Americas Methanol Demand and the Mixed Market Indicators

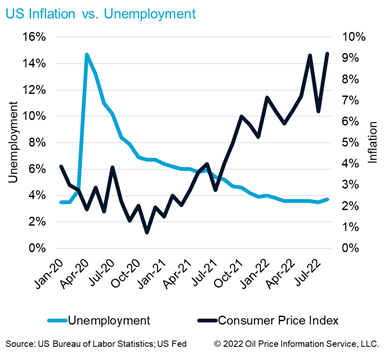

When we look at the Americas’ methanol demand, it’s probably the hardest thing to predict these days, especially as most of us have seen several mixed signals from the market and the economy, starting with a commonly mentioned relationship between high inflation and low unemployment, as shown in the chart.

This comparison has been critical because it is known that the US Fed is targeting high interest rates to bring down inflation. However, with low unemployment, it may take extreme interest rate hikes to try to accomplish this goal. The high interest rates are especially concerning for the methanol market, which has many ties to the construction industry and benefits from a low-interest rate environment. However, when looking for clues on how this sector is doing, we’ve also gotten mixed signals; for example, when comparing two major home improvement retailers in the US, Home Depot and Lowes, Home Depot reported a pretty good increase in second-quarter sales while Lowes reported a decline.

What was the difference? Home Depot reported that its increase was still wildly supported by sales to professional contractors, while Lowes’s sales were more dependent on average three-year self-consumers. It is visible that the construction market overall is still active, but average consumers are the ones who have already tightened their budgets.

This was also similarly reflected by recent construction spending stats for July, where non-residential construction was up by almost 1% versus June, but residential construction was down by nearly 1.5%. A more concerning number was perhaps the PVC market, another petrochemical segment closely tied to construction, which saw an almost 12% decline in regional sales in July. Other preliminary stats for August indicate that these markets have stayed weak, making the near-term outlook even more gloomy.

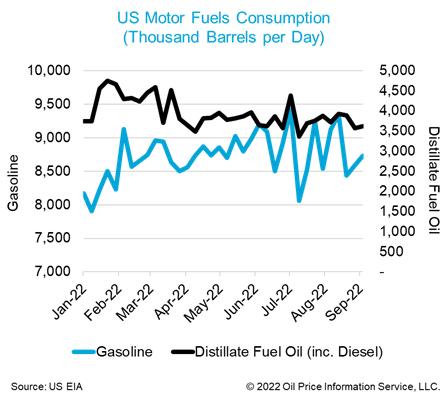

What about other markets like automotive and fuels that are also significant consumers of methanol derivatives? The US auto sales have been mixed, with manufacturers like Ford and Hyundai recently showing positive results. While producers like Toyota and Honda have been struggling. A lot of negative performance is blamed on ongoing supply chain shortages, which have helped to keep demand for automobiles high. Indeed, most auto producers have also begun to mention increased levels of auto loan delinquencies and reduced buyer appetite as consumers reduce their discretionary spending. In the case of fuels, the demand for MTBE and biodiesel also grew relatively stronger during the summer, but these markets expect reduced consumption in the fourth quarter.

However, there might still be some strength left in these markets. As the chart above shows, gasoline consumption in the US dropped significantly in the middle of the summer driving season when prices were very high. However, with the recent decline in gasoline prices, consumption increased again, and this trend could also be possible in the MTBE-consuming parts of Latin America. Finally, another bright spot in the market has been diesel fuel, which has seen relatively steady consumption throughout the past several months, suggesting that demand for commercial transportation is still healthy and could also be reflected in the biodiesel market.

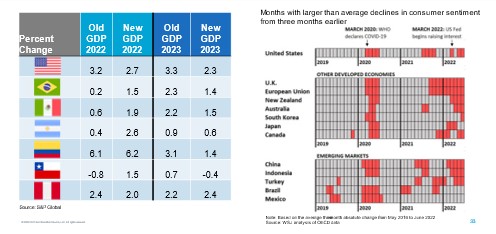

Despite any signs of lingering strength left in the market, most economic forecasts 2023 have been downgraded. The good news, for now, is that our latest GDP forecasts do not show a prolonged recession for America’s region in 2023. The caveat is that this forecast is also liable to change in the coming weeks and months. That said, there is a sense that consumer sentiments will play a more significant part than usual in determining how economic conditions ultimately develop, with a sharp decline in sentiment possibly creating a self-fulfilling prophecy of weaker demand. Our colleagues at the Wall Street Journal recently demonstrated in the diagram below that consumer sentiment in most major economies has indeed been turning weaker, as shown by the red squares, which represent months with larger-than-average declines in consumer sentiment from three months earlier.

Javier Ortiz

North & South America Methanol

Chemical Market Analytics by OPIS, a Dow Jones Company

Expand Your Reach in the Global Methanol and Acetyls Markets with Chemical Market Analytics Market Advisory Service. The most comprehensive analysis for over 100 commodity chemicals across 34 individual services.