Economy & Energy

The biggest news on the geopolitical front has been and will continue to be, at least for the foreseeable future, the Russia and Ukraine. The conflict has led to a tremendous amount of volatility in the global market. As you can see, there is a lot of inflation going on and that’s mostly because of the disruption of the commodity space that’s happening because of the Russia – Ukraine conflict. We are likely seeing inflation ending the year at around 7.3% according to our former colleagues at S&P Global. Inflation is defined as too much money chasing too few goods. So, what do you do? You choke off the money supply by raising interest rates, and that’s what everyone seems to be doing around the world. Growth rate, the real GDP growth rate, we’re looking at 2.7% here. If you did some back casting and you look at where it was at the start of the year, it was considerably higher, probably a little over 3 1/2% and that number keeps inching down the further we get into the year and the more data continues to happen. We do expect this period of volatility will sort of shake out at around the 2 1/2% level on global growth.

We do expect this period of volatility will sort of shake out at around the 2 1/2% level on global growth.

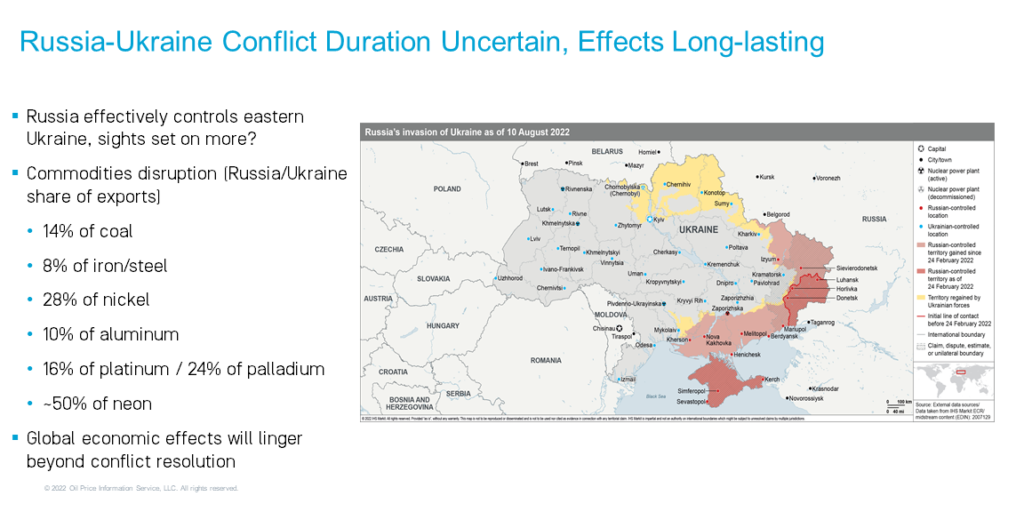

As mentioned before, the Russia-Ukraine conflict is taking center stage. In the map here on the right, you can see the areas in red. Those are the areas that are effectively controlled by Russia. The question is what’s next? What else is Russia going to do? You can see that the areas in yellow are areas where Russia is continuing to make inroads, surrounding Kiev and also moving further West into Ukraine. The question is what has happened from a commodity space? As you can see from the numbers on the left the share of global exports that Russia and Ukraine account for is considerable especially when we’re talking about coal, which is very critical to energy. When we’re talking about aluminum, platinum and Palladium, very core to refining catalysts, there’s a lot of volatility that has happened on these. So it stands without reason that even if we get a resolution to this conflict today, likely the economic effects will linger far beyond the resolution.

Chemical Market Analytics experts will also be speaking at the Asia Chemical Forum on the November 3 – 4, 2022 in Singapore. Find out more and register now.

Carlo Barrasa

Vice President, Energy

Chemical Market Analytics by OPIS, a Dow Jones Company