Chemicals Sustainability—the Train is Gathering Momentum, but is It Express or All-stops Regional?

Maybe we have been talking about chemicals sustainability for too long. We’re setting goals and pursuing effective policy, but, despite some progress, advances are not outpacing plastics waste. Yet experts seem to believe that speed is in the eye of the beholder: “Progress is slow, but progress is also fast; it depends on your perspective,” a panel speaker stated at the recent World Chemical Forum in Houston.

Some market participants are less confident about the rate of progress, with one stating, “We’re not going to unleash the solution. . .until we see contracts between oil companies and waste companies to urban mine solutions. [Until then] we can’t really be on the path to circularity.”

Most experts, however, agree that chemical recycling technology is evolving rapidly, and simply having global leaders meet to discuss circularity is already a huge step forward. Getting the regulatory framework in place and “taking that first step [so] then we can reassess and readjust and realign as we go”, according to a World Chemical Forum speaker, is key.

Plastics circularity is making clear advances at the company level

Stakeholders leading the transition to a circular ecosystem for plastic are redefining their business models. They are embracing new levers so they can overcome the inevitable disruptions that arise when redefining any value chain.

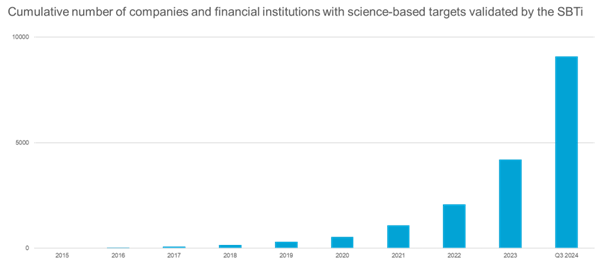

Overall, companies seem to be increasingly on board with net zero and circularity efforts. The number of companies with approved targets and commitments reached over 4,200 in 2023, more than doubling compared with 2022, escalating to 9,090 by Q3 2024, according to the Science Based Targets initiative (SBTi).

The linear model for plastics production that has been fine-tuned over decades is changing to meet the challenges of circularity.

The linear model for plastics production that has been fine-tuned over decades is changing to meet the challenges of circularity: Products and packaging are being redesigned to extend material use, incorporate the principles of repair and reuse, and provide value-added end-of-life disposition.

Additionally, new business models are emerging. The lines that historically separated waste management, recycling, and chemical companies are blurring quickly. Some companies are fitting chemicals recycling assets to chemical infrastructure (crackers). Others are making new products altogether, like UBQ, which makes thermoplastics from “unwanted waste” (80–90% organics, about 10% films and other typically nonrecyclable packaging). The output material can be extruded, injection moulded, and mixed with existing polymers.

Key challenges to chemicals sustainability have been lingering for too long

The availability of raw materials remains a big issue for many companies. For instance, polypropylene (PP) collection rates are extremely low. Most operational materials recovery facilities (MRF) today were built in the 80s or 90s, before the boom in PP usage, and incorporating PP sorting requires a hefty financial investment. If these investments were made, it could easily increase the supply of recycled PP.

Government support is also an ongoing challenge in the US. More and more efficient collection mechanisms and public education could significantly increase how much plastic is recovered back into the supply chain. The current economics do not support recovery; they support landfill, at around $30/t, according to experts. As such, government subsidies could also fund new MRF investments and the integration of mechanical and chemical recycling technologies.

The implementation of chemicals recycling and pyrolysis to expand the processability of plastic materials back into supply chains is also an ongoing debate. The economics are often impeditive, however, and much of it relates to efficiency issues and feedstock.

Additionally, without sufficient collection rates, economies of scale are difficult to achieve. When considering “mega” chemicals recycling facilities, the geographic area of collection to allow such large feedstock streams would potentially have to be massive (depending on plant location and collection volumes available in nearby areas). When calculating the costs of running a recycling facility, one would have to incorporate freight, collection, sorting, mechanical processing, and chemical processing costs, often making projects for large-scale facilities a rather prohibitive endeavour.

Could AI fast-track the circularity train towards chemicals sustainability?

It looks like the circularity train is ready for a revamp. Recently, new gears became available: AI and GenAI. With the ability to process huge amounts of data, AI could potentially massively impact the optimization of supply chains, from collection to sorting to processing:

- AI could allow global-level standardized implementation of scan codes containing the material structure of each piece of packaging, supporting more efficient and effective sorting mechanisms, even for waste streams traded between countries.

- From a supply chain optimization perspective, AI tools can support expanding geographical areas of collection, increasing feedstock volume availability.

- From an R&D perspective, AI can support product and process design for circularity, pushing faster go-to-market for new circular solutions.

- Even on a processing level, AI can be used to analyze process patterns such as contamination, composition, safety concerns, and for feedback alerts, data, and suggestions, and it can even be linked to process control to actively make adjustments.

These are not new uses for AI in the industry; there are companies already operating in these spaces that are using these tools. However, AI implementation has been growing and improving efficiencies expeditiously. New solutions arise daily, and existing tools are rapidly spreading globally; thus, there is huge potential to increase applicability within waste management and processing and support plastics circularity.

Collaboration and action across the supply chain is key

Despite the recurring issues, market participants are optimistic that the solution is achievable, but it requires collaboration. “Everyone has a piece of the puzzle, and we need to collaborate to solve it,” said an industry expert at the WCF, “even competitors in the market are rolling up their sleeves and looking for solutions together”.

According to experts at World Chemical Forum, there are several areas that have a pressing need for action. These span across the value chain and include external partners (legislators and investors) as well:

- Brand owners need to play a part in educating the public on how to bring resources back into the supply chain.

- Further improvement in waste management is needed, including establishing better collection and sorting mechanisms that allow for more closed-loop systems (besides PET bottles).

- Additional investment in chemical recycling technology development and deployment is required. Large petrochemical and waste management players also need to play a part in pushing development and scaling these technologies with their expertise, instead of leaving it all to small companies and “entrepreneurs.”/li>

- Creating end markets for recycled products is necessary; we are currently in a supply-constrained scenario, but demand also needs to grow to allow scale. As a WCF speaker put it, recycled content mandates “with teeth and incentives, perhaps penalties” are key to propelling

- Investment decisions need to be unlocked at all levels, not only from government but also private funding.

Policy and regulations: are we on the right track toward a circular economy?

Advancing circular solutions will also require unprecedented alignment of effective policies to affect fiduciary management of plastics on a global scale. There are numerous regulatory schemes across the world relating to plastic circularity. One of the main issues with current policy frameworks is the lack of clarity and/or global standardization of methodologies, such as measuring recycled content.

The absence of a standard globally applied and enforced methodology for recycled content claims is a key factor in the circular plastics space. To take one example, for pyoil use as a feedstock in plastics production, a mass balance approach can be used to calculate the amount of recycled material in the final products. However, there are multiple mass balance approaches that can be applied.

Four main methods are listed below, in growing order of recycled content that can be claimed:

- Technical/proportional. This is very strict, allowing only the proportional amount of recycled content to be allocated to the final product.

- Polymer only. Recycled content can only be allocated to outputs directly related to polymer production. It is being assessed for the EU’s Single Use Plastics Directive.

- Fuel exempt. Recycled content can be allocated to all outputs, except for fuel and process losses. Currently used in the Recycled Material Standard (RMS).

- Free allocation. Recycled content can be allocated to all outputs, except process losses; very lenient and flexible, and so may lead to greenwashing. Used in the ISCC PLUS and Recycled Claim Standard (RCS).

The lack of standardization in recycled content methodologies that can be applied to the same product made through the same process increases uncertainty, making it difficult to invest in new capacity and secure long-term contracts.

This is just one of many examples where the industry urgently requires standardized practices, consistent measuring methodologies, and adherence to claims to remove variability and uncertainty, allowing more predictable demand forecasts and supporting market growth.

One of the main issues with current policy frameworks is the lack of clarity and or global standardization of methodologies, such as measuring recycled content.

How far down the regulatory framework line are we?

One could argue that there have been many meetings of global leaders to discuss sustainability, circularity, and decarbonization goals but with limited measurable outcomes. Many issues have been raised regarding standardization and methodologies, per above, but what has been achieved so far on plastics circularity?

Europe has been at the forefront in addressing plastics pollution, giving it a leadership position in this space; its regulatory framework has evolved rapidly in the last decade. The European Plastics Strategy was adopted by the EU Commission in January 2018, with revised legislative proposals on waste in 2020 concurrent with the adoption of the new circular economy action plan.

It is part of the European Green Deal and builds on existing measures to reduce plastic waste and build the strategy for chemicals sustainability. It is a key element of Europe’s transition towards a carbon-neutral and circular economy. Consisting of five main laws, it contributes to reaching the 2030 Sustainable Development Goals, the Paris Climate Agreement objectives, and the EU’s industrial policy objectives.

The EU does enforce these laws, taking action against countries that do not appear to achieve targets. For example, in September 2022, the European Commission took legal steps against eleven member states—Belgium, Denmark, Estonia, Ireland, France, Croatia, Latvia, Poland, Portugal, Slovenia, and Finland—on the grounds that they had not communicated to the commission the measures necessary to ensure the full transposition of the directive.

The upcoming Packaging & Packaging Waste Regulation (PPWR; current roll out plan December 2024) should have a major impact in the region. PPWR has been adopted, and will be applicable across the EU, setting mandatory targets for recycled content recovered from post-consumer plastic waste, per unit of packaging (minimum percentage), per the PPWR Targets table.

Both the EU and United Kingdom have implemented a tax on unrecycled plastics.

Elsewhere in the world, the number of Extended Producer Responsibility (EPR) schemes is growing, building on the example set by the EU.

- In the US, five states have enacted EPR legislation between 2021–24. Several other states are either looking to enact EPR or have product stewardship legislation considered to be precursors to EPR. In March 2024, the US Senate passed two pieces of legislation to improve recycling and composting systems at the Federal level: the Recycling Infrastructure and Accessibility Act of 2023 and the Recycling and Composting Accountability Act. However, the bills are not expected to progress in the US House of Representatives in 2024. More recently, a bill has been introduced to establish minimum recycled content requirements on a national level.

- Canada has comprehensive EPR regulations on a subnational basis that involve a variety of systems for different products (electronics, batteries, and packaging).

- Kenya and South Africa are in the process of implementing EPR systems in some sectors and gradually extending them to others.

- In Asia, multiple countries are implementing packaging EPR schemes, but most are in the early stages of development. Japan and South Korea have well-established EPR models. Vietnam and the Philippines both implemented EPR schemes in 2022. India made the Amendments to the Plastic Waste Management (Amendment) Rules in 2022, establishing mandatory targets on EPR, recycling of plastic packaging waste, reuse of rigid plastic packaging, and use of recycled plastic content.

- In the Middle East, Israel and the United Arab Emirates have implemented comprehensive EPR programs for packaging.

- In Latin America, packaging EPR is prevalent, especially for OECD members.

- Australia has EPR schemes on a subnational level. New Zealand has a regulatory framework and legislation for EPR and Product Stewardship for packaging waste, but participation is often voluntary. New Zealand also has had the New Zealand Plastic Packaging Declaration since 2018, whereby businesses commit to use 100% reusable, recyclable, or compostable packaging by 2025.

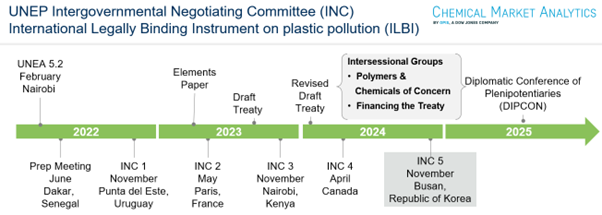

The UN is also taking steps to implement standard regulations on a global scale—this is instrumental to building a global circular plastics economy. The UN’s Intergovernmental Negotiating Committee (INC) is developing an Internationally Legally Binding Instrument (ILBI) on Plastic Pollution. The two-year negotiating period is coming to an end, with the fifth and final session scheduled last November.

The globalization of plastics circularity guidelines and regulations could rapidly advance the scale-up of this transition.

This regional train could soon switch to express

Circularity is complex. There have been many disruptions on the path to a new circular economy. After decades of slow development, the last 5–10 years brought an acceleration of technological advancements, a growing alignment of stakeholders, and further clarity about government policies. Globalized efforts increased and communication between industry and government grew, and with this expanding collaboration, we started seeing measurable, meaningful progress.

Speak to our experts to get a demo of Circular Plastics Service

As technologies are further refined and scaled, and governments work on a global scale to find standardized solutions to implement circularity regulations, the market will grow rapidly. As new policies are implemented, bottlenecks and setbacks will occur, allowing for targeted adjustments to regulations. The end of the line is not yet in sight, but eventually the added regulatory clarity will propel industrial investments in this space forward. As we collectively hone the gears moving the circularity train, the transition will become increasingly fast-paced.

The transition to circularity is quickly becoming more multifaceted. Market participants must make the transformation while considering decarbonization, energy transition, evolving regulations, rapid technological advancements, and shifting consumer preferences.

The Circular Plastics Service of Chemical Market Analytics provides holistic analytics and insight into the circular plastics transformation, empowering clients to successfully implement actionable strategies.