CBAM Regulation Rumba—One Slow Step Forward for the Energy Transition, Two Quick Steps Back for the EU Industry?

The European Union is making bold moves to accelerate the energy transition and carbon abatement. Rather than dancing around the subject, they are moving forward with measurable policies and targets. By creating the Carbon Border Adjustment Mechanism (CBAM), the EU has expanded its borders of action to include any trade partners that want to maintain these commercial relationships.

This piece will give an overview of the Emissions Trading System (EU ETS), show how it translates into the CBAM, and discuss the policy’s potential effects on and risks to the chemical industry.

CBAM Regulation Rumba First Step: EU ETS in the lead

The EU industry has been paying a market-based carbon price since 2005. The EU Emissions Trading System (EU ETS) requires industrial operators to acquire one carbon allowance for every metric ton of carbon they emit. The UK ETS is similar to the scheme in the EU.

The EU ETS covers around 10,000 installations across different industries, including oil refineries, steel works, iron production, aluminum, metals, cement, acids, bulk organic chemicals, lime, glass, and more, as well as the power generation sector. The steel and cement sectors account for 5% and around 4%, respectively, of greenhouse gas emissions produced by installations subject to the EU ETS, according to the EU and Climate Bonds Initiative.

The scope of the EU ETS is expanding into aviation, maritime, road transport, and more. The scheme has proved to be key for decarbonization: EU emissions decreased by 47% in 2023 from the 2005 levels when it was first introduced.

Carbon prices and EU allowances (EUAs) are a significant cost component for European operators and have been rising since 2018. EUA prices are highly correlated to natural gas prices, and thus geopolitical events like the Russia-Ukraine war affect EUA prices. As of July 2024, EUAs were trading at around €70/mt CO2, after peaking at over €100/mt CO2 in February 2023.

The annual average EUA auction price has increased every year between 2021 (€57.27/mt CO2) and 2023 (€82.93/mt CO2). Recent forecasts point to EUAs potentially surging to over €125/t CO2 by 2030.

The scope of the EU ETS is expanding into aviation, maritime, road transport, and more.

Free carbon allowances phase-out

Difficult-to-decarbonize sectors like chemicals, steel, cement, and others are provided free carbon allowances (EU Allowances, EUAs) to cover their carbon emission costs as an incentive to remain within the EU or UK, rather than relocating to where carbon levies are not in place (“carbon leakage”). If producers manage to cut their emissions, they can sell surplus-free allowances to other emitters, thereby profiting from decarbonizing their own assets.

For installations in the EU, operators can also hold on to their surplus EUAs, as the value of the allowances increases, a trend that has materialized in the last three years and is expected to continue while EUAs are in place. The number of EUAs in circulation was at about 1.4 bn in 2020 but should drop to 1 bn in 2030, and no new allowances are expected to enter the market by 2039.

These free allowance systems are designed to prevent operators in these sectors from being undercut by imports from countries where there are no levies on emitting carbon.

However, free allocation should be fully phased out by 2034 when the EU simultaneously implements the CBAM regulation, a tariff enforcing the bloc’s carbon price on exporters to the EU.

Could CBAM be protectionism masked as environmentalism? Let’s look at the CBAM Timeline.

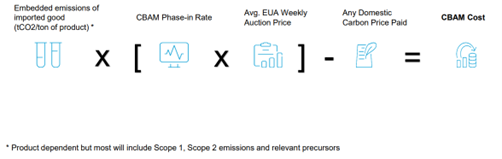

The EU’s CBAM will require importers to pay the EU carbon price on the embedded emissions of imported products from a range of sectors.

Despite being a means to global carbon abatement, it also intends to level the playing field for European producers by imposing carbon prices on imported products similar to those on domestically produced goods. Arguably, it is just another type of import duty.

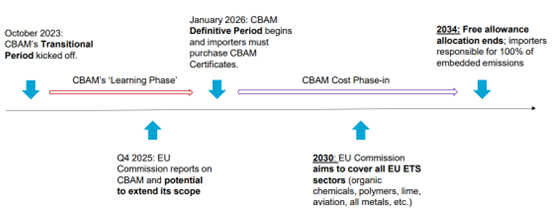

The EU rolled out the Transitional Phase of the CBAM in October 2023. During this phase, EU importers do not have to pay any costs on the embedded emissions of their imports but rather file quarterly reports detailing emission data. By 2027, the CBAM will require EU importers to pay the carbon price through the purchase of CBAM Certificates, whose price will be tethered to the weekly average auction price of EUAs.

The UK is enacting its CBAM in 2027, which will include the same sectors as the EU CBAM, with the exception of electricity, and will also cover imports of ceramics and glass products. The UK CBAM will also likely be closely linked to the EU ETS, as a mismatch between UK ETS and EU ETS carbon prices would expose the British industry to higher European carbon prices, potentially affecting the UK trade flows to continental Europe.

Meanwhile, the tariff has pushed other countries, like Brazil and Turkey, to create their own carbon schemes to protect their companies that export to the EU.

Speak to our experts to get a demo of our Chemical Market Analytics Platform

CBAM’s full impact on global emissions has yet to be assessed, and much will depend on how willing Europe’s trading partners are to adhere to the required carbon abatement timeline to remain competitive in the region or if they choose to find new export destinations outside of the EU.

Europe has been increasingly dependent on imports, especially from Asia. Competitive import prices originating in Asia are a major risk factor and one of the main drivers of Europe’s wave of deindustrialization. However, Asia’s share of imports entering the region is expected to fall as a result of CBAM regulation.

According to the Asian Development Bank, a carbon cost of €100/mt could result in a 1.1% decrease in Asian exports to the EU, while extending CBAM to cover other Organisation for Economic Co-operation and Development countries would cut Asian exports by 1.9% on average at a carbon price of €100/mt and by 3.7% at a carbon price of €200/mt.

Step by step, CBAM regulation is heading towards chemicals

Currently, we are in CBAM’s Transitional Phase (2023–2025), which consists essentially of a “Learning Phase” for stakeholders and the commission itself, with the potential to extend CBAM’s scope. CBAM’s Definitive Period begins in 2026 and will be gradually phased in until 2034.

Chemicals are not the first in line for implementation, though it will be coming this way soon: The EU will consider the inclusion of organic chemicals and polymers by the end of 2025. Sectors currently covered include steel, aluminum, cement, electricity, hydrogen, and fertilizers.

As CBAM is gradually phased in from 2026, the free allowance system will be phased out and will be removed entirely by 2034. Notably, as they are phased in, CBAM Certificates will be based on the weekly average price of EUA auctions (EUA auctions take place almost every day).

As free allocation is phased out over the next decade, policy revisions will influence how companies act on their carbon abatement plans.

One major risk to European producers is a mismatch between the speed of the CBAM phase-in and the EUAs phase-out; if EUAs are eliminated too fast compared to CBAM ramping up, this will leave domestic products once more at a cost disadvantage versus imports.

Another major risk to the industry is the macroeconomic repercussions resulting from demand erosion and inflation. As both CBAM and carbon costs are added to domestic and import prices across the value chains, EU consumers will eventually carry the cost.

Additionally, the EU chemical industry has long been at a disadvantage due to higher energy and feedstock costs. The removal of EUAs, although necessary to meet decarbonization targets set by the European Commission, puts the remaining chemical industry operations’ cost structure at even more of a disadvantage compared to more competitive regions like North America, Asia, and the Middle East. As a result, we could see further rationalization taking place in Europe in the next decade.

Aluminum as a case study for possible CBAM regulation missteps

The aluminum industry is on the initial list of industries subject to new carbon emission regulations during CBAM’s Transitional Period from October 2023.

For aluminum, industrial process scrap accounts for more than one-third of global aluminum production.

The European Commission outlined in early 2024 a wide range of amendments to regulations related to free EU carbon allowances (EUAs) that will apply to incumbent operators from 2026 to 2030. The bloc uses benchmarks set by the 10% most efficient installations in their respective industries based on inputs and outputs to designate how many free EUAs an installation should receive.

The industry is raising strong concerns that this could inhibit faster carbon abatement, pushing was what the aluminum industry considers to be “a big loophole”: a decision not to provide free carbon allowances to operators that use scrap metal in aluminum production, by labeling industrial process scrap as carbon free. However, instead the EU ETS rewards producers who use scrap metal with free allowances. For aluminum, industrial process scrap accounts for more than one-third of global aluminum production.

As it stands, the industry sees this measure as favoring non-EU re-melters over domestic operators and believes it could leave CBAM effective for only a very small part of the aluminum value chain. The situation undermines investments in recycling within Europe, as it weakens the profitability of established recycling plants in Europe and undermines the rationale for new investments in recycling. An increase in market and regulatory risk invariably increases uncertainty and hinders investment decisions.

The aluminum industry’s struggles are reflective of how misinformed or detail-lacking policies can weaken an industry policymakers intended to strengthen and protect.

CBAM regulation is the first step toward a global carbon economy revolution

CBAM should aim to be a step forward for decarbonization without dragging European industry two steps back. In order to avoid the potential shortcomings of the CBAM regulation requirements, the EU chemical industry needs to carefully assess the current proposed policies and, if necessary, lobby to ensure that the measures result in their intended purpose.

CBAM should aim to be a step forward for decarbonization without dragging European industry two steps back.

The EU is leading the carbon economy revolution. Monitoring policy development around the world and projecting the price of carbon is critical for all market participants, regardless of where they are located. It is pivotal for designing sustainably competitive assets for now and the future.