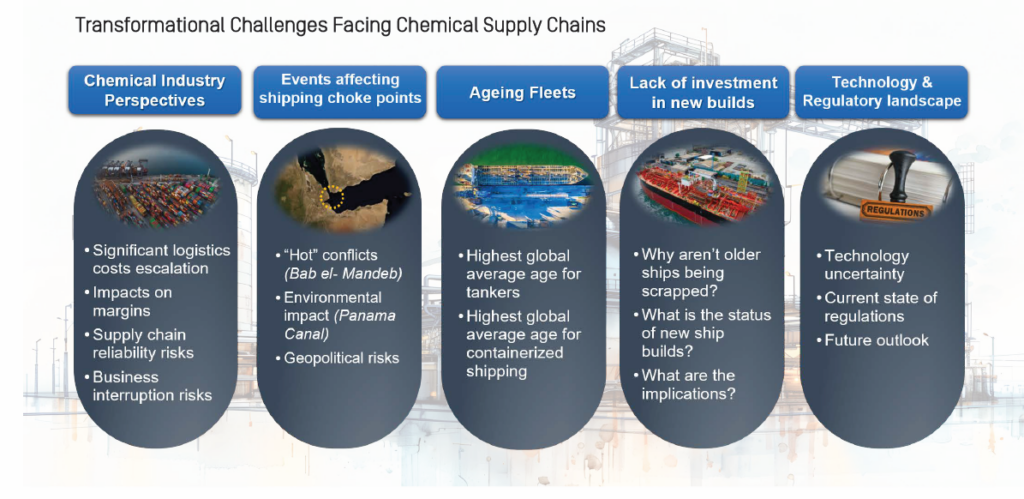

Transformational Challenges Facing Chemical Supply Chains

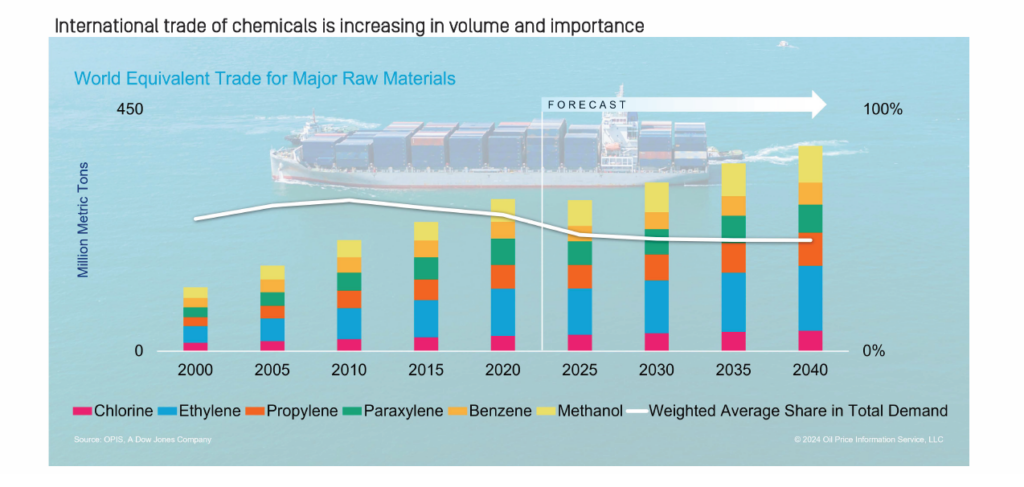

The chemical sector has one of the most evolved, efficient supply chains in the global era. Investments, manufacturing, logistics, and storage facilities in the industry are fine-tuned to provide solutions for multiple downstream sectors at affordable levels. In fact, Chemical Market Analytics estimates that over 40% of base chemicals are traded globally: They are used in a different geographic location from their manufacturer. This effective capital deployment is also fundamental to the success of chemicals-based solutions for inter-material replacements in multiple end-use applications.

But post-pandemic, supply chains and global trade flows are in flux. And lately, geopolitical and environmental events have disrupted the efficient supply chains that were the norm for the past few decades. While this has obviously affected shipping costs and downstream logistics efficiencies, it could also herald a structural shift, with long-term consequences for the industry at large.

A wave of geopolitical tensions…

The COVID-19 pandemic and the resultant shutdowns and logistics disruptions in 2020–21 were the first real disturbances to reveal the fragility of the supply chains that had evolved in the post-General Agreement on Tariffs and Trades/World Trade Organization era. Subsequent events, such as the Russia-Ukraine crisis and the risks to critical shipping choke points in the aftermath of the recent Israel-Palestine conflict, have complicated the situation even further.

Russia-Ukraine war: After Russia invaded Ukraine in February 2022, sanctions were quickly imposed on Russian exports. The event had a major impact on energy markets, as Russia was the single largest supplier of oil and gas to Europe; this has led to a significant shift in both energy and chemicals flows globally. As Europe rushed to firm up alternatives to Russian gas and crude supplies, much of Russian energy streams started flowing East. Europe is now importing more refining products, oil, and gas from the US and Middle East, while Russia is shipping more to India and China and some volumes also to Brazil. Overall, these changes in trade flows have impacted Western European efficiencies and competitiveness significantly. Many chemical and manufacturing operations were halted temporarily, and over time, a wave of capacity rationalization materialized.

The impact on chemical shipping routes is clear. Since the EU is becoming increasingly reliant on imports, more vessels are coming into EU ports. However, a lack of exports to fill the vessels on the return routes is stemming from the wave of capacity rationalization. The result is a mismatch in trade volumes coming in versus going out of the region. To make up for this imbalance, shippers have increased inbound shipping costs to the region.

Israel-Hamas war and the Red Sea crisis: In October 2023, the Israel-Hamas conflict opened a new chapter on the geopolitical risk register. In the aftermath of the initial attacks and the subsequent escalation of the conflict involving Iran and its regional proxies, the Houthi rebels in Yemen commenced attacks on shipping through the Bab el-Mandeb straits. The Bab el-Mandeb is a crucial shipping choke point on the East-West route to the Suez Canal. Once the key route to move products from Asia to the Western world, the Red Sea-Suez Canal route effectively closed, forcing trade route diversions.

Chemical Market Analytics estimates that over 40% of base chemicals are traded globally.

As per the US Department of Energy, prior to the crisis in the first half of 2023, close to 12% of crude oil flows and 8% of LNG flowed through the Bab el-Mandeb straits. It is also estimated that 30% of the global container volumes and around 50% of global polymer volumes pass through the Red Sea. With the Houthis adopting disruptive but highly effective tactics involving using drones to attack ships, by March-2024, most shipping lines had ceased passing through the Bab el-Mandeb straits and preferred to take the longer route around the Cape of Good Hope.

…and disruptions due to

Panama Canal: From early 2023, Panama has been experiencing some of its driest months on record. Precipitation remained below average for over a year in the area of the Panama Canal Watershed, feeding into Gatún Lake, the single source of water in the Panama Canal. This resulted in the Panama Canal Authority restricting both the size and number of ships passing through the canal as of June 2023, causing worldwide shipping disruptions for over one year.

Many vessels passing through the canal were container lines, so bulk shipments of chemicals were diverted either through the Suez Canal, Cape of Good Hope, or even via the Strait of Magellan. Prior to the Panama Canal crisis in 2022, container ships made up 22% of the total transits through the Panama Canal, while dry bulk carriers made up 22.5% and chemical tankers made up 18%.

Trade route diversion effects are rippling through supply chains

Trade route diversion effects are rippling through supply chains. The Panama Canal and Red Sea diversions in 2023–2024 were two key events restricting ship availability, increasing lead times, and bumping up shipping costs per ton of product transported.

Most shippers reported an increase of 3% in ton-miles (weight of each shipment in tons multiplied by the distance it was transported in miles), solely as a result of route diversions during this period. When the cost of ton-miles increases, it effectively reduces the amount of tonnage a ship can carry, thus shippers also experienced a drop of 1.5% in transported volumes.

The vast majority of international vessel owners have been avoiding the Red Sea route, typically diverting via the Cape of Good Hope. Typical transit times were around 30–40 days; now, as ships are diverted through the Cape of Good Hope, transit times have increased to 60–90 days. One shipping company reported a 4% ton-mile increase for this route since the crisis began.

The doubling of transit times has, in turn, put pressure on buyers, as they had to build inventories to ensure timely supply. As inventory building efforts surged, at one point there was more inventory in the water than at warehouses. The demand for containers was also surpassing supply because the backhaul was not taking place in a timely manner, meaning ships were not returning fast enough to ports where they were needed. As a result, container freight costs increased as much as 30–40%, and in some cases, as much as 80%, when the Suez Canal route disruption pressures started building up around December 2023.

The Bab el-Mandeb crisis has had a larger impact on container freight rates than the Panama Canal crisis. The Red Sea Crisis affected both tankers and container carriers, and the Bab el-Mandeb/Suez Canal choke point falls along a major sea-lane impacting the East-West trade between Asia and the West and affects all East-West trade.

Indeed, the effect of the Red Sea crisis extends well beyond chemicals and container shipping—energy and refining products markets were impacted too. Crude oil and fuel shipments around Africa rose by nearly 50% since the attacks began through mid-2024, according to the US Energy Information Administration (EIA), with Asian and Middle Eastern refined product exports to Europe increasing by almost 30%. Oil and refinery products’ volumes passing through trade routes between the US, the Middle East, and Asia via the Cape of Good Hope expanded by about one-third.

Are supply chains readjusting and back in shipshape?

Fortunately, the Panama Canal situation seems to be resolving. As the country entered the 2024 rainy season, water levels improved enough to allow 32 daily transits in July and 36 daily transits in August, while pre-drought daily transits were around 40. At the lowest point, there had been only around 9 daily transits. Efficient maritime traffic was ensured in August, even if not back to historical levels, having an immediate impact on container transportation costs, which decreased during the month.

Experts warn, however, that to avoid major weather-related disruptions in the Panama Canal in the future, investment is required (e.g., building a second dam to increase water supply into the canal or upgrading the lock system to be able to reuse the water).

Meanwhile, the Red Sea crisis continues to be a challenge today. Supply chains are adjusting to the new lead times and costs to move product around the Cape of Good Hope.

From Energy Policy to Trade: Strategic Insights on Trump’s Return

Complimentary Webinar on Jan 22, 2025

The changes in trade flows resulting from the Russia-Ukraine crisis and the Bab el-Mandeb crisis have also impacted container backhaul dynamics, which led to severe inefficiencies in the repositioning of “empties,” resulting in higher costs on specific routes. As of mid-September, Drewry’s World Container Index reported that the price for a 40-foot container was $4,168, which is 60% below the pandemic peak of $10,377 in September 2021. Notably, shipping costs are still much higher than pre-pandemic rates, with current prices at about 193% more than the average of $1,420 in 2019.

Structural and transformational challenges

Chemical supply chains also face structural and transformational challenges, in addition to the disruptions in the aftermath of the environmental and geopolitical events mentioned above. Geopolitical pressures and trade wars: Today’s global chemical markets are largely oversupplied, and with demand growth failing to keep up with more rapidly expanding supplies, the situation will likely not change for several years, as further significant capacity volumes will come onstream. The changing geopolitical environment, including the risks of increasing trade barriers in many markets, if further exacerbated, will contribute to greater arbitrage between regions and reduced chemical supply chain efficiencies.

Rising trade barriers could impact not just trade flows, but potentially also investment flows in the medium term. In the longer term, the accumulated inefficiencies could impact demand growth itself.

Aging Fleets: The average age of the global shipping fleet hit 13.7 years in December 2023, the highest since 2009, according to Clarksons. Containerized shipping had an average age of 14.3 years at the end of 2023, the highest average age since 1993. The average age of tankers, which carry oil and other liquids, hit a two-decade peak of 12.9 years.

Arguably, as highlighted by industry experts during a panel discussion at the World Chemical Forum, vessel age should not be an issue as long as they are well-maintained. However, experts do acknowledge that aging vessels have an impact on increased ton-miles, as they would have to run slower to adhere to lower emission norms. The latest revision of the International Maritime Organization’s (IMO) greenhouse gas emissions strategy (dated July 2023) targets a 20% reduction in absolute emissions by 2030 (versus 2008), a 70% reduction by 2040, and net zero by 2050. It is estimated that reducing a ship’s speed by 10% can reduce its emissions by 25–27%.

An aging fleet is also a sign of recent low investment in new builds. A potential consequence for chemical supply chains is a shipping capacity shortage in the medium term. Global chemicals demand is growing, and traded volumes are forecast to increase steadily through 2040. One major factor hindering new ship orders is the lack of clarity on the regulatory side. In the absence of new builds, the resulting higher ton-miles do have an impact on vessel supply, which, in turn, keeps prices higher.

Decarbonization pressures and regulatory uncertainties: The global shipping sector is estimated to contribute to 3% of global greenhouse gas emissions (estimated 716 million MT CO2 in 2023). Container ships and bulk carriers account for 50% of these emissions, while oil and LNG tankers account for around 20% of these emissions.

Fully recognizing the need to reduce the maritime sector’s carbon footprint, the International Maritime Organization (IMO) has mapped out an updated greenhouse gas strategy aimed at reaching net zero by 2050.

However, the technology and regulatory landscape needed to firm up pathways to meet the 2030 targets is still evolving, according to shipping industry participants. Additionally, it is well-acknowledged that any decarbonization measures would increase costs, and the lack of a uniform carbon pricing regime also contributes to the uncertainty in new build investments.

The technology and regulatory landscape needed to firm up pathways to meet the 2030 targets is still evolving, according to shipping industry participants.

Consequently, shipping companies are hesitant to commission new builds in several vessel categories. With a build time between 2–3 years, and uncertainty still prevailing on the above fronts, most shipbrokers (who advise owners on shipbuilding) say the industry is reluctant to order new vessels that run on greener fuels due to uncertainty about green regulations and alternative fuels and the availability of these energy resources. Half of the ordered tonnage has selected a flexible option and can run on LNG, LPG, or methanol in dual-fuel engines. The current timelines for new builds being commissioned are dangerously close to the 2030 targets, as the lack of regulatory frameworks only complicate investment decisions. Despite uncertainties, some financing partners are now only lending money to projects with green credentials.

A recent surge in new builds for container and LNG ships might moderate the aging trend marginally. However, there are fewer and smaller-sized new build programs for bulkers and tankers, so the aging fleet trend will most likely continue.

Choppy waters will not capsize this ship—chemical supply chains are resilient.

The efficient chemical supply chains we are accustomed to have been disrupted by a series of events, and more transformational pressures are on the horizon.

Speak to our experts to get a demo of Chemical Market Analytics Platform

Many factors are contributing to regional market segregation, resulting in increasing opacity. Geopolitical tensions, protectionist trade tariffs, and differing regional/national sustainability policies (including ETS and carbon pricing, EPR, and other tax structures) all contribute to the separation of regional chemical markets and reduced logistics efficiencies.

As the Chinese proverb goes, “We continue to live in interesting times.” And while the chemical sector and its supply chains will be shaped by these events, the true strength of the industry will be its capacity to adapt to new realities.