. Acetone has seen decreasing availability as a result of low phenol operating rates. Several imports are expected to arrive at the end of October.

Two BPA producers are on turnaround/maintenance in October. In addition, two phenol producers are on force majeure. Another phenol producer completed a turnaround in late September, which began early September and reduced run rates by half. Phenol nameplate operating rates are around the high 60% range.

Phenol/acetone demand is expected to decrease in Q4 2023 following seasonality, destocking and turnarounds. North American polycarbonate production is still lackluster, with weak domestic demand and an export market threatened by Asia capacity additions. Epoxy resin demand is seeing a similar picture, with relatively low demand that has not significantly improved since the fourth quarter of 2022. Olin announced its intention to rationalize a portion of their epoxy capacity. Bisphenol A (BPA), nylon 6, and epoxy imports from Asia have put further pressure on US prices and phenol operating rates. However, this month the BPA/epoxy imports have decreased as Asia’s feedstock costs increased. Solvent demand is resilient but is expected to decrease in Q4.

Overall, US automotive production in August has increased following summer maintenance. The semiconductor supply has improved and is less of a constraining factor compared to the beginning of this year. However, there is an ongoing strike by the United Auto Workers against General Motors, Ford and Stellantis, which doesn’t appear to be ending anytime soon.

The average 30-year mortgage rate is 7.6%, which is historically high. The US Federal Reserve (Fed) issued no fed fund rate change in September. Inflation has begun to ease slowly, but unemployment remains low with a persistent labor shortage. The higher Fed fund rate has been used to lower inflation, resulting in weaker construction demand. The Fed’s 2% inflation target is expected to remain out of reach until 2024.

Europe

The European market has been busy with plenty of spot inquiries, reports of tightness, and rising prices. Demand has been described as firm but not spectacular in Europe. With European phenol rates cut further, and delays of acetone and MMA from the Middle East, the market quickly became short of product and spot prices were said to be increasing on a daily basis. There were several reports of distribution channels that had run dry and one large distributor in Europe reportedly will have no material available until the third week of October at the earliest. Demand, although better than for some months in Europe, is well below 2021 levels. Consumers and producers alike are reporting healthy orders and this positive sentiment has been extended through all of October, November and some traders now indicating that better demand could last into early 2024. With a tightening acetone supply and delayed shipments of both acetone and MMA, acetone spot prices have moved up substantially in the first half of October. Imports of acetone are expected to be reduced during October, though export demand from North America remains high.

Delays in material arriving from the Middle East and a drop in imports of acetone derivatives from Asia have boosted local acetone sales. There continues to be quite some optimism for further stronger demand for acetone in the remainder of October and through to the end of the year. The current price for acetone is expected to at least hold or even increase as no increase in supply has been forecast and demand remains relatively healthy.

Bisphenol-a (BPA) consumption continues to be subdued with constrained demand and limited by reduced output at most European sites. BPA derivatives such as polycarbonate and epoxy resin continue to flow into the European market even if they have slowed considerably recently. MMA pricing as it is not firming as was expected with traders seemingly working off old-priced inventory. The arbitrage with Asia is closed. One major acetone consumer, Lanxess, will take its annual turnaround at the end of the year.

For propylene, the weakening in costs could indicate some potential for a lower price in the future and buyers are therefore extremely cautious. Bisphenol A, epoxies, MMA and acetone imports from Asia may be reduced for the rest of 2023 as no producer in Asia wants to take the risk against the price they have at home and the prices now seen in Europe. Recent spikes in natural gas will have producers looking again to increase prices, which could open the door for imports towards the end of the year. With higher costs and limited supply, make versus buy and rationalisation options will no doubt be a serious focus for producers as we head towards the end of 2023.

Asia

October saw Asia’s acetone prices peaking, then retreating, primarily due to energy and feedstock prices, with volatility the name of the game. Acetone supply also remained tight, which helped to support prices as well. Benzene feedstock prices were down from September after surging past the $1000 per mt mark for the first time since earlier in May this year, alleviating some pressure for producers. Supply of acetone continues to be curtailed and is capped by operation rate cuts by producers due to negative margins on an integrated basis, as well as several plant maintenances.

Acetone supply in Asia in October remains curtailed as producers continue to run at reduced operating rates. Supply looks to be tight going into the next few weeks due to not only reduced operating rates but also maintenance and shutdowns by several plants in the region. The demand side saw little improvement as well and with integrated margins continuing to be in the red, low production rates by phenol producers also mean less acetone volumes have been produced. There have been enquiries for spot sales not only from within Asia and but also from other regions like Europe and South America as well. Given the limited inventory levels for most producers, they have held out for higher prices for acetone in a bid to minimize losses on an integrated basis given that phenol is already making a loss. In mainland China, acetone prices also showed a similar downtrend. The slowdown in the BPA sector was most obvious, reflecting the decline in downstream orders. A couple of units shut down across the month, although the capacity losses were partly offset by the restarting of other plants. With a bearish outlook taking the wheel among consumers, sales were challenging during most of the month. Acetone trade flows within Asia have been predominantly contractual volumes, with minimal spot cargoes due to reduced operating rates as well as lackluster demand downstream. Interregional enquiries for spot acetone has picked up recently as acetone supply has dwindled coupled with planned and unplanned spot plant maintenances.

Based off the latest figures, phenol producers are currently expected to be in the red based on our estimates for at least the month to date largely due to the phenol benzene spread. However, losses are expected to narrow gradually as it would not be sustainable for producers to continue operating with losses for an extended period of time, although this may take some time given the volatile global macroeconomy situation.

Authors

Steven English

Director, Consultant Aromatics

Terence Peh

Principal Research Analyst

Jonathan Faulk

Senior Research Analyst, Aromatics – Americas

Learn how we can help you prepare and navigate market disruptions today.