Soda Ash World Economic Outlook

The global soda ash market was extremely tight in 2022. Demand recovered post-pandemic but supply was constrained as capacity additions were delayed because of COVID-19. Production in Europe was repressed due to energy and raw material limitations while logistical issues impacted on supply in the US. Meanwhile, costs were extremely high, especially in Europe, following the impact on world energy prices of Russia’s invasion on Ukraine. The situation is very different today. Soda ash is oversupplied in most markets and spot prices are falling quickly in line as well with a drop in cash costs. Meanwhile, world economic growth is slowing, with soda ash demand also seeing some slowdown in certain sectors and/or regions.

Global Supply

While soda ash demand growth is slowing, there is also a lot of new supply scheduled, mainly in China and in the US. After decades of dominating world capacity additions, in recent years there has been a net loss in Chinese capacity. Also, natural soda ash has only made up a small share of China’s capacity total. But China’s soda ash capacity is set to increase sharply, while the technology profile is also set to change. Inner Mongolia Berun Yingen is adding 5 million mt of natural soda ash capacity commencing with the 1st line in June and another 2.8 million mt by around 2026. There are also synthetic expansions underway in China, including some fairly large projects.

While the US is entirely based on natural soda ash and amongst the lowest-cost producers in the world, it hasn’t added any significant capacity in decades. This is set to change. By 2030, the US capacity is expected to increase by over 10 million mt. Genesis is adding about 1.1 million mt this year. The single biggest capacity addition though is scheduled by Sisecam with plans to build a 5.0 million mt greenfield plant by 2028. There are also expansions scheduled in other parts of the world. Inochem in Saudi Arabia is to start in June. Ciner is expanding its capacity in Turkey by about 1.0 million mt between 2022-2025. There are plans to capacity in Kazakhstan and various expansion plans in India.

Global Supply/Demand Outlook

Trade

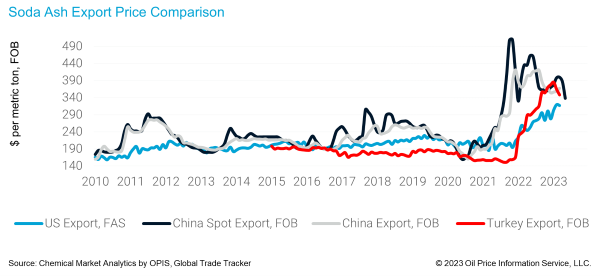

The US, Turkey, and China are key soda ash exporters while South America and Southeast Asia are key importing regions.

In the wake of the COVID-19-led supply chain complications, and the ongoing war between Russia and Ukraine, the global soda ash trade remains robust. Nonetheless, there were some residual supply chain issues last year and as a consequence, the only significant increase in exports in 2022 came from China. China’s ability to increase exports in the forecast years will be influenced by the success of the new Inner Mongolia plant and also what impact it has on some of the local high-cost plants in China.

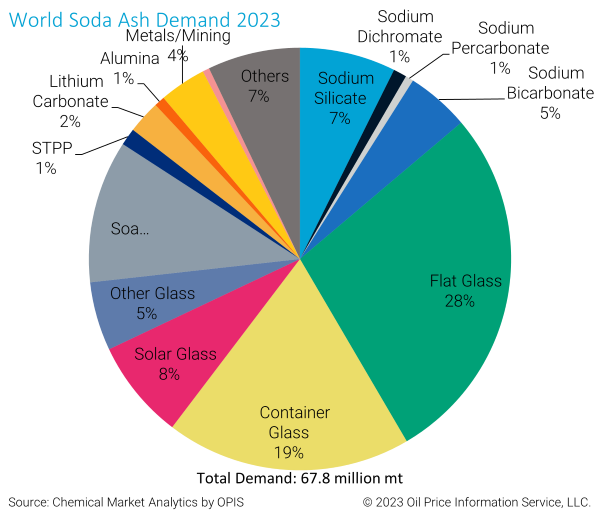

Soda Ash Demand Distribution

Soda ash demand is dominated by glass with flat glass the single biggest end-use. In terms of demand growth, environmental sectors are contributing very positively with solar glass set to be the single biggest driver for soda ash demand by 2027. Lithium carbonate, a material used in some electric batteries, will also be an important demand driver. The flat glass will also remain an important driver even though production growth in China is expected to slow.

For the most part of last year, global demand was strong. 2023 started off with some slow-down in demand in certain applications, and surplus stock was observed in many markets. For the remainder of the year, we are expecting that soda ash availability will continue to improve as new capacities come on stream, especially in China, and as demand growth globally is subdued.

China Demand Outlook

Flat glass, which has been the key driver for soda ash demand in China, will remain an important demand driver, but we believe that solar glass will be the key demand driver going forward. There is also potential growth for soda ash for lithium carbonate in China, which we are projecting will average 19% per year between 2022-2027.

Other Asia

Southeast Asia is a large developing market, but one that is entirely dependent on imports which last year totaled about 3.6 million mt. Northeast Asia, excluding China, is a mature market, with imports last year of about 1.3 million mt. After strong demand growth in 2022 and tight market conditions, the soda ash market in Other Asia has been fairly long since the start of this year, with reports of high stocks in the region. Total imports have seen a 14% decline so far this year. We expect that the market should remain well supplied for the remainder of the year. In terms of demand, the picture is mixed. Solar glass and container glass demand are observed to be good, while flat glass and detergents are weak.

India

While the Indian market was fairly tight last year, some softness in demand was apparent ahead of most other regions, being visible since the second half of 2022. Consumers began this year carrying substantial stocks with surplus availability remaining throughout the first quarter. However, it seems that the Indian market may have turned a corner. Demand for detergents, the single biggest end use in India, has already begun to improve. Container glass has been performing well and is likely to continue to do so. And while Indian flat glass producers have been impacted by growing imports from Asia, new float and solar lines are coming on stream this year and next year. Meanwhile, with a soda ash per capita demand level of only 3 kilograms per person, the long-term prospects are good.

West and Central Europe

West Europe is a net importer of soda ash. Central Europe is a net exporter, mainly from Bulgaria. Soda ash was extremely tight in Europe last year. The market is much more balanced today. Demand for container glass, the single biggest application in West Europe, has been strong to date this year, however, the outlook for the rest of the year is cautious. Nonetheless, a cullet availability issue has the potential to increase soda ash consumption. Flat glass demand has slowed since Q4 last year and is expected to remain fairly weak this year.

North America

The US market is mature, although there is some growth potential which is mainly for lithium processing. In general, therefore as the US adds soda ash capacity it will primarily be destined for export. In 2022, US exports were restricted because of various plant problems and also domestic logistical constraints. Some restrictions on exports have remained to date this year.

South America

South America, is almost exclusively reliant on imports. Demand was extremely strong in 2022, with double-digit growth. The market was extremely tight to the extent that it attracted imports from as far away as China, at very high prices. We see a very different market dynamic to date this year. There are no longer any problems with availability and there is strong competition for market share amongst all key suppliers. While some softness in demand has been noted this year, nonetheless, the medium/long-term prospects are strong with lithium carbonate the single biggest demand driver.

Middle East/Africa

Ciner is, as already mentioned, expanding its natural soda ash capacity in Turkey. However, there are also numerous glass projects scheduled for Turkey over the coming years which means that much of the new soda ash capacity being added will eventually be absorbed by the domestic market. Meanwhile, the new soda ash plant which is about to start up in Saudi Arabia will primarily serve the domestic market.

The African market has also switched from being very tight in 2022 to being oversupplied to date this year. There is a new demand on the horizon in Africa, including for detergents, chemicals, and glass. However, by 2027 per capita demand is not expected to alter significantly and Africa will continue to have the lowest soda ash per capita in the world.

Prices, Costs, and Margins

Higher freight rates also contributed to cost increases for soda ash over the past 1.5 years. But container freights have started declining rapidly since the end of last year. Bulk freights started to decline much later and at a slower pace. We have though also started observing decreases in the bulk market this year.

Based on our forecast for energy prices, cash costs for producing soda ash seem to have peaked. The cost curve was extremely steep last year with a huge gap in place between the lowest-cost producers in the US and the highest-cost producers in Europe. Costs across the world are weakening this year but large deltas still remain between the regions. Even by 2027, while the gap in costs is expected to narrow, natural gas-based production in Europe looks set to stay at a considerable premium.

The US is the biggest soda ash exporter in the world, Turkey is in 2nd place. China’s export position is more volatile as its export volumes can change significantly from year-to-year. The US tends to fix more annual soda ash prices and thus its prices tend to be fairly stable over the course of a year while China exports a lot of products on a spot basis, with Turkey somewhere in between. Therefore, monitoring both prices and availability from China is helpful to also understand the underlying global market dynamics. In August 2020, in the midst of the pandemic, China’s export prices average $161 per mt FOB while by August last year, prices increased to $420 per mt FOB. This year we see a different market dynamic with spot export prices recently at $260-290 per mt FOB. Even though producers’ stocks remain relatively low in China there is a lot of nervousness about the imminent start-up of Inner Mongolia Berun.

Summary and Conclusion

World operating rates may have peaked. However, the timing of the new projects will be critical in terms of the actual operational levels going forward. In addition, our forecast doesn’t include potential capacity closures, except for what’s scheduled. It’s very likely that the huge capacity addition in Inner Mongolia will force the closure of some small Hou-based plants and/or some Solvay-based plants that have problems disposing of calcium chloride. Synthetic plants in other parts of the world may also be vulnerable.

For a detailed overview of the global soda ash and allied industries join us at the World Soda Ash Conference in Athens, October 10-12th.

Authors

Marguerite Morrin

Global Soda Ash Service Lead

Hasan Copur

Global Soda Ash

Rock Bain

China Soda Ash